Tuo on totta, mutta esimerkiksi noista mainitsemistani täkäläisistä 8 kilpailevasta merkistä yksikään ei ole tuon kauppaketjun oma vaan löytyy muualtakin. Oatly on aina ollut kallein ja itsepintaisesti pitänyt hinnan korkeana vaikka kilpailijoita tullut lisää. Jossain vaiheessa Oatlylla oli varsinkin kahviloissa etulyöntiasema kun oli ensimmäinen premium-barista vaihtoehto, mutta ne ajat on takana nyt kun kilpailijoita on useita.

Oatlyn kurssi intoutui reiluun nousuun viime päivinä. Hyviä juttujahan sieltä on tullu, mutta toki isoin ongelma ei ole poistunut vaan toiminta jatkunee tappiollisena vielä hyvän tovin. Velan uudelleenjärjestelemisestä luulisi tulevan uutista vielä ennen kesää.

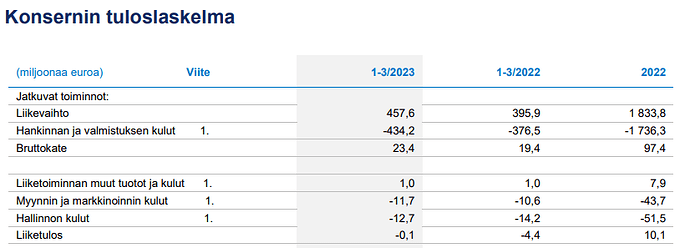

Kauramaidolla meni 2022 hyvin

Uusia tuotteita:

Sieltä se odotettu Form 6-K tuli.

"Explanatory Note

Oatly Group AB (publ) (the “Company”) today announced that it has submitted for publication on January 24, 2023 a notice (the “Notice”) convening an extraordinary general meeting (the “Meeting”) of the Company on March 6, 2023. A copy of the Notice is being furnished as Exhibit 99.1. The purpose of the Meeting is to seek approval by the Company’s shareholders of two proposals that are being submitted to shareholders in order to provide the Company additional flexibility to raise capital to support its business plan.

The first proposal seeks approval of shareholders to increase the limits in the Company’s articles of association regarding share capital and number of shares to a maximum of SEK 3,400,000 and 2,000,000,000, respectively. The effect of this change would be to increase the room for issuance of additional shares without the need for further shareholder approval.

The second proposal seeks approval of shareholders to authorize the Board of Directors of the Company to raise up to $300 million in the form of shares, warrants exercisable for shares or bonds convertible into shares without first offering those securities to existing shareholders of the Company pursuant to preemptive rights. Adoption of this resolution will replace the Board of Directors’ current authorization adopted at the annual general meeting in 2022 and will provide the Company with a wider range of approaches to raise capital.

The Company’s Board of Directors and management believe that approval of the foregoing proposals, and the other proposals set forth in the Notice, are in the best interests of the Company and its shareholders. If adopted, the Company may seek to raise capital from existing investors, including its major shareholders, and from new investors.

Additional information is set forth in the Notice, which shareholders are encouraged to read in full.

Wasteland capitalin tekemä Q4 analyysi.

Kaveri on aika kärkäs sanoistaan, mutta kansantajuistaa näitä tulosjulkaisuja suorapuheisesti ja viihdyttävästi.

Oatlylla mielenkiintoista ja poikkeavaa mainontaa ![]()

Oatlyn kalvosulkeiset on jo klassikkoja, joka kvartaali saa arvailla montakohan fonttia tällä kertaa käytössä. 90% kalvoista aina ihan puuta heinää.

