Jenkkien fixed wireless access (FWA) kehitys on nopeaa.

5G Fixed Wireless and the Threat to Cable’s US Dominance - Dell’Oro Group (delloro.com)

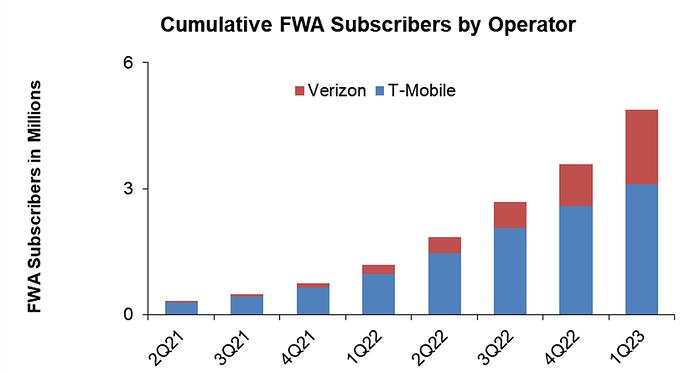

T-Mobile has a stated goal of serving 7-8 million subscribers by the end of 2025, while Verizon has a goal of serving between 4-5 million subscribers by the end of 2025. Collectively, that’s a potential subscriber base of anywhere from 11-13M subscribers. Those numbers don’t include the entry of AT&T in the 5G FWA market via its Internet Air service, which could net anywhere from 1.5-2M subscribers by the end of 2025, according to our estimates.

5G investointitahti on hidastunut, ei yllätävää. Mutta ne monet jenkkianalyytikot tuijottavat melkeinpä vain tätä asiaa. Toki jenkkimarkkinoiden merkitys on suuri Nokialle ja Ericssonille.

What they’re saying about 5G capex in 2023 and 2024 | Light Reading

**AT&T’**s CFO confirmed the operator is slowing its network spending. “We expect to move past peak capital investment levels as we exit the year,” said Pascal Desroches during AT&T’s quarterly conference call, according to Seeking Alpha.

Specifically, he said AT&T’s overall capital expenses (capex) would be $1 billion lower in the second half of 2023 when compared with the first half of this year.

Other 5G providers in the US offered similar commentary. “We expect capex to taper in Q3 and then further in Q4,” agreed T-Mobile’s CFO Peter Osvaldik during his company’s quarterly conference call last week, according to Seeking Alpha. He said T-Mobile’s capex for 2023 would total just under $10 billion.

“We continue to expect 2023 capital spending to be within our guidance of $18.25 billion to $19.25 billion. Our peak capital spend is behind us, and we are now at a business-as-usual run rate for capex, which we expect will continue into 2024,” explained Verizon CFO Tony Skiadas during his company’s quarterly conference call last week, according to Seeking Alpha.