Nokia vaan ostamaan Qualcommin siruja tukiasemiinsa, jos niiden käyttö on halvempaa kuin omien tai muiden valmistajien tekemien käyttö. Näin Nokia toimii jo muutenkin. Nokia’s 5G Smart Node portfolio will be powered by the Qualcomm 5G RAN platform for small cells (FSM100xx)

VERIZON PUTS PRIVATE 5G IN FOCUS WITH NOKIA, MICROSOFT PARTNERSHIPS

Today Verizon said it will offer private 5G network solutions to enterprises in Europe and Asia-Pacific with Nokia, using the Finnish vendor’s Digital Automation Cloud (NDAC) tools. The move to help international business customers deploy dedicated 5G networks expands on Verizon’s network-as-a-service (NaaS) strategy, and points to growing enterprise interest in private cellular networks.

Verizon’s private 5G managed service solution for global enterprises consists of “the Nokia NDAC (core, radio antenna), coupled with Verizon’s existing portfolio of managed WAN and LAN services, as well as professional services to define exact requirements for a given use case.”

When it comes to spectrum for private 5G networks internationally, business customers will apply for their own spectrum licenses, Crawford said via email, but “Verizon’s professional services team will work closely with customers and advise them on any procedures required.”

In a recent interview with FierceWireless, Nokia’s head of business development for private wireless Dustin LaMascus said about half of its private wireless sales are direct, while the other 50% are indirect, either through carriers or smaller partners including local systems integrators.

On se kumma tämä Nokia, kun ei vain meinaa jaksaa nousta. Taas laskeltu nysessä vastoin kaikkea loogisuutta (omasta mielestäni). Hyviä uutisia on ja tulee, on verrokkeihin kai halpa jne… Kuka siellä oikein enää viitsii myydä? Vai treidataanko siellä vaan isosti…

Onko joku tutkinut tarkemmin tuota miten Noksu nysessä tuntuu päivästä toiseen laskevan kun muut nousee ja päin vastoin = menee vastavirtaan? Joku kuva olis kiva.

JuhaHutin kommentilla, jossa on Tommi Uiton twiitti, on enemmän tykkäyksiä inderesin foorumilla kuin Tommi Uiton twiitillä twitterissä.

![]()

Saa liputtaa.

Huokuuko tämä viesti vähän sellaista suhteiden ”palauttamista”? Tarkoitan siis tuota all in kohtaa - onko Verizonella ajateltu että Nokia on all in vain T-Mon kanssa? Nyt Uitto tavallaan muistuttaa ettei se ihan niin mene.

Mutta kun menee sanojen taakse, myönteinen twiitti luonnollisesti. Jos asiakkuus olisi menetetty (joka siis ei ole) ja saataisiin armopaloja, tuskin näin kommentoisi. Tässähän on nyt selkeästi koukku et markkinat voivat tulevaisuudessa yllättyä tästä asiakkuudesta.

Erkin Q3 tulos tulee tänään ? Heti aamusta ?

Kyllä, tässä odotukset:

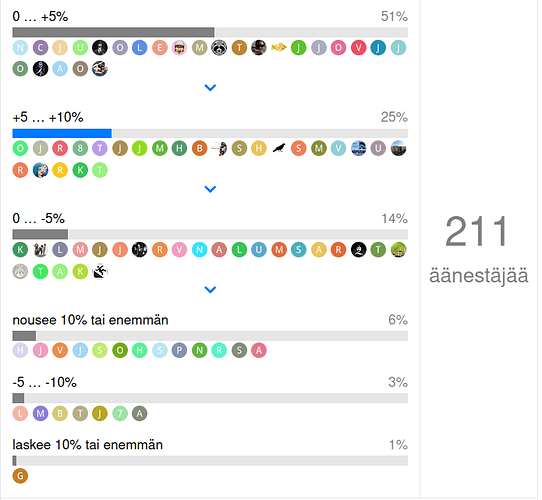

Hetki sitten suljettu äänestys Ericssonin pörssikurssin reaktiosta tulosjulkistuksen jälkeen. Kylläpä jännittää. ![]()

Kyyti voi olla kylmää tai hottia. Toivon hartaasti, että Ericsson kertoo positiivisista investointinäkymistä operaattorikentässä. Se voi olla jopa itse tulosta paljon merkittävämpi ajuri Nokian ja Ericssonin pörssikursseille. Muistissa on vielä Cienan varoittelut, joille pitäisi saada vastapainoa.

