CELLINK has acquired Visikol, a contract research services company focused on advanced imaging, 3D cell culture assays and digital pathology

Nyt on pakko kysäistä kun en löydä yhtään mitään itse (länsinaapurin murre on hyvin heikolla tasolla, mutta esim. Avanza luettuna translatorin läpi ei vallaissut tilannetta yhtään):

Pari päivää tultu alas aika haipakkaa. Olisiko mitään tietoa miksi?

Voiko tämä olla syynä? Nanoscribe uutinenhan on jo vanha mutta detailit osakkeina maksuineen tässä 31.5. julkaisussa.

Kiitän! Osuu ajoituksen osalta kuin nenä päähän, joten eiköhän syypää löytynyt.

Uusi osto

Kvartaalipäivä lähestyy (18.08) ja ruotsalaiset piensijoittajat tapaavat ostella runsaasti ennen sellaista tapahtumaa. Yhtiö on muutenkin myötätuulessa (ainakin näennäisessä) yritysostojensa kanssa. Joidenkin firmojen hinta tippuu rajustikin jopa hyvienkin tulosten jälkeen…

Olisiko niin että siellä on sellainen alaryhmä joka kerää mansikat kakusta ennen seuraavaan siirtymistä.

Sen verran vähän ketjussa viestejä että vastaan tännekin.

Lisäksi maanantaisen lanseeraustiedote saattoi nostaa pöhinää. Myös selvittävät nimenvaihdoksen mahdollisuutta.

Osalleen ehkä aiheuttaa pientä lisäpöhinää:

https://twitter.com/mw_stocks/status/1418475968461746176?s=21

Ja TP nostettiin 600 kruunuun.

Tänään julkistettu alkuvuoden 2021 tulos. Kurssi ennen pörssien avautumista 554 SEK (YTD + 136% ja vuodessa +236%

Cellink on juuri vaihtanut nimekseen BICO Group Ab

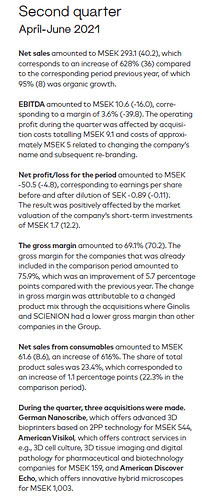

BICO Group AB: Interim report January-June 2021: Increased net sales of 628% driven by M&A and organic growth of 95% and positive EBITDA in Q2.

Itse olen ollut vajaan vuoden kyydissä ja lisäillyt kolmeen otteeseen. Tällä viikolla pohdin vielä lisäsiivua, mutta taisin jäädä kelkasta. Mielenkiinnolla odotan mitä tällaisen tulosjulkistuksen jälkeen kurssille käy. Tuleeko tästä salkkuni raketti?

About BICO

Founded in 2016, BICO (formerly CELLINK) is the leading bio convergence company in the world. By combining different technologies, such as robotics, artificial intelligence, computer science, and 3D bioprinting with biology, we enable our customers to improve people’s health and lives for the better. With a focus on the application areas of bioprinting, multiomics, cell line development, and diagnostics, the company develops and markets innovative technologies that enable researchers in the life sciences to culture cells in 3D, perform high-throughput drug screening and print human tissues and organs for the medical, pharmaceutical, and cosmetic industries. We create the future of health. The Group’s products are trusted by more than 2,000 laboratories, including all the top 20 pharmaceutical companies, are being used in more than 65 countries, and have been cited in more than 1,850 publications. BICO is listed on the Nasdaq Stockholm under BICO.

“ In five years, we have built a world-leading group that offers something truly unique – a bio convergence revolution ”, said Erik Gatenholm, CEO and President BICO. “A s the company has continued to grow, we saw limitations to make radical change in the industry and at our customers’ laboratories with just one product. We realized that our customers needed more and better technologies, products, solutions, and to create the most change. I am proud to introduce BICO to the world and look forward to continuing to push the boundaries of science to create the future of health. ”

Taas ostoksilla

BICO announces intention to carry out a directed issue of approximately SEK two billion

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, WITHIN OR INTO THE UNITED STATES, CANADA, JAPAN, AUSTRALIA, HONG KONG, NEW ZEALAND, SINGAPORE, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION, DISTRIBUTION OR RELEASE WOULD BE CONTRAVENING TO ANY APPLICABLE RULES. ADDITIONAL RESTRICTIONS ARE APPLICABLE, PLEASE SEE “IMPORTANT INFORMATION” IN THE END OF THIS PRESS RELEASE.

