Hello, I started a new separate thread for SEE. So we can collect facts, analysis and news about SEE in that thread. And of course discussion too which is mainly about SEE.

Veikkasivat 10$ Telegrammin puolella btw.

A new article from EE Times. Comments (not all new) from Seeing Machines, Smarteye, Jungo, Cipia and Barnden.

I raise some interesting points:

First NCAP draft withour camera?

“Some industry observers, speaking on condition of anonymity, suspect that the first draft of NCAP testing protocols might be even limited to head pose, with no eye tracking.”

Holy grail = single camera

“Jungo’s Herbst, for example, observed that many cameras are coming into vehicles — for DMS, occupant monitoring systems (OMS), and gestures — each easily adding $70-$100 in cost. The holy grail for OEMs, in his opinion, is “having eventually a single camera that can do everything,” including DMS.”

OEMs may skip Tier1

“Herbst also noted the convergence of SOCs inside vehicles, resulting in the deployment of a fewer, more powerful SoCs. This trend is prompting OEMs to license DMS/OMS software directly from DMS software suppliers such as Jungo, instead of through a Tier 1. This is because “the software stack affects many subsystems (ADAS, autonomous, infotainment, HUD) and there are evolving feature sets growing in time,” he explained.”

Also Jungo with Qualcomm and Xilinx (I guess nothing new)

"Herbst stressed that Jungo “partners with almost all” chip suppliers, including “Qualcomm, Texas Instruments, Xilinx, Ambarella, Nvidia, Renesas, Intel.” He stressed, “We plan to remain agnostic.”

Kranz: no shortage of chip manufacturers

"Krantz said, “The situation was different when Mobileye in the early 2000s chose to develop their own silicon for their ADAS algorithms.” The supply of high-capacity auto-grade SoCs was very limited, he said. “Now there is a very large number of different processors that will all work for DMS and interior sensing, and there are all sorts of reasons for an OEM or a Tier-1 to select one.”

We’ve heard this before from EE Times (true or not)

“Among all DMS suppliers, Seeing Machines appears to be in a league of its own.”

Jungo seems to follow Smarteye path instead of SEE

"Jungo CEO Herbst, on the other hand, said, “We absolutely do NOT develop our own chip or IP.”

So if Jungo, Seye and SEE work with all chip manufacturers, they can all claim to be chip agnostic?

Well, it did not specifically mention that Seeing Machines works with all chip manufacturers, did it? It did mention that Jungo works with almost all and Kranz commented that there are plenty of options.

Edit: quoting the EE Times reporter, she did refer Seeing Machines as hardware agnostic.

Anyway, let’s say that SM is hardware agnostic. What should we think about this? Smarteye has been on the right path all along? What’s the purpose of Qualcomm partnership if all chip manufacturers remain important?

I take your point.

The tie up with a major chip manufacturer, not saying its Qualcomm, probably someone else, just opens another way to market if the chip manufacturer licenses SEE software.

Vuodelta 2016 tuli taas uusi oppari vastaan. Tämä on nyt neljäs löytämäni.

https://odr.chalmers.se/handle/20.500.12380/240296

Tuossa kans joku yleisoppari:

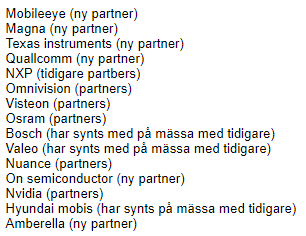

Suosittelen katsomaan listaa CES2019 kumppaneista (SmartEye). On siellä Qualcommia ja Nvidiaa ja monia muita mukavia mukana ollut…

Sanonpahan vaan että Q1 näyttää suunnan, anaalit ennustanut +100% lv kasvua. Jos siihen tarinaan tulee rakoja ja foorumilaisten kelkka alkaa kääntymään, niin tulee “ovella ruuhkaa”

Niin paljon tätä NON alkuset ovat ostaneet. Todella laadukasta keskustelua kyllä löytyy tästä ketjusta, kiitos kaikille. Multa ei lisäarvoa tähän valitettavasti tule.

2022 malliston osalta on odotettavaa, että autoja julkaistaan lähempänä Q3-Q4/2021 ![]() Olettaisin itse liikevaihdon kasvun painottuvan loppuvuoteen. Olen samaa mieltä että 2021 pitää alkaa näkyä liikevaihdon kasvua. Ilmeisesti osa automalleista on selvästi myöhässä, mitä olen huhuja kuullut (audi, porsche).

