Osinkodippi tulee irtoamispäivänä, joka on yhtiökokouksen jälkeinen pävä (T+1). Seuraava päivä (T+2) on täsmäytyspäivä, jonka perusteella omistajille maksetaan osinko. Saadakseen osingon, sitä on omistettava viimeistään yhtiökokouspäivänä, koska kirjaaminen vie sen 2 päivää. Korjatkaa jos olen ymmärtänyt väärin.

Ulkomaisissa osakkeissa ei toimi välttämättä samoin kuin suomessa. Mm BW lpg jäi saamatta itsellä kesältä, onneksi osakkeen arvo oli kuitenkin selvästi korkeampi ostohintaa

Ulkomaisista osakkeista löytyy osinko datet hyvin kun googlaa ex-div “ticker”

The world’s largest product tanker owner has avoided the worst of the seasonal third quarter downturn. Scorpio Tankers has released rate data for the quarter so far, with its MR product carrier fleet earnings slightly more than in recent fixtures.

The New York-listed tanker owner’s 63 MRs were earning an average time-charter equivalent of $14,250 per day so far in the third quarter, with 80% of days booked. The figure was higher than most routes over the last two weeks, as assessed by Clarksons.

Meanwhile, it’s 42 LR2s were earning $19,250 per day and its 12 LR1s $18,500 per day, both with 90% of days booked. Its 21 handymax tankers were fetching $10,000 per day with 85% of days booked.

Norwegian investment bank Fearnley Securities said it now expects Ebitda of between $80m and $90m for the third quarter. Cash should reach between $150m and $160m. “The demand curve is what really matters from here and onwards,” Fearnley said.

"It is especially transportation fuel that trends well below pre-Covid-19 levels, while the strength in demand has come from parts of the barrel that barely provide a margin to a refinery (petchem).

For petrol, the US market has lagged behind countries like China and India due to high unemployment, social distancing and travel restrictions, Fearnley said. It views the US as important because it is the largest petrol market - three times the size of China.

“Despite both customary seasonal weakness and drawdowns of the extraordinary inventory builds during Q1 and Q2, the company’s TCE rates in Q3 '20 outperformed those in Q3 '19,” chief executive Emanuele Lauro said in a statement.

“This trend of higher quarterly company TCE rates year-over-year has continued since Q4-18 and suggests that the underlying supply and demand drivers in our market have continued to tighten.”

Lauro added that inventories of refined products stored at sea had fallen from 104m barrels in May to 33.9m barrels on Wednesday. The rate disclosure comes the day after the world’s largest product tanker owner announced it had repurchased $13.1m common shares last week…

…redeemed $52.4m in convertible notes due in May 2022 this quarter and launched a new $250m repurchase programme covering shares, the remaining convertible notes and senior unsecured bonds due in 2025. The news boosted its shares around 12%, closing at $13.07.

Shortly after Wednesday’s open, shares were down to $12.80, a dip of $0.08. Evercore analyst Jonathan Chappell said on Wednesday that Scorpio Tankers’ rates were “coming in slightly ahead” of his forecasts and avoiding the worst of the traditionally weak third quarter.

The rates for the LR2, LR1 and handymax vessels are roughly in line with Clarksons recent assessments. Chappell said the 2022 notes were among the higher-cost and most dilutive paper in the company’s capital structure.

In repurchasing shares, he said Scorpio Tankers’ leadership shows they can be flexible, despite deleveraging remaining the top priority. “Based on our pro forma year-end 2020 NAV [net asset value] estimate, [Scorpio Tankers] still trades at a 39% discount to NAV …”

“…thus further repurchases could be forthcoming if this large gap remains.” The updates prompted him to raise the third quarter earnings per share estimate up to a $0.36 per share loss from a $0.53 per share loss, with the year estimate jumping to $2.61/share from $2.42

