Disclaimer: A brief letter to RedEye representative is presented below. It is meant to openly discuss about company practices and is not aimed against any individual. I, as person responsible for compiling this message, am a RedEye customer and a retail investor. The purpose of this text is to openly raise questions about ethical side of processes at the company as there are lots of other paying customers with similar interests.

Dear @Viktor_C

I have a question about your trading rules for your analysts regarding their own followed companies. Lets take Case Neonode as an example.

Here we can see the updates for Neonode. Highlighted with red circles are reports where target prices etc. have been recently updated. And in blue circles we have one fresh research note about the updated lawsuit process.

Figure 1. Recent Neonode Inc reports by RedEye

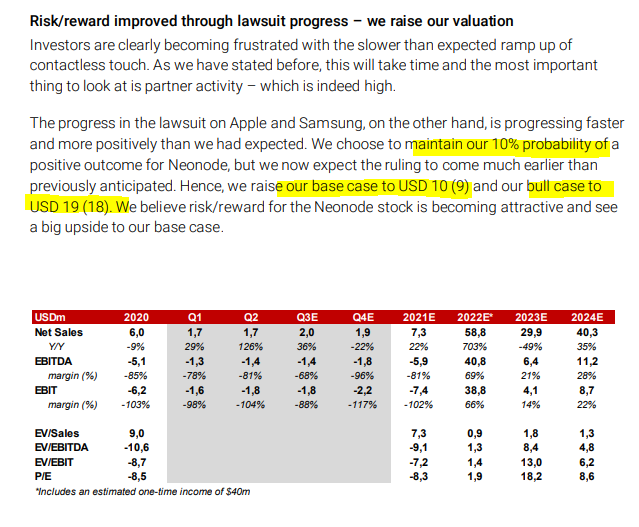

To start from the update on 13.8.2021 the following was stated:

- Base case raised to USD 10 from 9USD

- Bull case raised to USD 19 from 18USD

- 10% probability for positive outcome from the lawsuit

Figure 2. A sample from RedEye report on Neonode dated 13.8.2021.

On September 23rd RedEye analysts responsible for following the company buys a position into Neonode:

Figure 3. Analyst buys Neonode on 23.9.2021

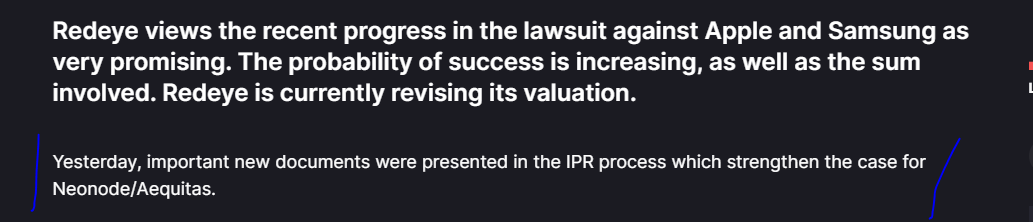

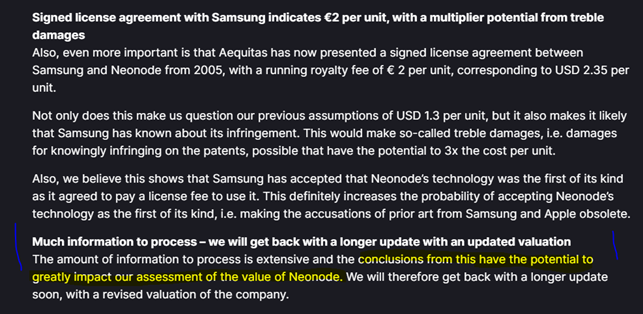

On September 24th same RedEye analyst acknowledges that this new information could have significant meaning to RedEyes own estimates – only a day after analyst bought the stock – and that an updated report will be published.

Figure 4. An excerption from RedEye research note on Neonode dated 24.9.2021

At the beginning of same report, on September 24rd, Analyst recognizes that meaningful new documents and information have occurred on September 23rd - the same day that analyst bought his position. This is a key piece in the timeline as we can conclude that analyst bought his position first on 23rd and then released a very bullish statement on 24th.

Figure 5. Excerption from RedEye reserach note on Neonode dated 24.9.2021

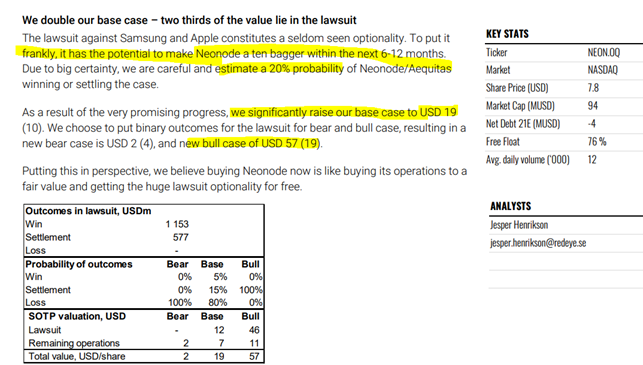

On September 29th the updated report is released with e.g. following updates:

- Positive lawsuit outcome probalility raised to 20% (10%)

- Base case raised to 19USD (10USD)

- Bull case raised to 57USD (19USD)

What is exceptional is the extremely rarely seen upside/bullish arguments for any stock considering the upside and timeline:

“it has the potential to make Neonode a ten bagger within the next 6-12 months”

Figure 6. A screen capture from RedEye researc report on Neonode dated 29.9.2021.

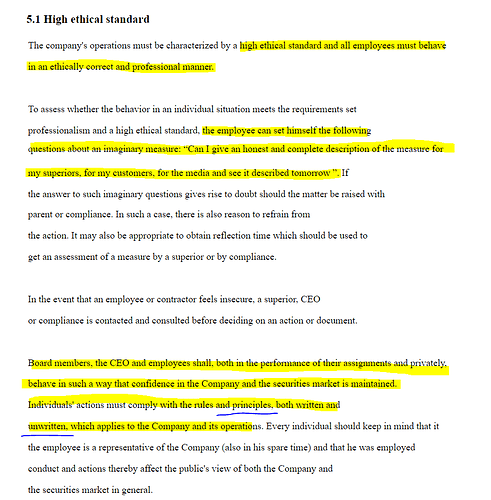

Following is an excerption from RedEyes own code of conduct (“Policy om Etiska riktlinjer” in swedish at Governance - Redeye ). This has been translated from swedish but the main points should be clear.

It highlights the responsibility of everybody, both at work and in private life, to act according to written and unwritten rules and highest ethical principles.

Figure 7. An excerption from RedEyes code of conduct.

Now my question is:

How does RedEye see this event and the presented timeline?

Does it follow the highest ethical principles, both written and unwritten? Are paying customers being served first?

Do you have any kind of time-dependant rules for your analysts regarding purchases, and if not should there be? Or any restrictions when a new research note/update is being drafted?

With best regards

“timontti”

local retail investors’ defender & hero