Alkuvuodesta kirjoitetun Stock Famin PBX-esittelytekstin kanssa kannattaa ottaa suolaa ja puolen vuoden aikana on tapahtunut paljon asioita, mutta kirjoitus silti kiteyttää keissin bull-teorian:

Powerband Solutions ($PBX in Canada. $PWWBF on the OTCQB) (Also mentioned $CVNA $KMX)

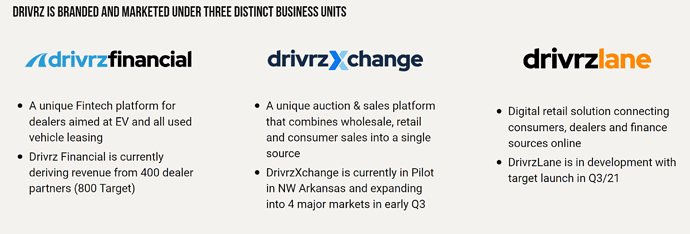

Industry: Automotive Digital Retail Marketplace

Key Management: John Lamb (President); Kelly Jennings (C.E.O.)

Highlights

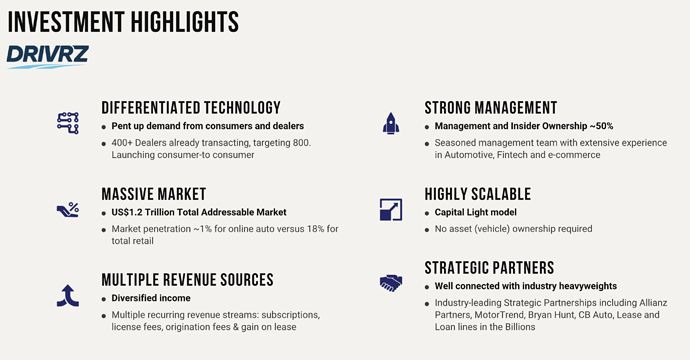

-Fintech solution for rapidly growing online automotive marketplace. Using the Amazon, Air Bnb model.

-One-stop shop for literally every facet of purchasing or selling a car online (the next generation of apps like Carvana or Autotrader)

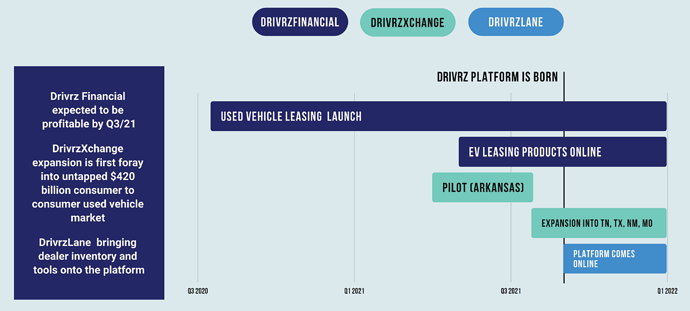

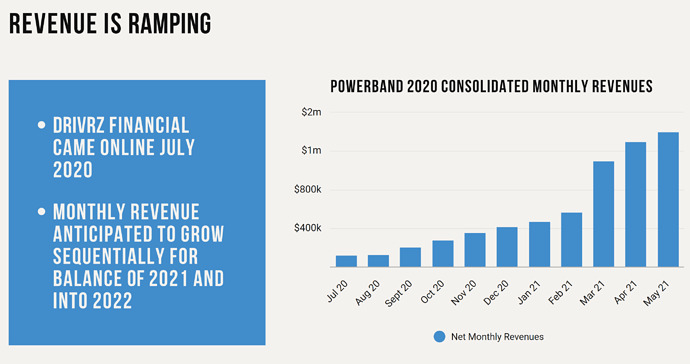

-Already rolling out regionally with full national rollout this year.

-Transformative deal with C.B.Auto, who represents union members around the United States, with a customer base of 67 million consumers.

-A goal of being the biggest electric vehicle marketplace in the United States, and a transformative MOU with a global EV insurance company.

-Management stating that a MOU with an EV manufacturing global giant may be imminent.

-45% insider held, with up to 70% friends & family insider held shares. Significant revenues and revenue growth

Why We Love It:

Listen to any Cathy Wood (ARK Invest guru) interview and the biggest takeaway is to always be “on the right side of change”, recognizing where we are going as a society, and what will help us get there. We will all be driving an electric vehicle before too long; most of us are already seeing the benefits of eating plant-based alternatives, both to our own health and to the planet; and global ecommerce runs increasingly on the incredible convenience and profitability of fintech. Those who recognized these societal shifts early, and invested accordingly, are wealthy people today.