Ja tässä olisi Ericsson:

Ericsson : Ericsson reports third quarter results 2020

Third quarter highlights

· Sales adjusted for comparable units and currency increased by 7% YoY mainly driven by 5G sales in Mainland China. Reported sales were SEK 57.5 (57.1) b.

· Gross margin excluding restructuring charges improved to 43.2% (37.8%) with margin improvement in all segments. Reported gross margin improved to 43.1%

(37.7%).

· Operating income excluding restructuring charges and items affecting comparability in Q3 2019, improved to SEK 9.0 b. (15.6% operating margin) from SEK

6.5[1] b. (11.4% operating margin) driven by Networks. Reported operating income SEK 8.6 (-4.2) b.

· Networks reported sales increased by 6% YoY, with an increase of 13% adjusted for comparable units and currency. Operating margin excluding restructuring

charges was 22.7% (18.4%).

· Net income was SEK 5.6 (-6.9[1]) b.

· Free cash flow before M&A was SEK 3.9 (4.5) b., including a capital injection into the Swedish Pension Trust of SEK -2 b. in the quarter. Net cash Sep 30,

2020, was SEK 41.5 (37.4) b.

[1] Q3 2019 was impacted by cost provisions of SEK -11.5 b. related to the investigation by the United States Securities and Exchange Commission (SEC) and the

United States Department of Justice (DOJ) as well as a refund of social security costs of SEK 0.9 b.

Planning assumptions highlights (please see the quarterly report for complete planning assumptions)

· The YTD results strengthen the Company’s confidence in delivering the Group targets for 2020. The financial targets for 2022 remain.

Nokia valittiin Telian 5G-yhteistyökumppaniksi Suomessa ja standalone 5G -runkoverkon toimittajaksi useilla eri markkinoilla Nokia valittiin Telian 5G-yhteistyökumppaniksi Suomessa ja standalone 5G -runkoverkon toimittajaksi useilla eri markkinoilla | Kauppalehti

Comments from Börje Ekholm, President and CEO of Ericsson (NASDAQ:ERIC)

Amid the continuing global Covid-19 pandemic and with more than 80% of our people working from home, we keep on executing on our focused strategy. We continue

to win footprint in several markets leveraging our competitive 5G portfolio. The gross margin[1] improved in all segments in the third quarter and reached 43.2%

(37.8%), the highest since 2006. With the acquisition of Cradlepoint, expected to close in Q4, we are making further progress in our strategy to build an

enterprise business. Covid-19 has so far had limited impact on our business, but we are closely monitoring any signs of a change in the situation. The year to

date results strengthen our confidence in delivering on the 2020 Group target.

Networks grew organically[2] by 13% and reported a gross margin[1] of 46.7% (41.6%). This reflects high activity levels in North East Asia and North America.

Underlying business fundamentals remain strong in North America driven by consolidation in the US operator market, pending spectrum auctions, and increased

demand for 5G. The 5G contracts in Mainland China have developed according to plan, contributing positively to profits in Q3 and are expected to improve

further. Our business in Europe grew based on several footprint gains. While the pandemic has hurt revenues for several of our customers, and in some cases this

has led to a reduction of capex, we have not seen any negative impact on our business, largely due to footprint gains. However, the pandemic negatively impacted

our sales in Latin America and Africa.

Digital Services continued to make good progress on the execution of the turnaround plan, transforming the business and increasing software sales. The gross

margin[1] improved to 43.5% (38.3%), supported by increased software sales and improvements in the underlying business. Our cloud-native 5G core portfolio shows

very positive momentum with a high win-ratio and a significant number of new customer contracts. We are selectively increasing R&D investments to accelerate our

growth portfolio to capture market opportunities. However, sales in our legacy portfolio is declining faster than earlier predicted. In the short term, this

shortfall will not be compensated by the growth in new offerings and therefore our sales volume is lower than expected. With weaker sales in combination with

higher R&D investments, there is a risk of further delay in reaching the 2020 operating margin target for Digital Services.

Managed Services delivered a gross margin[1] of 20.1% (17.9%). The 4Q rolling operating margin[1] is 7.4%. Sales declined mainly due to the US operator

consolidation. We expect our investments in automation and AI to create future business opportunities, which are anticipated to gradually improve the margin

profile as this new portfolio grows.

