By Caitlin McCabe

Updated May 29, 2023 11:15 a.m. EDT

Firms that use computers to determine buy and sell signals have been loading up while other investors sit back.

The U.S. stock market is surprisingly calm right now, especially in the face of the debt-ceiling fight.

- A key reason: a growing divide between mainstream investors, who have largely been sitting out the 2023 stock rally, and the machines whose buying has been driving it.

Only days remain until the U.S. blows past its debt-ceiling deadline. On Satur-day, President Biden and Republican House Speaker Kevin McCarthy reached a tentative agreement to prevent a destabilizing default.

- But passage of the plan, which could face some opposition in the House or Senate, isn’t yet assured and procedural hurdles could delay final legislation even if they don’t scupper it.

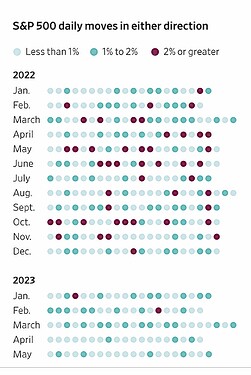

Despite the political uncer-tainty, the rebounding stock market has barely gotten nicked, with the S&P 500 finishing 0.3% higher last week.

- Over recent months, stocks have handily over-come stress in the banking system, stubborn inflation and interest-rate hikes. Last year, those kinds of issues repeatedly torpedoed stocks. This year, markets have met such events with a shrug.

The market’s steady rise has puzzled *analysts and portfolio managers as the S&P 500 has churned more than 9% higher this year (and the technology-focused Nasdaq Composite has risen 24%).

- One explanation: Quant funds, or those relying on computer models and automated trading, have been doubling down on equity markets as other investors have stepped back, citing high valuations and concerns about the likely course of the U.S. economy.