We love Powerband Solutions because, before anything else, it is a fintech company. E-commerce is the way to do business in the global marketplace, and it is impacting almost every industry. You have almost certainly heard of Autotrader, CarMax and Carvana, and all have formed different niches in the digital automotive sector, but we believe that Powerband has the only comprehensive ecosystem in the industry, and 2021 is shaping up to be its inflection year.

But to understand Powerband’s opportunity for growth ahead, we need to understand the industry itself, which is evolving rapidly, and, at first glance, may appear crowded. As always, we will prime the engine with a look at the macro landscape for the auto industry in the US. A place where an estimated 287million registered vehicles roam over 4 million miles of roadways (6.6 million km - for those who don’t want to convert), the average household owns 2 vehicles (1.88 based on recent data by US Department of Transportation), and the open road will always be king.

Although 2020 was inevitably a poor year for sales, with a 15% overall decline (the leanest year since 2011), the back half of the year actually picked up more than expected. And looking forward, forecasters conservatively expect an 8-9% increase in sales year over year. Despite the optimism, the Covid-19 pandemic has irreparably altered the auto industry, just like it has countless other sectors. Not that change is bad, but the industry is looking at big changes in both what people buy (used and EV) and how they buy it (online). Don’t get me wrong, in-person transactions still represent the lions’ share of the market, but online sales are gaining ground every year. Your parents may never buy a car online, but you might, and your kids certainly will. And the biggest beneficiary of the digital automobile marketplace shift is the perennially under-appreciated used car. Times have changed, and this Forbes article sums up the changing marketplace:

New car sales might be in trouble, but expect boom times for used cars in 2021. Growth will be helped along by the rising appeal of online used car retail, which we anticipate will jog along at a compound annual growth rate of 9% between 2019 and 2025. Demand for used electric and hybrid vehicles is also expected to pick up.

The evolution of the used car buying experience has really picked up steam in the last few years. Trips to sketchy-looking places with colorful names like “Honest Ed’s Auto Emporium” have virtually disappeared from our car-purchasing experience. While large dealers still command a very large market share of the used car space, the industry itself is going digital. Before we get to Powerband and their DRIVRZ platform, let’s quickly look at the evolution of online purchasing.

Before the internet, the go-to guide for appraising a car to buy or sell was the venerable Kelley Blue Book, originating all the way back in 1926. Updated yearly, it was good enough to give your grandparents a loose idea on the value of their Lincoln Continental.

The landscape stayed that way until the late 1990’s, when companies started listing their inventories online. Carmax was an early adopter of the internet as a tool to attract customers to their dealerships with massive inventories. Autotrader was another early player in the space; essentially a Craig’s List for automobiles. Autotrader, still prevalent today, simply connects the seller with buyers, but leaves the rest to the interested parties. In recent years, companies like Cars.com and CarGurus have entered the increasingly crowded ‘online listing’ space.

While still focusing solely on the used car market, one company that has gained traction quite recently is Carvana, with a 2020 IPO and a current market cap of over $54 billion USD. Carvana, at its pre-Covid peak in 2019, sold approximately 180,000 used vehicles. What has made Carvana different from others in the sector is its low-overhead business model, removing the physical lots and existing solely online. The company purchases cars off sellers and then keeps them at inspection centers, waiting for the time when a consumer will select them from an online inventory. But despite their low-overhead business model, customer awareness, and increased marketplace presence Carvana is not expected to be cash flow positive until 2022 with profitability even further down the road. Carvana boasts that it removes the middleman, but essentially it replaces the middleman, as it acts as either buyer or seller in all transactions. It is a virtual used car lot, no different than “Honest Ed’s” or any other lot with a wacky air dancer outfront trying to grab your attention and business.

So, where does Powerband fit in? Is it just another upstart in a crowded space? Is it gaining any traction currently? Are we talking about a niche solution or a disruptive one?

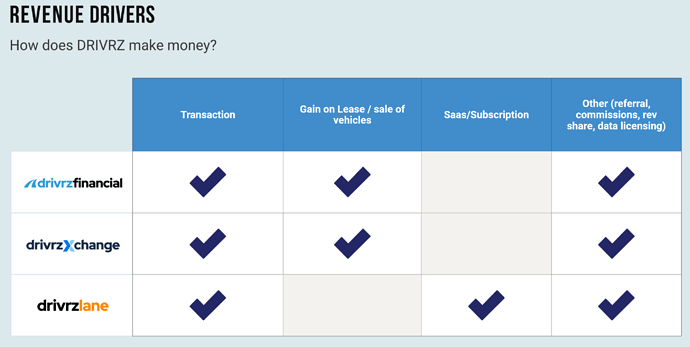

You be the judge. The runway for the sector is vast. Far less than 1% of vehicles are currently being purchased online, yet that market share is growing quickly. And as the auto industry continues to pivot to online sales, Powerband’s DRIVRZ is the only platform that is a true consumer-focused ecosystem. In one place, a consumer can buy a car, purchase a lease, arrange financing, sell their car in an auction, trade it in, insure the parts through protection plans, and even get a credit card. No other company offers a true marketplace like this.

