https://seekingalpha.com/filing/5430489

onko tämä joku ennakkoilmoitus, että ehkä joskus lähi tulevaisuudessa on tarkoitus kerätä $100 miljoonaa myöhemmin tarkennettavalla hinnalla/osakemäärällä ?

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

USE OF PROCEEDS

Our expected use of the net proceeds from this offering represents our current intentions based upon our present plans and business condition. As of the date of this prospectus, we cannot predict with certainty all of the particular uses for the net proceeds to be received upon completion of this offering, or the amounts that we will actually spend on the uses. We currently intend to use the net proceeds to us from this offering for general corporate purposes, which may include providing funding to complete our Arizona manufacturing facility, develop commercial scale BEV and FCEV Class 8 trucks and develop hydrogen station infrastructure. Pending our use of the net proceeds as described above, we intend to invest the net proceeds from this offering in interest-bearing, investment-grade instruments.

![]()

Niin sen eilen illalla tulkkasin, mutta itselle tuli vähän wtf ajatus mieleen, että nytkö jo on rahat loppu? Kyllä tämä on kuitenkin varmasti tehty sillä ajatuksella, että se myös toteutetaan lähiaikoina.

- kurssi reagoi afterissa, mutta ei mitenkään dramaattisesti

- itsellä ei ole positiota, mutta olen seurannut tarkasti sitä silmälläpitäen, josko siitä infrahankkeesta tulisi lupausten mukaan totta. Koko ajan se näyttää kuitenkin huonommalta, kun vertaa niihin annettuihin “aikataululupauksiin”. Ilman sitä tämä projekti on viemärissä - pelkällä autolla ovat takamatkalla.

Taas yksi Nikolan partnereista on heittämässä pyyhkeen kehiin. Hanwhalla oli reipas 6% osakkeista ja paikka hallituksessa.

Nimitysuutisia taas

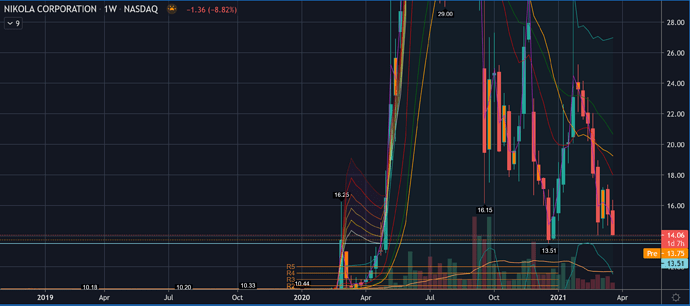

Satuin katselemaan EV-sektorin läpi ja NKLA lähestyy aika kriittistä tukitasoa 13.51

- voidaan nähdä isompi syöksy, jos tuo ei pidä

Tiedän että satusetien terävin kärki voi tienata ihan mukavasti, mutta että tarinalla pick-upista jonka pakoputkesta kuljettaja voi pitkällä pillillä imeskellä juotavaa kesken matkan ohitellessaan ilman moottoria ajavia rekkoja tehdään 49 miljoonan tili. Waudewow.

Oleelliset pätkät:

Nikola founder sells shares for $49m

Trevor Milton offloaded stock while electric truck start-up faces investigations

Trevor Milton, who stepped down as executive chair seven months ago in the wake of a short seller’s report and online accusations, sold 3.5m Nikola shares on Wednesday at the closing price of $13.89. The transaction appeared on the Securities and Exchange Commission’s website two days later after business hours, suggesting a wish to avoid publicising the sale.

The price was above the 52-week low of $10.51, but a fraction of the stock’s June peak of $93.99.

Toihan on ihan nappikauppaa kokoinaisuuteen verrattun: " In September 2020, Forbes assessed Milton’s net worth to be at least $3.1 billion"

Tänään tehtiin uusi weekly lower low 12.62, seuraava tukitaso 10.42

Itse olen jättänyt jopa treidaamisen väliin, jottei jää vahingossa laput käteen, jos sattuu treidatessa tulemaan uutinen infrahankeselvityksen aikataulun siirtymisestä syksyyn.

- yllättävän rauhallisesti kurssi on siihen nähden käyttäytynyt, vaikka lasku on ollut yhtä pitkää alamäkeä LH 25.23 tasosta. Ilmeisesti tänne saakka omistaneet ovat päättäneet katsoa tämän tarinan loppuun saakka.