“It’s Happening Again” - Traders Store Oil At Sea As Recovery Falters

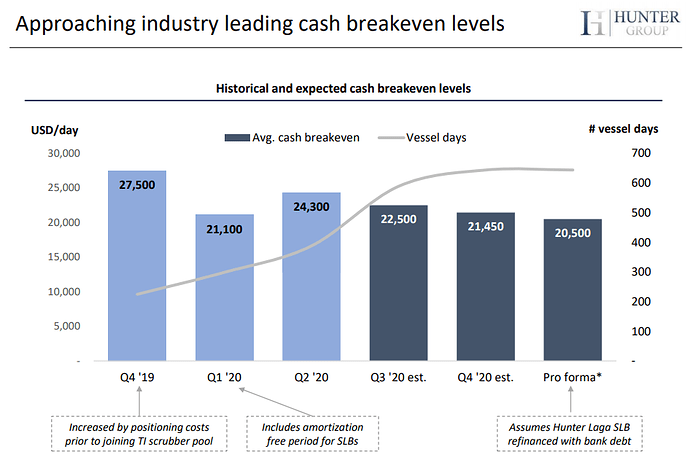

Lähdin tänään mukaan Hunter Group ASA… Tietoja kaiveltu Q2 tuloksesta ja uudesta 9.9.2020 päivätystä yhtiöpäivityksestä. Linkit lopussa.

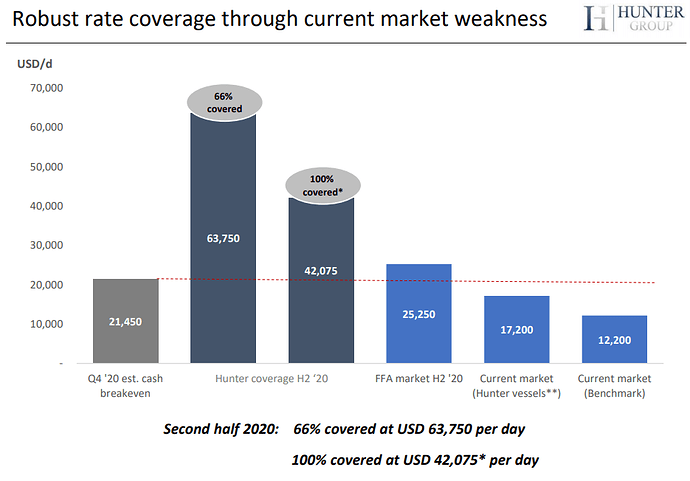

Cash breakeven menee n. 20000 USD/päivässä

Mutta H2 varattuna jo timecharter 66% hintaan 63750 USD/päivässä, ja arvioidaan saatavaksi 100% hintaan 42075 USD/päivässä, ja nythän hinnat ovat taas nousussa.

Superuusi pieni laivasto, joka mennyt suoraan tehtaalta hyvällä hinnalla töihin:

“Successfully took delivery of Hunter Disen on 5 June 2020, the fifth of seven identical VLCCs from DSME. Hunter Disen commenced it’s six-month time charter (“TC”) immediately following delivery from the yard”

“Successfully took delivery of Hunter Idun and Hunter Frigg on 3 July and 21 August 2020, respectively. The delivery of Hunter Frigg marks the end of the Company’s newbuilding program with all seven VLCCs having successfully been delivered and put in operation. Both vessels commenced TCs following delivery from the yard, with Hunter Frigg recently having been fixed at USD 40,000 per day for 6-8 months”

Tänään saa ottaa jo pullaa kaffen kanssa, hyvin vihertää $DHT $STNG $GLNG $TNK

Jos kurssit nousee contango-huhujen vuoksi niin se on kyllä aika hanurista, toivoisin että johtuu siitä että kysyntä on alkanut kasvamaan loppukäyttäjillä.

Eipä ole vielä tarttunut Hafniaan. Noh, saipahan edullisesti hankittua.

Omasta salkusta löytyy kaikki paitsi DHT ![]()

Näkeekös joku reaaliaikaisia hintoja jostain,mistä vois ihmetellä onko tosiaan tapahtunut jotain vai huhuillako tässä mennään…?

Jos firmojen kursseja tarkoitat, niin Yahoo Finance ja TradingView tarjoavat ainakin real-time hinnat:

Juu tarkoitin pvän laivanvuokraus ”rate”

Hintoja taidetaan spotmarket hintoina paremmin tuntea,sry epäselvästä artikuloinnista…

Täytyy tuohon Twitter heeboon paremmin tutustua,kiitti vinkistä ![]()

Scorpio Tankers call volume above normal and directionally bullish $STNG

@DayTraderXL näetkö IB:stä call volyymien kehitystä?

EDIT:

Henry Himmler

$STNG Bullish News and BUY Signal Confirmation: Scorpio Tankers call volume above normal and directionally bullish The Fly On The Wall -10:25 AM “Bullish option flow detected in Scorpio Tankers with 1,002 calls trading, 1.0x expected & implied volume increasing over 2 points…”

Tuoltakin voi katsella