If you compare Auto-trader and its copycats to a dating site, both essentially do some initial legwork and then let the match happen, after which their responsibility is over. Carvana provides more services, but sellers are dealing directly with Carvana, which may be reasonably convenient, but it forces sellers to accept the offered price from a single buyer (Carvana) without the opportunity to solicit other potential buyers. The company then turns around and sells that same car at a profit, to those aforementioned ‘other potential buyers’. Carvana is a glorified middleman and as such is limited by its own inventory, just like the used car lot down the street, instead of operating as a true public marketplace. Both systems, the basic listing sites and virtual car lots, are inherently flawed.

DRIVRZ is a full fintech-style ecosystem. If you are selling your car, it is the only solution that actually sets up an auction for you. DrivrzXchange, as the auction is called, selects the highest offer, verifies the funds, puts them into your account, and even takes away your car for you! You never have to meet the buyer or deal with inconveniences like title transfer. DRIVRZ does literally everything. Your only obligations are to upload pictures and basic vehicle information. To ensure sellers are truthful and the integrity of the marketplace is maintained they will come inspect vehicles before finalizing any purchase.

For buyers, it is even more full-service. The financing and leasing side is covered by their 2019 purchase of MUSA, a Dallas-based fintech company that is industry-leading in the areas of vehicle acquisition, leasing, lending and auction services. It also happens to be a Tesla Motors leasing partner (more on that later). The company can currently do $300 million USD in monthly financing, and will ramp up from there. Powerband has even teamed with DigniFi, a major lender in the auto industry, to offer buyers a credit card for any fund deficits, special warranties or other products. Buyers also have the protection of a 14-day exchange window and debt cancellation services.

So, what about dealers?

Consumer experience is the focus here, but the dealers play a big part, too. The model is Consumer-to-Dealer (C-to-D), Consumer-to-Consumer (C-to-C), and Dealer-to-Dealer (D-to-D), so dealers remain a large part of the ecosystem, but the real key to DRIVRZ is the empowering of consumers, essentially creating a dealership for the little guy. Powerband can also involve dealers in wholesale purchases as leases come due from consumers. The company has a nationwide network of dealers already participating in the ecosystem.

Now for the due diligence that turned me into an investor:

Powerband is not just a company with a revolutionary, disruptive solution that may one day get traction. DRIVRZ is already out of the garage, and the wheels are turning. In late 2020, the company partnered with CB Auto Group, an organization that provides a suite of products for union members across the United States, essentially giving its members services and benefits to assist them in buying a vehicle. CB Auto has added DRIVRZ as its preferred ecosystem, and this opens up a database of 67 million members, producing 3.4 million vehicle purchases annually. It is a massive, game-changing agreement for Powerband.

Yet perhaps the biggest news to date was released just a few days ago. After one year of negotiations, Powerband signed a MOU (Memorandum of Understanding) with a global insurance provider (An MOU is a formal document stating the willingness of two parties to enter into a binding agreement). While the partner has not yet been named, it has been identified as one of the largest vehicle insurers in the world, with a major focus on electric vehicles. The partnership will enable the insurer to provide automotive specialty insurance, protection plans, and other products on both EV and non-EV vehicles in the DRIVRZ ecosystem. And, music to any investor’s ears, the partner is planning a strategic investment into Powerband.

This bears repeating.

This global insurance giant is not only partnering with Powerband Solutions; it is finalizing investment into the company. There couldn’t be a bigger vote of confidence than this.

Finally, we have the biggest news that hasn’t been announced yet. In a recent interview with StockFam TV, Chairman Kelly Jennings stated that there is another MOU coming, and it is with a company that everyone thinks of when they picture electric vehicles. Now, he didn’t expressly say the “T-word”, but his message was hard to mistake. And, when you think about the big picture, a global insurer that specializes in EV’s was always going to open a very big door to the biggest EV manufacturer of them all. I guess we’ll just wait and see, and I doubt we will be waiting for long.