Emerging Business and Other reported a gross margin[1] of 30.5% (20.5%). Our IoT platform sales grew by more than 40% despite an impact on demand from Covid-19.

In the quarter we announced our plans to acquire Cradlepoint, which will strengthen our ability to grow in the 5G enterprise market alongside our existing

dedicated networks and IoT portfolio. Cradlepoint will drive revenues for our customers as wireless WAN gains further penetration. Cradlepoint will operate as a

standalone subsidiary within Ericsson, and we look forward to welcoming the team at Cradlepoint to Ericsson.

Patent licensing continues to perform well based on our strong IPR portfolio, even though revenues decreased in the third quarter as one of our licensees

experienced lower sales volumes. We are approaching several important contract renewals. We are confident in the value of our broad patent portfolio, including

a strong position in 5G and will seek to maximize the net present value of our patent estate that has been built over time through our large R&D investments.

Depending on timing of the agreement renewals, we may see gaps in IPR revenues in 2021 and 2022.

Free cash flow before M&A amounted to SEK 3.9 (4.5) b. in the third quarter, a year-on-year improvement of SEK 1.9 b., if adjusted for a capital injection into

the Swedish Pension Trust and last year’s positive effect from a social security refund. On a 4Q rolling basis we have generated SEK 17.7 b. of free cash flow

before M&A[3] if excluding the payments to SEC and DOJ.

We are committed to continue improving our Ethics and Compliance program. Through driving stronger management ownership and accountability for compliance, we

are also reinforcing our commitment to responsible business practices and a stronger corporate culture. Our people should always be able to speak up and we

expect Ericsson leaders to operate with integrity at all times.

Open RAN is a hot topic in our industry today and Ericsson is a strong supporter of openness and actively engages in alliances, such as 3GPP, ONAP and the O-RAN

alliance. In the years to come, networks will gradually evolve, as will the current open standards. At the same time 5G is ready and happening now so focus must

be on providing early access to 5G networks to enable the broader ecosystem to innovate at scale.

We remain positive on the longer-term outlook for the industry and Ericsson. The year to date results strengthen our confidence in delivering on the 2020 Group

target.

Oma analyysi: Kova tulos.

Pieniä kysymysmerkkejä toki joukossa, mutta eiköhän tällä päästä oikein mukavaan positiiviseen vireeseen. Pääosin selvästi yli ennusteen.

Aika paljon Börje heitteli IF-lausekkeita puheenvuorossaan. No, eipä yllätä.

Tämä on iso diili, tuolla mainitaan 7500 tukiasemapaikkaa, jos BT diiliä hehkutettiin pot isoksi, niin tämä on noin 70% tukiasemavolyymiltaan

Hyvä Telia !

Nokia on tänään julkistanut yhteistyösopimuksen Telian kanssa, jonka myötä Nokiasta tulee Telian 5G-radioverkkolaitteistojen ainoa toimittaja Suomessa. Viisivuotinen sopimus kattaa nykyisten verkkojen uudistamisen ja siihen kuuluu yli 7 500 tukiasemapaikkaa. Nokia on Telian pitkäaikainen yhteistyökumppani ja valittu nyt myös Telian standalone (SA) 5G -runkoverkkojen toimittajaksi Liettuassa, Norjassa, Ruotsissa, Suomessa, Tanskassa ja Virossa.

Hetkonen. Käsittääkö tämä nyt koko Suomen, as in myös Suomen Yhteisverkon alueet? Se on aika iso juttu se.

EDIT: Ja onhan tuo Ruotsi tuolla listassa aika kova myös. Hatunnosto.

Ilmeisesti voidaan odottaa nousu päivää nokioille? En uskaltanut tuplata eilen, mutta 1750 kpl sentään lisäsin, onhan sekin jotain…

Nokialta viime aikoina hyviä voittoja?

En näe, miten Nokia voisi Ericssonin tuloksen jälkeen laskea. Todennäköisesti Ericsson nostaa myös Nokiaa tänään. Kuten Kezist totesi, paljon on if-lauseita vielä toimarin teksteissä, mutta itse en ainakaan huomannut mitään viitteitä markkinoiden hiipumisesta.

Dagens Industri muuten otsikoi “Ericsson murskasi odotukset”.

Telian Ruotsin ja Viron 5g-soppari puolestaan ericssonille. Tästä tullee hyvä päivä ![]()