Joko tämä holdaajien tiedossa?

https://www.sec.gov/ix?doc=/Archives/edgar/data/1731289/000119312523074380/d468221d8k.htm

Al Root

Shares of electric and hydrogen fuel cell truck technology company Nikola are taking it on the chin. The reason is arcane.

Monday, Nikola (ticker: NKLA) filed a notice with the Securities and Exchange Commission saying that on Thursday, it filed a petition in the Delaware Court of Chancery, seeking to validate certain documents for Romeo Power, a maker of EV battery packs and associated technology, it acquired in October.

If it feels very obscure, it is. Investors don’t usually worry about comings and goings in the Chancery court.

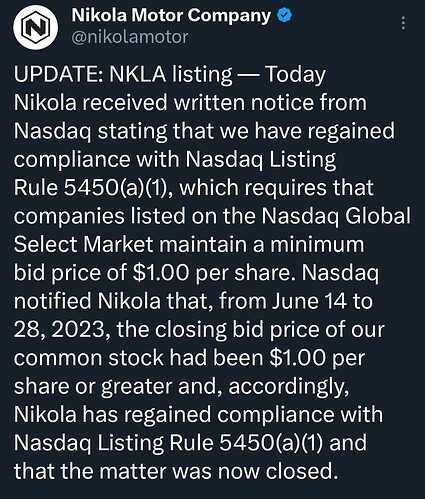

The petition seems to matter, though. Nikola stock hit a 52-week low Monday and was down 9.1% at $1.54 in late trading. The S&P 500 and Nasdaq Composite were up 0.7% and 0.2%, respectively.

Nikola filed the petition citing “uncertainty created by a recent Court of Chancery decision in Garfield v. Boxed.” In December, the Chancery court ruled that companies like Boxed, with multiple classes of stock, are required to hold separate votes for each class of shares to expand the number of shares issued in connection with a merger with a special purpose acquisition company.

Romeo became a publicly traded company by merging with a SPAC in late 2020. It expanded the number of shares outstanding in connection with that merger. If that issuance is deemed somehow invalid down the road, it would create some uncertainty for Nikola.

Nikola wants to validate a restated certificate of incorporation of Romeo Power, securities Romeo issued under the restarted certificate of incorporation, and the certificate of merger between Nikola and Romeo.

Investors hate uncertainty. Nikola referred Barron’s to the filing when asked about the petition and its implications for the company.

Nikola’s hearing in Delaware is slated for March 29. Investors will have to wait until then to see what happens next.

Nikola stock is now down about 29% year to date and off about 83% over the past 12 months.

Write to Al Root at allen.root@dowjones.com

This content was created by Barron’s, which is operated by Dow Jones & Co. Barron’s is published independently from Dow Jones Newswires and The Wall Street Journal.

(END) Dow Jones Newswires