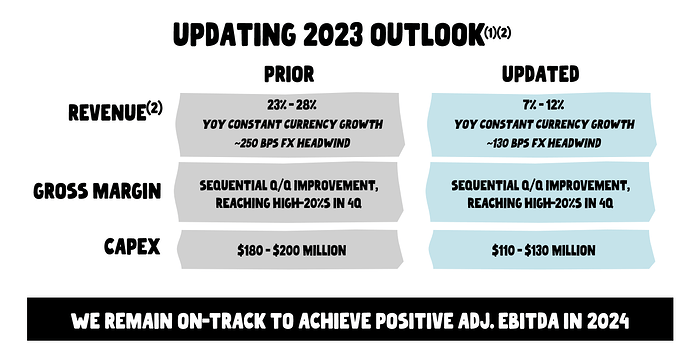

Ennusteet laitettiin tosiaan hieman uusiksi.

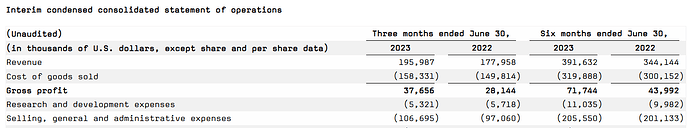

Kassan tilannehan on nyt ihan hyvä, mutta kyllä tässä liiketoiminnassa on jotain pielessä, jos valmistat sokeroitua kauravettä, pyydät siitä premium hintaa ja lopputulos se, että teet 196 miljoonan liikevaihdolla 52 miljoonaa tappiota kvartaalissa.

Näissä muissa mainitsemissasi yhtiöissä on vain se perustavanlaatuinen ero että nämä ovat alustayhtiöitä.

Oatly toimii pääomavaltaisella toimialalla ja kilpailu on erittäin kovaa kun jokainen Pirkka ja paikallinen meijerifirma puskee kilpailevaa tuotetta markkinoille kilpailemaan ennen kaikkea hinnalla.

Jenkkimeininkeinen adjusted ebitdan ennustaminen on kanssa erittäin punainen vaate kun ei edes sitä voida ohjeistaa rehdisti.

Elintarvikealalla on paikkansa myös isoille globaaleille brändeille. Aika moni reissaaja valitsee mieluummin sen tutun ja turvallisen tuotteen kuin paikallista, “joka voi olla mitä sattuu”. Luultavasti paikallinen tuote myös ihan fine, mutta näin ihmiset käyttäytyvät. Oatly pyrkii olemaan se kaurajuomien Coca-Cola.

Se että onnistuuko tämä on oma kysymyksensä. Voi olla että on liian kunnianhimoinen tavoite tällä alalla, mutta ei sitä kukaan muukaan yritä. Seuraan tällä hetkellä sivusta, hyvin kiinnostuneena.

Terveisin nimimerkki:

Itsekin muutaman kerran reissussa päätynyt ostamaan Fantaa, enkä sitä paikallista appelsiinilimua.

Kyllä siinä kohtaa kannattaa ainakin markkinointitiimille antaa kenkää ja ottaa kokonaan uudet kenties juuri Cokikselta kannukset hankkineet osaajat tilalle pyörittämään.

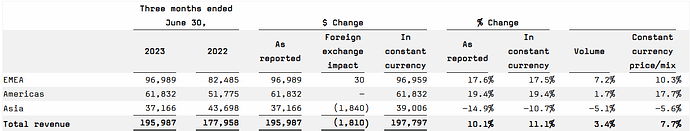

Yhtiö käyttää puolet liikevaihdostaan markkinointiin eikä yhtiö siltikään pääse käytännössä mihinkään volyymikasvuun.

Tuo on aivan alaarvoinen kasvu tuolla markkinointibudjetilla ja täytyy todella ihmetellä että miten ihmeessä markkinointiin voidaan kaataa noin järkyttäviä summia jos volyymikasvu on tuota luokkaa.

Yhtiöllä on kassassa rahaa taas 340 miljoonaa ja kun kassavirta oli taas 113 miljoonaa pakkasella niin tässä on yhtiöllä taas 6kk työrauhaa ennen kuin johdon pitää viimeistään alkaa taas ssuunnittelemaan jatkorahoitusta jollei kassavirta ala jostain syystä kääntyä positiiviseksi.

