Q3 ulkona, liikevaihto kasvaa hyvin. Kannattavuus laahaa hieman perässä

Another strong quarter, with top line growth of 72 per cent, significant EBITDA growth, and growing momentum in the Wellness segment

Jul - Sep 2022

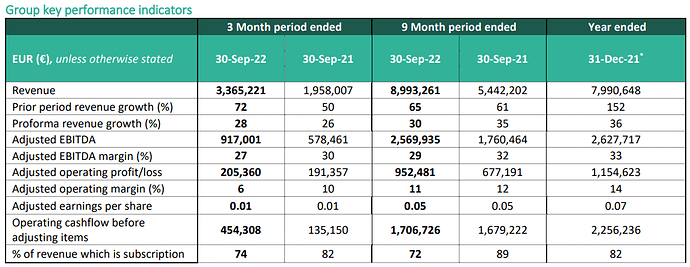

· Revenue increased by 72 per cent from the comparative period in 2021 to generate total sales of EUR 3.4m (EUR 2.0m). On a proforma basis revenue grew by 28 per cent. This proforma growth was achieved in both the Lifecare Technology (17 per cent) and Virtual Wellness (57 per cent) divisions.

· Adjusted EBITDA of EUR 0.9m (EUR 0.6m) was generated resulting in an Adjusted EBITDA margin of 27 per cent (30 per cent). This movement was driven by recent acquisitions, as well as the Group’s focus on continued investment in the two divisions allowing a strong footing for their scale-up ambitions.

· Operating profit after taxation of EUR 0.02m (EUR 0.03m).

· Adjusted operating profit of EUR 0.2m (EUR 0.2m) was generated resulting in a margin of 6 per cent (10 per cent).

· Adjusted ordinary and diluted profit per share totalled EUR 0.01 (EUR 0.01).

· Cashflow generated from operations before the payment of adjusting items equalled EUR 0.5m (EUR 0.1m).

Jan - Sep 2022

· Revenue increased by 65 per cent from the comparative period in 2021 to generate total sales of EUR 9.0m (EUR 5.4m). On a proforma basis revenue grew by 30 per cent. This proforma growth was achieved in both the Lifecare Technology (22 per cent) and Wellness (53 per cent) divisions.

· EBITDA increased by 340 per cent from the comparative period in 2021 to EUR 1.2m (EUR 0.3m).

· Adjusted EBITDA of EUR 2.6m (EUR 1.8m) was generated resulting in an Adjusted EBITDA margin of 29 per cent (32 per cent).

· Adjusted operating profit of EUR 0.9m (EUR 0.7m) was generated resulting in a margin of 11 per cent (12 per cent).

· Adjusted ordinary and diluted profit per share totalled EUR 0.05 (EUR 0.05).

· Cashflow generated from operations before the payment of adjusting items equalled EUR 1.7m (EUR 1.7m).

Operational highlights

· Continued investment in Access Ecosystem to broaden the Champion Offering for the inclusion of mental health therapy and further acceleration of Champion Health – Physiotherapy.

· Launched the re-branded Champion Health – Nordics and Champion Health in Germany.

· Transition of development team in-house, comprising seventeen highly skilled tech developers. Through a fresh perspective, the new team have fast tracked development of key features including Easylink, EasyPrint and EasyAssign.

· Investment in a new Learning Management System (LMS) forming the backbone of the continued education element of this business line.

Henrik Molin, Co-founder and CEO of Physitrack PLC, commented:

“Despite the challenging macro environment for businesses and individuals, Physitrack Group manages to strengthen the position further this quarter as we keep experiencing significant top line and EBITDA growth. Underpinned by its robust business model, the Group is well positioned to continue enhancing offerings in both operating segments. We see a strong momentum in the Wellness segment, with a massive market opportunity ahead of us, further propelled by increasing demands for cost savers such as higher efficiency and less employee turnover.”

Jatkuvien kuukausiveloitusten määrä kasvussa

Uusi palvelu julkaistu samaan hengenvetoon Champion Health brändin alle  .

.

Champion Health, part of Physitrack Group, launches Mental Health Therapy in premium product

Champion Health, part of the Physitrack Group, today announces the launch of another integrated care pathway into its premium Employee Wellbeing product – Mental Health Therapy. The new care pathway seamlessly integrates into Champion’s user journey as of today and is expected to significantly accelerate the growth of its SaaS offering.

The acquisition of Champion by the Physitrack Group, announced in May of 2022, opened up the possibility for Champion to enhance its holistic wellbeing with Physitrack’s virtual-first care offerings delivered through the Access ecosystem, while also establishing a strong commercial foothold in the corporate wellness market. The global digital health market is projected to be a USD 222 billion market by 2026, according to Facts & Factors Research.[1]

Through the integration of another Care pathway into Champion following the successful launch of Physiotherapy in July of 2022, new growth avenues in SaaS with substantial revenue potential are opened up, and the Group’s expansion in the UK, the Nordics, Germany and the US is substantially accelerated.