Disclaimer. Olen jo ainakin kaksi ruotsin pörssin yritystä onnistunut nostamaan foorumille, joiden kurssit sen jälkeen sössineet alas yli 50%, joten kolmas kerta todensanoo ![]()

Ala ei ole tuttu itselle, joten keskityn liiketoiminnan numeroihin.

AlphaHelixin kuvaus Nordnetissa:

“AlphaHelix Molecular Diagnostics AB develops, manufactures, and markets products for DNA-identification and quantitation in molecular diagnostics and life science research. Its product inlcude Rob, BugScreener MRSA, and aAmp. The company applications inlcude Diagnostics, PCR and Liquid handling.”

Eli liiketoiminta liittyy DNA-tunnnistamiseen terveysteknologian alalla. (ruotsin Nightingale?)

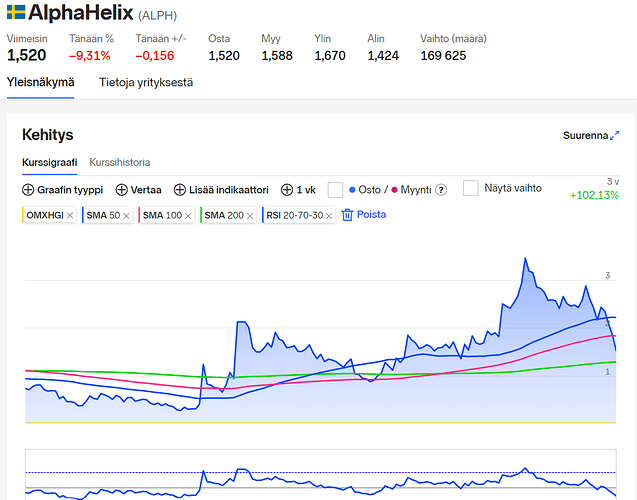

Kurssi on laskenut kunnolla, kuten muidenkin kasvuyhtiöiden.

Yhtiö on kuitenkin jo voitollinen ja kasvu ainakin joltain osin jatkunut myös 2022 alussa hyvin. Ilmeisesti kassakin ihan ok tasolla:

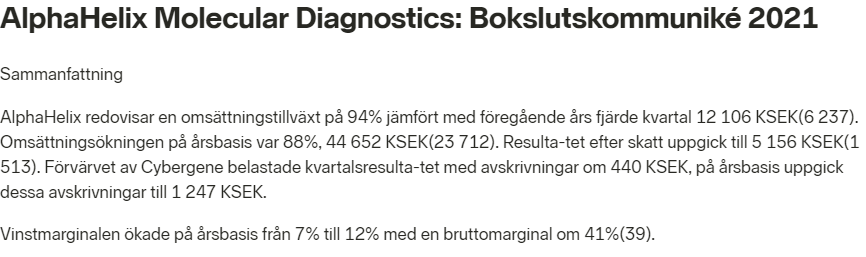

Q4/2021 raportin pääkohdat:

Q4 kannattavuus oli vissiin melko heikko, mutta silti voitollinen. En tiedä millainen kausivaihtelu tässä on, tai oliko kertaluontoisia eriä/investointeja yms.

Ja raportti

Bokslutskommuniké 2021 - AlphaHelix Molecular Diagnostics (cision.com)

Tammikuusta tiedote jonkun tytäryhtiön kuulumisista (Google kääntäjällä)

"Alphahelix’s subsidiary Techtum set a sales record in January

The life science company Alphahelix’s subsidiary Techtum set a new sales record in January.

The company had sales of close to SEK 6.8 million during the first month of the year. January is normally a seasonally weak month and last year sales were around SEK 2.4 million. Techtum also set a sales record in December.

In January, the company entered into a distribution agreement with Italian Sentinel regarding the Nordic market.

"It is mainly increased diagnostic sales that accounted for the increased sales in January, but it is gratifying that the majority of agencies have made a positive contribution. The collaboration with Sentinel strengthens Techtum’s product portfolio, primarily for increased automation for clinical operations. Sentinel’s products are characterized by user benefits combined with an attractive price picture “Techtum continues to connect with new interesting diagnostic companies for the Nordic market. The fact that we were contacted by Sentinel also indicates that our competitiveness has attracted international attention,” says CEO Mikael Havsjö in a comment."

Johtoryhmän jäsen ilmeisesti ostanut osakkeita hieman

“Board member increases his shareholding in Alphahelix

On February 23, Artur Aira bought 27,152 shares in the life science company Alphahelix, where he is a board member. The shares were purchased at a price of SEK 1.96 per share, a deal of SEK 53,000. The deal was made outside the trading post. It appears from Finansinspektionen’s transparency register.”

Syksyllä puolestaan jotkut myyneet isommin.

P/E 2021 tuloksella n. 20

Onko kukaan muu törmännyt yhtiöön? Vaikuttaa melko edulliselta, joten oletan, että jokin pommi piilotettuna, jota en ruotsinkielisten tiedotteiden vuoksi vielä hoksannut ![]() . Voin toki olla väärässä ja oikeasti löysin piilotetun helmen tällä kertaa.

. Voin toki olla väärässä ja oikeasti löysin piilotetun helmen tällä kertaa.