Olettaisin itse liikevaihdon kasvun painottuvan loppuvuoteen. Olen samaa mieltä että 2021 pitää alkaa näkyä liikevaihdon kasvua. Ilmeisesti osa automalleista on selvästi myöhässä, mitä olen huhuja kuullut (audi, porsche).

Mikäli automotivessa on tietty sykli DW-julkaisuille niin mahdollisesti maalis-huhtikuussa on uusia DW julkaisuja tulossa. Eli esim 2020 neuvotellut DW:t mahdollisesti julkaistaan 3-4kk viiveellä. Ainakin 2020 keväällä tuon suuntaista oli ja Colin on kanssa vastaavaa kommentoinut 2018 vuonna koskien kevättä 2019. Mielenkiintoinen kevät. Mun mielestä on ihan turha hätäillä mihinkään ennen kuin ilotulitus käynnistyy ja sen jälkeen varsinkaan ei hätäillä ![]()

Alkuvuodesta jännään lähinnä CES2021. Nähdäänkö Colinia tänä vuonna Smartin osastolla vai heittääkö rennosti huulta SEE-porukoiden kanssa? ![]()

Don’t think Colin will be seen at CES this year, its virtual.

So, why incur the cost of a booth and take 12 staff to CES2020 if Seye were in 15 ‘partner’ booths the year before?

This is probably because you are new, but when you introduce new information it is curteous to link to the source where you have gotten this information. As you can see, there is around 1800 posts in this thread. Most give new information, or cite old information. It takes a lot of time to find the source, and then comment a response.

I didn’t find with a quick glance a notice of Smarts ces-booth in 2021, might be that somebody mentioned it already but it would have been nice to cite that.

Edit: some misunderstandings on my part but thank you for the source!

Yuri, my post said Smarteye booth CES 2020.

Scroll through the pics here

These are just based on my own thoughts:

By having their own booth they have more visibility most likely? They can solely focus on showcasing and selling their own solutions and explaining the future of car safety compared to being just a partner at other booths.

I would see it as step-up from being just a partner in several booths to having a booth for themselves

Yes Gremeor that makes some sense. If the partner booths weren’t working well then a dedicated booth means more focus.

I am having a little hard time to understand why would SEYE not be also licensed to Qualcomm at some point? Has there been info that there would only be a single vendor and Qualcomm is now off-limits of SEYE? I have not seen this, so I would like to get a bit more clarity to this. If both are HW agnostic, why would SEYE not be possibly here too?

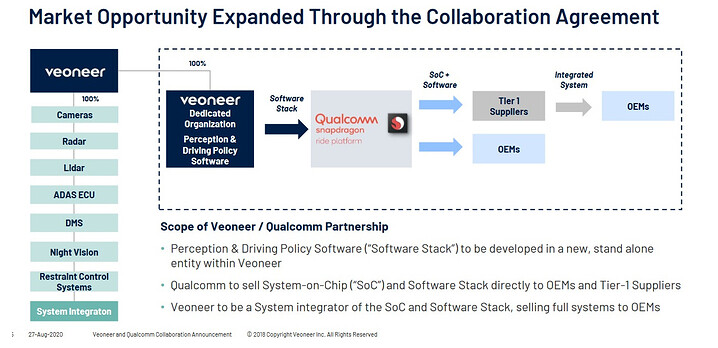

And by referring also to the Veoneer slide circled here on multiple occasions :

Has there been an indication that SEYE could not be a partner with Veoneer through another SoC partner? Or as earlier said a partner through Qualcomm? Also am I correct in assuming the partnership with SEE and Veoneer is through Qualcomm only?

What I am getting as an argument is more or less that since they (Qualcomm and Veoneer) are with SEE now it would mean game over for SEYE here. Why would it be like this? Do we know that Veoneer is not dual-sourcing on SoC’s? As said I find these are talked as being totally binary but is it really so when talking about a chip vendor or system integrator?

EDIT: answering to myself on the Veoneer + Qualcomm partnership part based on this article. This according to Veoneer CEO from the article: "Veoneer’s CEO Carlson clarified the company’s commitment to Qualcomm’s SoC platform. Asked if the partnership is exclusive, Carlson said, “We have no intention to go into any other relationship for SoC partnership. We picked Qualcomm here.”

So Qualcomm is the only SoC where they will play the role of system integrator. What I still do not understand is that does Veoneer only source Qualcomm chips by themselves to the OEM’s? Since this is only for the Qualcomm ride platform which is then supplied to either other Tier1s or OEMs. ![]()