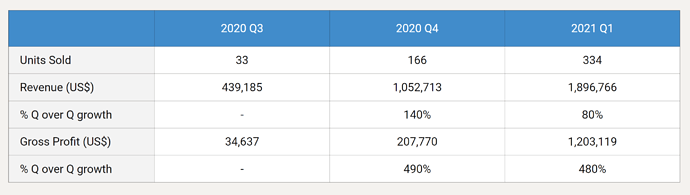

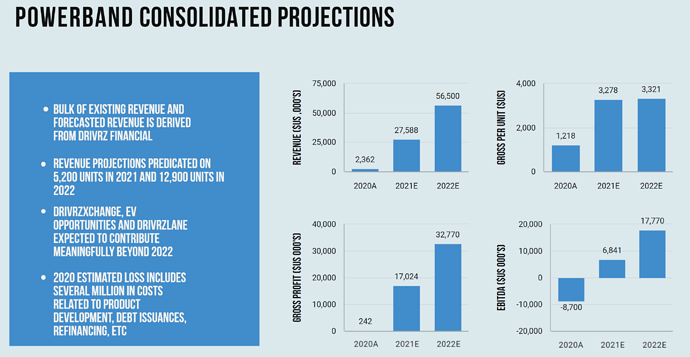

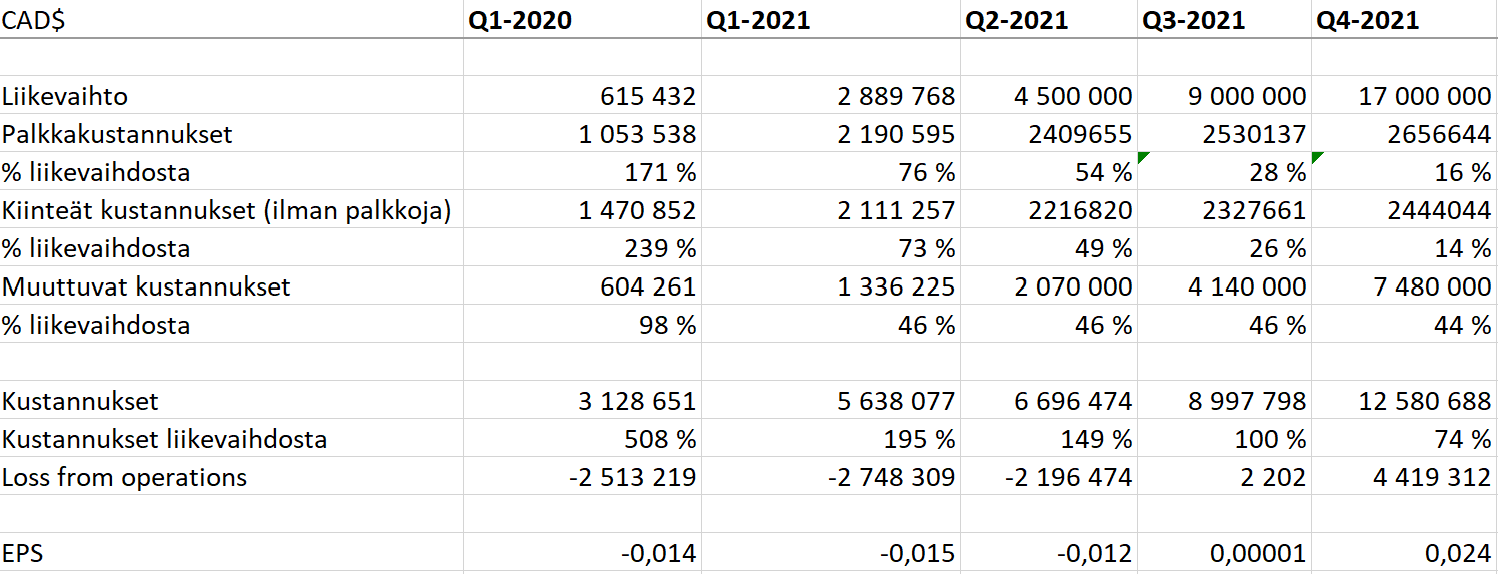

Revenue forecasts are strong, with a conservative estimate of $25.3 million in 2021, as the DRIVERZ platform rolls out in select areas in Q1. By Q2/Q3, management expects a full national rollout. Sales have been rising an incredible 8-10% month-over-month, with gross margins between 60-65%. Also worth mentioning are the countless other verticals not even addressed above as Powerband is not limited to the basic used vehicle market, their platform can be used for anything with an individual identifying number including RVs, trailers, heavy duty trucks, and even boats. The PBX market cap has plenty of runway, sitting at $110 million CDN, and the stock is 45% insider held. The company recently raised money through a financing, and no further capital raises are planned for the foreseeable future.

The potential for market disruption is easy to see, but honestly speaking, early investors don’t need Powerband to dominate the sector; they just need DRIVRZ to become a player in it, which is already happening. For me, the validation is in the investment from this mysterious global insurer, which apparently will be named shortly, and the upcoming MOU with a major EV manufacturer. If these global firms see the value and potential in the DRIVERZ ecosystem, especially as an EV-heavy platform, it is a risk very much worth taking.