Nikola loses key fuel-cell development exec Nikola loses key fuel-cell development exec | Seeking Alpha

- Nikola says Schneider departed the company on good terms.

- Schneider said in an emailed statement to Bloomberg that he left Nikola with the purpose of starting a new company in California. He is listed on LinkedIn as chief executive officer at startup ZEV Station.

Ei kyllä hyvältä näytä

Schneider led the Nikola engineering teams working on fuel-cell systems, a planned hydrogen fueling station network and storage technology

first step in establishing a nationwide plan for its Class 8 truck sales and service coverage. Nikola, in partnership with RIG360 Service Network, a network of heavy-duty truck service and maintenance centers, plans to provide sales and service products for commercial customers at more than 65 RIG360 dealer locations throughout the Southeast, Midwest and Northeast regions of the United States.

In addition to providing service and maintenance for Nikola’s complete portfolio of Class 8 trucks, this dealer association is intended to provide customers with a well-known and reputable sales and distribution channel to be established for Nikola BEV and FCEV vehicles and ancillary products and services.

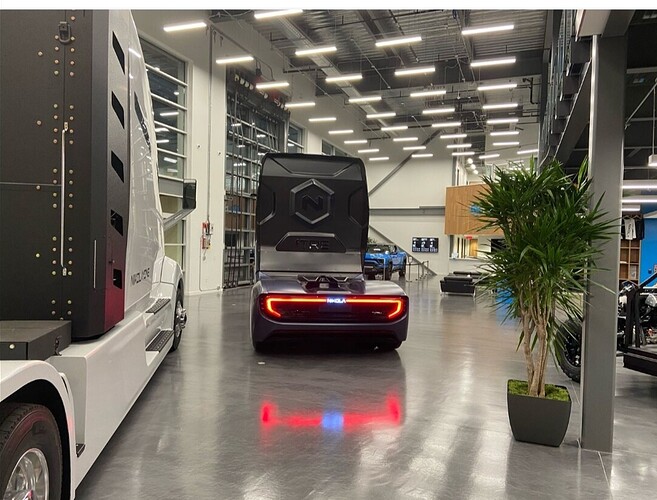

NIKOLA Badger havaittu Nikolan päämajassa.

Saivat prototyypin ilmeisesti tehtyä. Tarina ei kerro onko BEV / FCEV vai peräti mäkiauto.

Mäyrä tuolla kuvassa takana.

https://twitter.com/nikolamotor/status/1382276674264260608?s=19

- The collaboration is expected to enable cost-effective distribution of hydrogen from production to storage and fueling locations in Germany to serve industry needs

- Nikola will lead the installation of hydrogen fueling locations for all OEM FCEVs at key locations supported by OGE’s hydrogen delivery systems

- The parties will collaborate with the intent to increase the availability of FCEVs and the necessary infrastructure required to operate trucks using hydrogen fuel

Eli vähän pitää mennä vielä alaspäin ![]() . Vitsit vitseinä, mutta nyt alkaa olemaan ihan pelilappu. Riippuu toki Trevorin liikkeistä (eikös hänellä vielä lappuja aika paljon ole) Mitkä fiilikset muilla?

. Vitsit vitseinä, mutta nyt alkaa olemaan ihan pelilappu. Riippuu toki Trevorin liikkeistä (eikös hänellä vielä lappuja aika paljon ole) Mitkä fiilikset muilla?

Mikä on Nikolan valuaatio? Rakentavat tehdasta, mutta mitään kehitystä ei ole infraprojektista. Tai ainakaan siitä ei kuulu uutisia. Raha palaa kassasta tehtaan rakennukseen yms ja kohta pitäisi varmaan hakea markkinoilta uutta rahaa. Ei taida onnistua ilman, että jotain konkreettista tapahtuisi? Sen vuoksi markkinat on jo luovuttanut (hinnan perusteella)?

Tuossa höpinää eiliseltä päivältä saksasta. Jotain viritystä tankkauksen suhteen. Nikola und Iveco planen H2-Infrastruktur in Deutschland - electrive.net

Tuon luinkin jo aikaisemmin, mutta vaikutti melko erilaiselta vrt jenkkisuunnitelmiin liisauksesta yms.

Euroopan kuvion pitääkin olla erilainen… mutten kyllä tuolle uutiselle paljon painoa anna nikolaa ajatellen. Enempi mietin tuon uutisen kautta Euroopan Nel kuviota.