Tässä artikkelin mielenkiintoiset osat alla. Toimittaja puhuu muuten DW:sta käsitteenä, vaikka Seeing CEO ei niitä noteeraa. Toimittaja kertoo myös vain pienen osan Smartin voitoista, jotta se ei näytä liian pahalta Seeingiin verrattuna.

Mitä muuten ensimmäinen lause tarkalleen tarkoittaa ennen ajatusviivaa?

Barnden puts stock in Seeing Machines – partly because of its experience and a series of design-wins. Seeing Machines takes pride in the voluminous data collected by monitoring more than 23,000 real-world truck drivers, combined with data from several thousand vehicles gathered through a licensing agreement with Caterpillar.

Seeing Machines’ spokesperson noted that it already has nine individual design-win programs with six OEMs.

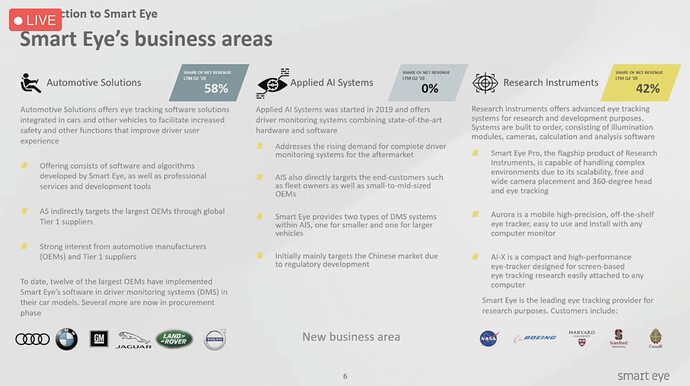

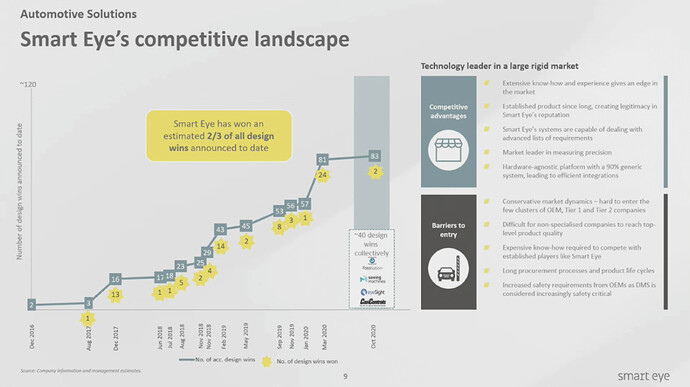

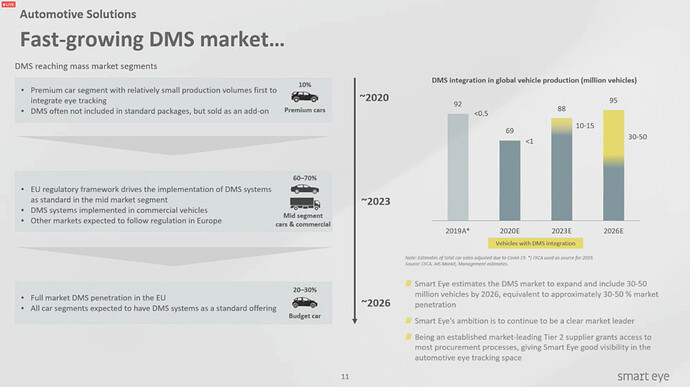

The Australian company isn’t the only one racking up design wins, however. Earlier this year, Smart Eye announced 24 new design wins with four different OEMs. Smart Eye, at that time, said, “Of the four OEMs, two are new customers; one is an American high-volume car maker and one is a European premium manufacturer, and two are existing European premium customers.”

Tässäpä vähän olennaista tietoa Seeingistä, jota en ole aikaisemmin nähnyt:

As DiFore explained, roughly half of Seeing Machines’ DMS business comes from the solutions made available in software, the rest is via chips. Xilinx has long been Seeing Machines’ silicon partner for DMS. With its field-programmable ability, Xilinx’s Fovio chip has gained traction from OEMs.

Seeing Machines also offers OEMs a second option of software only DMS solutions, creating an optimization path for specific chips OEMs prefer.

A good example is Qualcomm. Qualcomm has pushed into infotainment and ADAS, leveraging its Snapdragon platform. Seeing Machines, with Qualcomm, has worked “on a very optimized software pipeline that makes use of not only the standard Arm cores on that device, but the proprietary Qualcomm accelerators,” explained DiFore.

Aware that DMS isn’t the only application those ADAS processors will run, DiFore called optimization “very important.”

Without naming OEMs as to who will using whose chips, DiFore noted that Seeing Machines has already demonstrated that its DMS software runs on Nvidia, Renesas, Texas Instruments and others “on a wide array of platforms that are popular among OEMs.”

In September, penetrating its own DMS further into the market, Seeing Machines announced a new generation AI engine called Occula. Available in both SW only and Fovio Chip form, the Occula neural processing unit enables the next generation of Driver and Interior Occupant monitoring systems, according to the company. Seeing Machines is also making Occula available for license in ASIC form to chip suppliers, with a goal to have Occula “fit efficiently into semiconductor companies’ own automotive compute platform,” the company added.

According to Seeing Machines, General Motors is the only car OEM publicly disclosed to adopt Seeing Machines’ DMS — in the Cadillac CT6 Super Cruise system. Seeing Machines added that more models are in progress. Under the agreement, Seeing Machines supplied GM its DMS solution in software.

Seeing Machines won contracts to supply DMS via its Fovio chip solution into two U.S. OEMs and one Chinese carmaker.

Juttu antoi itselle vahvistuksen, että See pystyy tarjoamaan pelkkää softaa ja on siten varteenotettava kilpailija Smartille (hardware agnostic). Softan laadusta syvällisemmin on mahdoton sanoa käpistelemättä itse laitteita jne. Varmasti tulevaisuudessa kilpailu näiden kahden välillä on kireämpää.

Redin analyysien mukaan alustariippumattomuus toi kevään suuret DW:t Smartille. Mielenkiintoista.