Muutama nosto raportista. Tulospuhelu on edelleen kuuntelematta, eiköhän senkin jossain vaiheessa ehdi viikonloppuna kuuntelemaan viimeistään!

Pohjois-Amerikan kasvu jatkuu vahvana.

“Sales in our largest market, North America, continued to develop very strongly in the fourth quarter, with a growth of 100% compared to the same quarter last year”

Toivottavasti tämä pysyy aikataulussa.

" We expect full-scale production to be achieved by the end of the second quarter of 2023."

Eurooppa, ilman Ruotsia kasvaa myös erittäin mukavasti, kiitos UK:n ja Saksan.

" Sales in the region increased by 56% compared to the corresponding quarter last year. "

Odotan mielenkiinnolla, mitä KNET tuo tullessaan, erityisesti Aasian osalta.

“With the acquisition of the micro duct manufacturer KNET in South Korea, we enhance our position in our strategic growth markets in the US and Europe, as well as opening up new selected markets in Asia.”

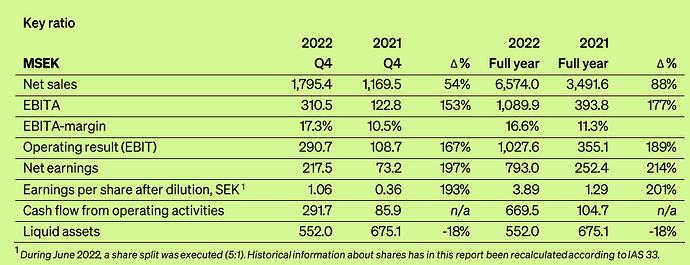

Kone ei näytä olevan hiipumassa

“Order intake has continued to develop strongly. At the end of the year, we have an order book that is organically 67 percent higher than the corresponding time last year”

Mikäli mennään taantumaan, on hyvä pitää riskit mielessä.

“We assess that it will not negatively affect the rollout pace on the market as the limited factor is still expected to be trained installers. In the event of a potential recession, we expect to see some negative impact.”

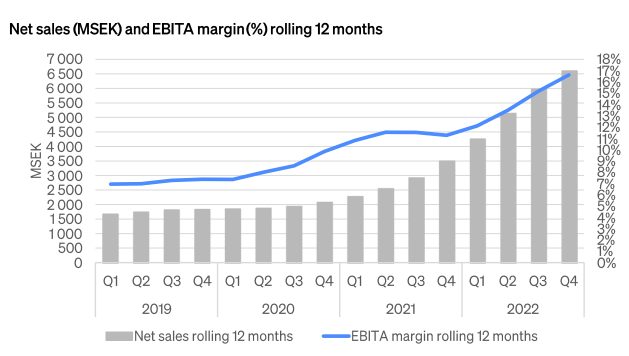

Graafit on aina kivoja niin laitetaan tämä loppuun!