Tuleeko Oatlysta seuraava Coca Cola vai nyhtökaura tai heinäsirkat niin aika näyttää.

Niin pitkään kun yhtiön liiketoiminta ei vastaa miltään osin tervettä liiketoimintaa niin kannattanee pitää osake sellaisella painolla ettei sen kehitys juuri salkun tulevaa kehitystä heiluta suuntaan eikä toiseen, jos yhtiön liiketoiminta alkaa näyttää terveemmältä niin lappuun pääsee myös siinäkin kohtaa mukaan jos näyttää että latu aukeaa juuri Oatlylle.

Ihan kaikkia rahoja tässä tuskin on kuitenkaan mahdollisuus menettää sillä eiköhän joku isompi alan toimija kuten taas esimerkiksi Cokis tai kenties Heinz tämän osta pois jos arvostus liian alhaiseksi syystä tai toisesta laskee.

Tämä nyt oli kärjistys kun ei täysin yhtiön sisälle nää ja yhtiö ei ole niitä tuon tarkemmin halunnut eritellä.

Hyvin lähellä tuota tuo kuitenkin on kun katsoo miten Oatly näkyy katukuvassa täällä suomessakin ja tulee tuo vastaan myös ulkomaiden katukuvassa ja erilaisissa yhteistöissä.

Vertailukohtaa voi hakea esimerkiksi Raisiosta jonka mainoskampanjoita ei juuri missään nää ja jonka vastaavat kulut ovat huomtavvasti tätä pienempiä esimerkiksi liikevaihtoon suhteutettuna.

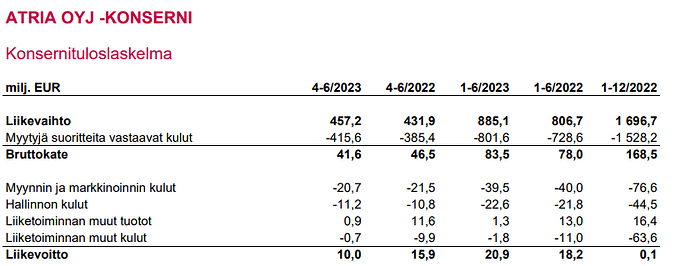

Atria on nämä eriyttänyt vielä erikseen ja siellä hallinnon kulut on murto-osa Oatlysta vaikka liikevaihto on yli tuplat verrattuna Oatlyyn.

Tässä vielä HKScan joka on kanssa nämä eritellyt tarkemmin.

Itse käytin aikaisemmin myös iKaffea, mutta siirryin muutaman vuoden jälkeen takaisin lehmänmaitoon kuten monet muut. Itseäni alkoi ahdistamaan hammaslääkärien varoitukset kaurajuomista, sekä skeptisyys siitä, että pelastetaanko planeetta oikeasti kaurajuomalla.

Maito on vasikoille. Muutenkin se pieni määrä mitä kaurajuomaa menee kahvin kanssa ei vaikuta kyllä millään tavalla hampaiden terveyteen. Se on selvä että kaurajuoman hiilijalanjälki on pienempi kuin lehmänmaidon, mutta tämä ei paljoa Oatlyä hyödytä kun paras kaurajuoma tulee ihan eri firmasta.

Ei välttämättä pidä edes paikkansa.

Kauravälipalajuoman hiilijalanjälki voi olla yhtä suuri kuin lehmänmaidon – jos näin on, miten se voi olla mahdollista ja onko sillä merkitystä? ← Toki pidän uskottavana sitä, että kaurassa pienemmät päästöt - mutta ero ei ole niin suuri kun alkuun uskoisi.

Kasvimaito voi aiheuttaa hampaissa kariesta ja reikiä ← Tämä mielestäni oleellisempi ja jopa kahvissa vaikuttaa.

