Kurssi laski tämän myötä koska ostotarjousta kambista lähiaikoina odottavat pettyivät.

KAMBI SIGNS LATEST RETAIL SPORTSBOOK DEAL IN WASHINGTON STATE21st September 2022 11:18 am GMT

Stockholm-listed sportsbook supplier Kambi Group is entering its 19th US state through an agreement with ilani Cowlitz Indian Casino Resort in Washington.

Kambi will power a new retail sportsbook in the Pacific Northwest at ilani, which has been developed by the Cowlitz Tribe and Salishan-Mohegan, a partnership that includes Mohegan Sun.

The long-term agreement further strengthens Kambi’s presence in regulated US sports betting markets, with Washington becoming the 19th US jurisdiction where Kambi will deliver its products […]

Onkohan tää nyt hyvä vai huono uutinen.

Korvausrahat kumminkin ihan mukavat kun kumminkin menetetään asiakas.

Mietteitä Q3 tuloksesta ja tulevaisuuden näkymistä? Vertailukaudesta ainakin jäätiin reilusti ja näkyy myös kurssissa.

Muistaakseni Q3 2021 oli vielä Draftkings mukana, joka oli jotain luokkaa 30-35% silloisesta liikevaihdosta? Selittäisi ainakin ton Y/Y liikevaihdon laskun. Ensi kvartaalista lähtien pitäisi alkaa näyttää Y/Y lukemat jo positiivisilta. Eihän toi raportti kuitenkaan mitään kauheen kaunista luettavaa ole imo. Jos jotain positiivista niin Q4 varmasti tulee olemaan kova, kun on kaikki liigat käynnissä ja jalkapallon MM-kisat käydään marras/joulukuussa. Edelleen uskon, että joku isompi peluri (Disney, ESPN, Fanatics…) tulee tämän vielä ostamaan pois pörssista ja sulauttamaan omaan platformiinsa kokonaan.

Brasilian presidentti on selvinnyt. Miten forumilaiset näkevät Lulan kannan online vedonlyönnin laillistamiseen Brasiliassa?

Mielestäni tämä asia vaikuttaa Kambiin isosti suuntaan tai toiseen…

Kambi’s newly adopted long-term financial targets are:

2027 revenue of 2-3x FY2022 levels

2027 EBIT in excess of €150 million

Nykyisillä hinnoilla edullinen jos uskoo näihin.

-

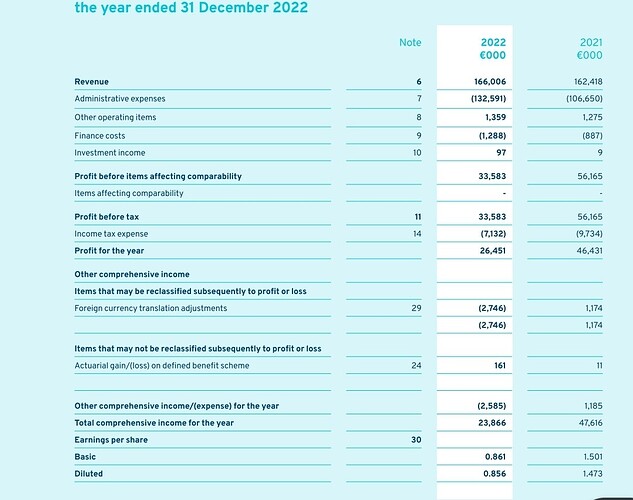

Revenue amounted to €57.8 (Q4 2021: 34.9) million for the fourth quarter of 2022, including a €12.6 million termination fee from PENN Entertainment, and €166.0 (2021: 162.4) million for the period January to December of 2022

-

Operating profit (EBIT) for the fourth quarter of 2022 was €18.7 (7.1) million, at a margin of 32.3% (20.2%), and €34.8 (57.0) million, at a margin of 20.9% (35.1%) for the period January to December of 2022

-

Revenue and operating profit (EBIT) excluding the termination fee from PENN Entertainment were €45.2 and €6.0 million respectively for the fourth quarter of 2022, and €153.4 and €22.2 million for the period January to December of 2022

-

Earnings per share for the fourth quarter of 2022 were €0.491 (0.198) and €0.861 (1.501) for the period January to December of 2022

-

Cash flow (excluding working capital and M&A) amounted to €17.9 (4.8) million for the fourth quarter of 2022 and €25.2 (44.6) million for the period January and December of 2022

-

The 2023 AGM will be held on 11 May 2023. The Board proposes that no dividend is paid out.

Tässä on Kambin aamupäivän webcast =)

Lueskelin kambin vuosiraporttia.

