A new article from EE Times. Comments (not all new) from Seeing Machines, Smarteye, Jungo, Cipia and Barnden.

I raise some interesting points:

First NCAP draft withour camera?

“Some industry observers, speaking on condition of anonymity, suspect that the first draft of NCAP testing protocols might be even limited to head pose, with no eye tracking.”

Holy grail = single camera

“Jungo’s Herbst, for example, observed that many cameras are coming into vehicles — for DMS, occupant monitoring systems (OMS), and gestures — each easily adding $70-$100 in cost. The holy grail for OEMs, in his opinion, is “having eventually a single camera that can do everything,” including DMS.”

OEMs may skip Tier1

“Herbst also noted the convergence of SOCs inside vehicles, resulting in the deployment of a fewer, more powerful SoCs. This trend is prompting OEMs to license DMS/OMS software directly from DMS software suppliers such as Jungo, instead of through a Tier 1. This is because “the software stack affects many subsystems (ADAS, autonomous, infotainment, HUD) and there are evolving feature sets growing in time,” he explained.”

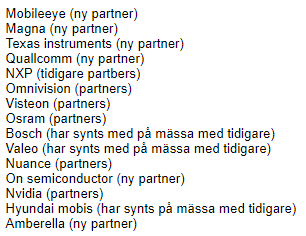

Also Jungo with Qualcomm and Xilinx (I guess nothing new)

"Herbst stressed that Jungo “partners with almost all” chip suppliers, including “Qualcomm, Texas Instruments, Xilinx, Ambarella, Nvidia, Renesas, Intel.” He stressed, “We plan to remain agnostic.”

Kranz: no shortage of chip manufacturers

"Krantz said, “The situation was different when Mobileye in the early 2000s chose to develop their own silicon for their ADAS algorithms.” The supply of high-capacity auto-grade SoCs was very limited, he said. “Now there is a very large number of different processors that will all work for DMS and interior sensing, and there are all sorts of reasons for an OEM or a Tier-1 to select one.”

We’ve heard this before from EE Times (true or not)

“Among all DMS suppliers, Seeing Machines appears to be in a league of its own.”

Jungo seems to follow Smarteye path instead of SEE

"Jungo CEO Herbst, on the other hand, said, “We absolutely do NOT develop our own chip or IP.”