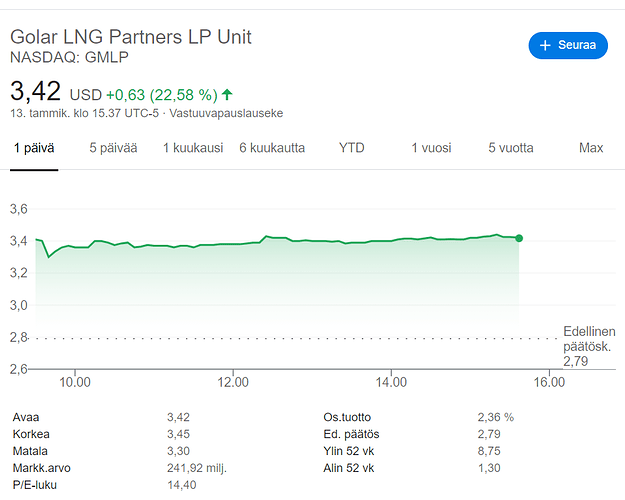

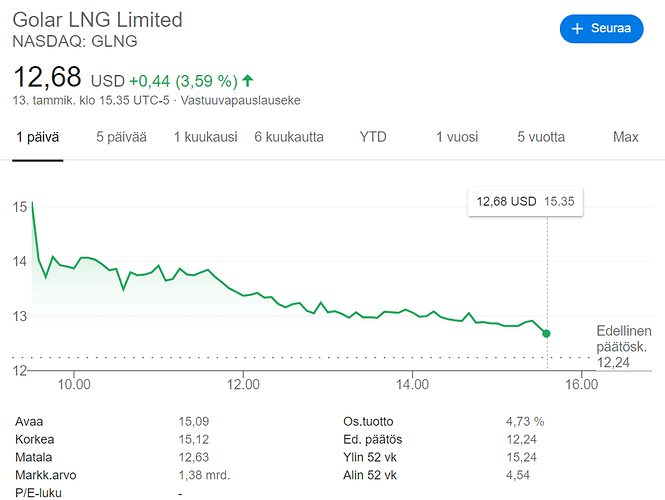

Eilen oli tosiaan hyvä päivä Golarille ja enää ei näytä rumalta punaiselta tämä hankinta salkussa.

Edellispäivänä tuli ilmoitus, että Hygo saanut aikaiseksi MOUn GdPn kanssa. Vaikka uutta IPOa päivää ei ole vielä tiedossa, saattoi tämä näkyä myös Golarin kurssissa.

Golar LNG Limited, today announced that an affiliate of Hygo Energy Transition Limited (“Hygo”) executed a Memorandum of Understanding (“MOU”) with Companhia de Gás do Pará (“GdP”). The MOU is a result of Hygo’s continued efforts to reduce energy costs significantly and support environmentally-responsible and sustainable industrial growth in the immense Amazon region, and especially in the State of Pará.

GdP is the regulated Local Distribution Company (“LDC”) that has the exclusive rights to distribute natural gas in the state of Pará, Brazil. The MOU establishes that Hygo and GdP will explore the local market potential and that Hygo will supply natural gas and LNG to GdP once the negotiations are finalized, and the contracts are executed. Hygo will utilize the Barcarena Terminal, the only one permitted in this isolated region, to supply the volumes. The Barcarena Terminal construction is expected to start shortly with operations to commence in the first half of 2022.

Fabio Amorim, Commercial Director of GdP said: “The MOU is an important step towards introducing natural gas to the Para state. The Barcarena LNG terminal will transform the fuel supply in the region, and our clients will have an affordable solution to reduce their environmental footprint. The large industries established in the region and the environment will be the most benefited from this initiative”.

Tor Olav Trøim, Chairman of Golar LNG commented: “Our commitment is to deliver cleaner and cheaper fuel to our clients. GdP can count on Hygo’s full support in order to introduce natural gas and LNG in this great region in the first half of 2022. The expected LNG demand for this terminal piles up day after day”.

Hygo estimates the potential for replacing approximately 1.8 million tons of LNG equivalents per annum of LPG, diesel, fuel oil, and coal from the terminal. The LNG demand for power generation is also significant. Hygo has secured 25-year PPAs for a 605MW power station in the region, which adds 0.6 mtpa of LNG demand to the Barcarena Terminal, starting in January 2025. This power station will be configured with the ability to run with a blend of up to 50% of Hydrogen. Hygo also expects to utilize the Barcarena LNG terminal to provide an LNG supply solution to the new regional power auction.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended) which reflects management’s current expectations, estimates and projections about its operations. All statements, other than statements of historical facts, that address activities and events that will, should, could or may occur in the future are forward-looking statements. Words such as “may,” “could,” “should,” “would,” “expect,” “plan,” “anticipate,” “intend,” “forecast,” “believe,” “estimate,” “predict,” “propose,” “potential,” “continue,” or the negative of these terms and similar expressions are intended to identify such forward-looking statements.

These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Unless legally required, Golar LNG Limited and Hygo Energy Transition Limited undertake no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise.

As a result, you are cautioned not to rely on any forward-looking statements. Actual results may differ materially from those expressed or implied by such forward-looking statements. Golar LNG Limited and Hygo Energy Transition Limited undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise unless required by law