Hyvä puoli on se, että liikevaihto on noussut draftkingin menettämisestä huolimatta.

2022 vuonna näyttää olevan veroihin menneen enemmän rahaa ja hallinollisiin kuluihin(?) rapia 30MILJOONAA euroa enemmän verrattuna vuoteen 2021.

Kassaa poltettu 19miljoonaa, joka liittyy yritys ostoon(?).

Muutenhan tuo näyttää ihan hyvältä, mutta osa kuluista herättää kysymysmerkkejä. Onko jollain muulla ajatuksia mikä on kambin haasteet? Pareto puhuu jostain ongelmista, mutta ei oikein taivu huonolla ruotsilla mitä ne tarkoittaa?

Financial summary

Revenue amounted to €44.0 (Q1 2022: 36.9) million for the first quarter of 2023

Operating profit (EBIT) for the first quarter of 2023 was €4.5 (7.3) million, at a margin of 10.3% (19.9%), which was impacted by certain non-recurring costs

EBITA (acq)* for the first quarter of 2023 was €5.8 (7.7) million, at a margin of 13.1% (20.8%)

Cash flow (excluding working capital and M&A) amounted to €3.2 (5.5) million for the first quarter of 2023

Earnings per share for the first quarter of 2023 were €0.107 (0.178)

The 2023 AGM will be held on 11 May 2023. The Board proposes that no dividend is paid out.

The Board of Directors decided on 19 January 2023 to adopt long-term financial targets in line with Kambi’s strategic vision

*EBITA (acq) = Earnings before interest, taxation and amortisation on acquired intangible assets

Key Q1 highlights

Operator turnover and revenue growth of 12% and 19% year-on-year respectively, driven by existing partners and launches into new US states

Partnership extensions signed with Rush Street Interactive and Corredor Empresarial S.A., two of Kambi’s most strategically important partners

It’s very quiet here nowadays. Anyway I thought I’d give a couple of arguments why I decided to buy @ SEK 170:

*2023E FCF yield near 7%, or EV/MC: 15x (Jefferies)

*Net cash position (quite nice in this interest rate environment)

*Gambling is defensive during downturns (addicts just don’t care about economics)

*Great trends and TAMs globally and in the Americas for online sports betting

Moreover they just announced positive news with a new client acquisition (no idea what the impact is on top line, anyone?)

After the departure of DK and Penn, I believe the principal risks with regards to customer concentration have been realized. A lot of people still doubt the business model, so it’s ofc a bit of a gamble (no pun intended).

PS: Apologies for writing in English, my writing in Finnish is horrendous.

Brazil regulates sports betting with 18% tax

25th July 2023 | By Zak Thomas-Akoo

After years of delays, sport betting is now legal in Brazil after president Luiz Inácio Lula da Silva signed the Provisional Measure (PM) implementing the 2018 law.

Markkinareaktion perusteella merkittävä uutinen. Kyseessä on siis Ruotsin Veikkaus?

Tästä voi jäädä jo viivan alle jotain, eikä tarvitse pelata jenkkikulttuurin kanssa.

Jep Ruotsin “veikkaus”!

Kambi paransi Q3/23 verrattuna vuoden takaiseen ![]()

https://www.inderes.fi/fi/tiedotteet/kambi-group-plc-q3-report-2023

Revenue amounted to €42.1 (Q3 2022: 36.7) million for the third quarter of 2023 and €129.0 (2022: 108.2) million for the period January to September of 2023. Revenue includes certain non-recurring items as explained in the report.

Operating profit (EBIT) for the third quarter of 2023 was €4.6 (3.9) million, at a margin of 11.0% (10.6%), and €12.8 (16.1) million, at a margin of 9.9% (14.9%) for the period January to September of 2023

EBITA (acq)* for the third quarter of 2023 was €6.0 (4.2) million, at a margin of 14.1% (11.5%), and €16.7 (17.1) million, at a margin of 13.0% (15.8%), for the period January to September of 2023

Cash flow (excluding working capital and M&A) amounted to €6.1 (1.8) million for the third quarter of 2023 and €9.5 (7.3) million for the period January to September of 2023

Earnings per share for the third quarter of 2023 were €0.117 (0.084) and €0.306 (0.370) for the period January to September of 2023

DNB aloitti seurannan osta -suosituksella ja tavoitehinnalla 250 SEK

Seuraako/omistaako tätä vielä joku? Markkina ei ainakaan tykännyt Q4 luvuista (-19%) ja toimarikin vaihtuu. Oma omistus tällä hetkellä -80% ![]()