Lehmien käyttö tuotantoeläiminä toki aiheuttaa pahaa mieltä, mutta suurin osa kauramaitojen juojista syövät kuitenkin normaalista maidosta tuotettuja juustoja, jogurtteja, jauhalihaa, hampurilaispihvejä yms. Kauramaidolla on varmasti paikkansa yhteiskunnassa, mutta tuollaisenaan se kyllä jää “niché” -tuotteeksi ja tästä syystä Oatlykaan ei liiketoimintaansa saa kannattamaan IMO.

Monenlaistahan voi nostaa esille, mutta otsikosta eteenpäin:

“– Mikäli kasvimaitoja haluaa käyttää, niitä kannattaa käyttää aterioiden yhteydessä, ja lisäksi pitää huomioida sokerien kokonaismäärä ruokavaliossa, (erikoishammaslääkäri) Siukosaari jatkaa.”

Toisella puolen pöytää on sitten ilmastonmuutos, lajikato ja esimerkiksi Suomessa Itämeren tila:

Ja sama toki pätee muihinkin vesistöihin.

Kun tietoisuus ympäristötuhosta kasvaa, on kaurajuomat ja monet muut vegefirmat varmasti voittajia. Valitettavasti aikuisten kasvattaminen uuteen tietoon on vaikeampaa kuin lenkkeilyharrastuksen aloittaminen, joten muutos ottaa aikansa.

Merkittävä kysymys lienee Oatlyn kannalta, että kantaako maailman johtava brändi samanlaiseen riemuvoittoon kuin sokerijuomapuolella on Coca-Cola ja Pepsi kantaneet. Kaurajuomista löytyy parempaa juotavaa sekä parempaa tulostakin tekevää vaihtoehtoa ihan kotimaastakin tällä hetkellä.

Nämä tutkimukset ovat aina vähän hähmäsiä, mutta verrattuna mihin dieettiin veganismi vähentää luontokatoa? Väitän, että päästäisiin jo pitkälle sillä, että sitä Entrecottia ja jauhelihaa syötäisiin vaikka kerran kaksi kuukaudessa. Paljon on perheitä, jossa punainen liha muodostaa melkein joka päiväisen rungon ruokapöytään.

Olen samaa mieltä siitä, että eläinproteiinit ovat ongelmallisia. Voittajat eivät kuitenkaan tule melko varmasti löytymään Oatlystä tai muistakaan vegefirmoista, vaan ihan niistä tutuista ja turvallisista consuler staples brändeistä (Pepsi, Unilever jne)

Itse syön melko vähän punaista lihaa ja kesän hampurilaispihvit on pitkälti jo korvattu Beyond Meatillä. Itse uskon, että lihan keinotekoisen alhainen hinta pitäisi saada ylös ja sillä ohjata kulutusta TODISTETUSTI kestävimpiin vaihtoehtoihin.

Toisekseen laboratorioliha saataa myös vastata tähän haasteeseen, eli liha joka kasvatetaan ilman eläintä esim. sonnin kantasoluista,

Jaa, tänne ne sijoittajien rahat menee, lobbaus toimintaan.

Täytyy kyllä sekin sanoa, että Ylen kirjoittajan mielipide tulee jo otsikosta selväksi. ![]() “Meidän maitotuotannon kiusana taas, pahalaiset…”

“Meidän maitotuotannon kiusana taas, pahalaiset…”

Siinä Oatly on onnistunu - pian miljarditappioiden lisäksi - että on kyseenalaistanu suomalaisten (ehkä hivenen aivopesunkaltaiset) uskomukset maidosta. “Miten kehtaavatkin”, oli omakin ensimmäinen ajatus.

Jokohan nyt osake lähtisi kunnolla nousuun? Tavoitehinta kuitenkin kaukana listautumishinnoista, mutta nykykurssiin nähden voisi olla hyvä sijoitus. Mitä olette mieltä?