BICO announces intention to carry out a directed issue of approximately SEK two billion

Through the Share Issue, the Company’s share capital will increase by SEK 106,250.00 from SEK 1,442,685.43 to SEK 1,548,935.43, by new issue of 4,250,000 series B shares, resulting in the total number of shares increasing from 57,707,417 shares to 61,957,417 shares together carrying in total 75,457,417 votes, whereof 1,500,000 are series A shares together carrying 15,000,000 votes and 60,457,417 are series B shares together carrying 60,457,417 votes. The Share Issue results in a dilution of approximately 7 percent of the capital and approximately 6 percent of the votes for existing shareholders based on the total number of shares and votes in the Company after the Share Issue.

Members of the Board of Directors and the management team, of which several are large shareholders in BICO, have entered into lock-up agreements to, subject to certain exceptions, not sell shares in BICO for a period of 90 calendar days after the settlement date. Furthermore, the Company has agreed to a commitment, with customary exceptions, not to carry out any additional share issuances for a period of 90 calendar days after the settlement date.

BICO has been awarded the Swedish Government’s Award Exporter of the Year 2021

https://bico.com/investors/press-release/?r=8B96C249305F0735

Tänään tankkasin 1/5 lisäyksen alennushintaan 425 SEK/s

https://bico.com/investors/press-release/?r=EEC1D700267F13B3

“BICO is showing a strong quarter with sales development of 292 percent driven by M&A and 59 percent organic growth. We saw a strong demand in the Group for our instruments and reagents and also an increased share of revenue from consumables and new product launches. We succeeded with this, despite that three of the Group’s companies had challenges in their global supply chain in combination with under capacity in their production. We have addressed the challenges and our assessment is that the measures taken will gradually have an effect from the fourth quarter of 2021. As a result, the order intake during the quarter was higher than sales, which generated a significant increase in the Group’s order backlog”, says Erik Gatenholm, CEO and President, BICO.

Interim report January-September 2021: Continued strong organic growth, improved gross margin and supply chain challenges

November 10, 2021

Third quarter: July-September 2021

-

Net sales amounted to MSEK 315.6 (80.6), which corresponds to an increase of 292% (121) compared to the corresponding period previous year. Organic growth amounted to 59% (49). Adjusted for sales of non-recurring pandemic-related hygiene products the previous year, the quarter’s organic growth was 80%.

-

EBITDA amounted to MSEK -33.8 (-5.6), corresponding to a margin of -10.7% (-6.9). The operating profit during the quarter was affected by acquisition costs totalling MSEK 4.7 (9.8). Other costs affecting comparability include implementation costs for ERP of MSEK 2.7 and costs for name change and rebranding of MSEK 2.5.

-

Net profit/loss for the period amounted to MSEK -105.0 (-12.2), corresponding to earnings per share before and after dilution of SEK -1.81 (-0.26).

-

The gross margin amounted to 73.1% (66.2). In the quarter, the company was positively affected by the product mix, partly due to the recent acquisitions, compared with the second quarter of 2021. In the comparison quarter, the Group was negatively affected by currency fluctuations and the sale of hygiene products that took place at a lower gross margin.

-

Net sales from consumables amounted to MSEK 63.1 (16.4), an increase of 286%. The share of total product sales was 23.0%, which corresponded to an increase of 1.3 percentage points (21.7% in the comparison period).

-

During the quarter, Advanced BioMatrix was acquired for a total purchase price of MSEK 156.9.

First nine months 2021: January-September 2021

-

Net sales amounted to MSEK 738.2 (158.8), which corresponds to an increase of 365% (75) compared to the corresponding period previous year. Organic growth amounted to 69% (29). Adjusted for sales of non-recurring pandemic-related hygiene products the previous year, organic growth was 86%.

-

EBITDA amounted to MSEK -58.1 (-27.3), corresponding to a margin of -7.9% (-17.2). The operating profit during the first nine months was affected by acquisition costs totalling MSEK 34.3 (9.8). Other costs affecting comparability include implementation costs for ERP of MSEK 2.7 and costs for name change and rebranding of MSEK 6.5.

-

Net profit/loss for the period amounted to MSEK -203.3 (-50.5), corresponding to earnings per share before and after dilution of SEK -3.62 (-1.15).

-

The gross margin amounted to 72.2% (69.3). The gross margin structure in acquired companies varies depending on the product mix. A larger share of service revenues than in the previous year, for instance through the acquisitions of MatTek and Visikol, makes a positive contribution, while Ginolis in particular operates with a lower gross margin than other companies in the Group.

-

Net sales from consumables amounted to MSEK 140.6 (29.4), an increase of 378%. The share of total product sales was 21.9%, which corresponded to an increase of 2.4 percentage points (19.5% in the comparison period).

“BICO is showing a strong quarter with sales development of 292 percent driven by M&A and 59 percent organic growth. We saw a strong demand in the Group for our instruments and reagents and also an increased share of revenue from consumables and new product launches. We succeeded with this, despite that three of the Group’s companies had challenges in their global supply chain in combination with under capacity in their production. We have addressed the challenges and our assessment is that the measures taken will gradually have an effect from the fourth quarter of 2021. As a result, the order intake during the quarter was higher than sales, which generated a significant increase in the Group’s order backlog”, says Erik Gatenholm, CEO and President, BICO.

“Our mission is to continue to develop the Group’s agenda for Bio Convergence through product development and innovation which will result in customer solutions that address the health challenges we are facing and that contributes to the future of health. We are continuing to build our organization in order to deliver on our long-term growth strategy through, new recruitments across all functions, larger facilities, and investments in R&D. During the final months of the year, we will focus on ensuring that the measures implemented to address the challenges we have with the companies’ supply chains gives result”, says Erik Gatenholm, CEO and President, BICO .

Alla koko raportti

Earnings call November 10, 2021

The presentation will be held in English. Presentation will be available at Investors - BICO - The Bio Convergence Company

Date: Wednesday, November 10, 2021. 14:00-15:00 (CET)

For audio: +46 8 502 439 36 Conference-ID: 733 136 669#

For video: Video link to the presentation

Speakers: Erik Gatenholm, CEO, Gusten Danielsson, CFO and Jonas Schöndube, Business Area Director

Biosciences

Annex: Interim report January-September 202

Markkinareaktio on armoton. 20% dippaus vaikka kasvu on lähes 300%. Muutama otanta:

-

Oliko odotettu suurempia myynnin kasvulukuja? Q2/2021 kasvu oli 628% vs. 292% Q3/2021. Tuo kasvu oli nyt puolittunut (kahden perättäisen kvartaalin välillä).

-

EBITDA oli nyt MSEK -33,8, kun edellisellä kvartaalilla MSEK +10,6. Johtunee varmaan yritysostoista?

-

Net sales from consumables oli nyt MSEK 63,1 vs. edellisen kvartaalin MSEK 61,6 . Tämä on todella pieni kasvu, käytännössä ei kasvua ollenkaan. Myynti sakannut vai onko business syklistä?

Onkohan logistiikkahässäkkä vaikuttanut näin paljon tuotantoon?

Group’s companies had challenges in their global supply chain in combination with under capacity in their production. We have addressed the challenges and our assessment is that the measures taken will gradually have an effect from the fourth quarter of 2021

Alla Q2/2021 vastaavat luvut vertailun vuoksi.

Kaikkiaan, nyt tuntuu että osake on hyvässä alennuksessa. Vai onko tämä pulkkamäen alkuvauhti?

Edit: En siis ole huolissani, yhtiö on kovassa vedossa. Näkemykseni mukaan nyt on ostopaikka niille jotka missasivat kevään alennusmyynnin.