Update

Miksi se kertoi että kiinnostusta on ollut Anown ostoon

Voihan se olla että Markku on leikellyt tunnin setistä vastauksia.

Tulkitsin niin että nykyisellä hinnalla markkinalla ollaan kiinnostuneita ostamaan kaikkia Voxturin liiketoimintoja joko erikseen tai joidenkin toimijoiden puolesta jopa koko kioski. Kai Gary tällä yritti sanoa että se on merkki siitä että bisnes on mielekästä ja ratkoo ajankohtaista ongelmaa. Myynnissä tässä kohtaa ei olisi mitään järkeä IMO.

Gary potkaisi tänään tätä tölkkiä taas kauemmas… “Need the market to stabilize. Will probably move to the TSX first and then NASDAQ.”

Tästä uplistauksesta Voxtur on puhunut ainakin niin kauan kuin minä muistan (pari vuotta) ja tämä nyt on yksi sellainen asia mikä herättää kysymyksiä kun ei tämä tunnu onnistuvan nousu- eikä laskumarkkinassa.

Tavoitehan oli viimeksi vuodenvaihteeseen mennessä ja sen jälkeen tuli kommenttia tammikuussa että asia on edelleen työn alla ja vastailevat kysymyksiin kera 2022 lukujen ja nyt sitten potkaisiin asia hamaaseen tulevaisuuteen…

Ei sinne tulla menemään ennen kun arvostus on kohdallaan tai ja kun siitä saadaan jotain todellista hyötyä. Realestate raiskataan parhaillaan Nassenkin puolella. Viime vuonna Voxtur olisi ollut sinne täysi raakile. Katselin tuossa sisäpiirin myyntien ennätysfirma Doman kurssikäyrää, ja kovin tutulta näyttää.

Edit:

Löperöt lupaukset annettiin toisenlaisessa markkinatilanteessa, jossa kaikki tekki oli pop.

Tämä oli jo arvattavissa kuten Perttu jo kommentoi. Toivotaan että nyt ollaan pian korkohuiput nähty ja markkina lähtee piristymään ja tulkoon listaus sitten aikanaan jos rahkeet riittää. Oleellisempaa varmaan on potkittiinko tölkkiä myös muilta osin?

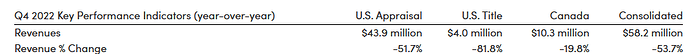

Asiasta toiseen ja realestaten raiskaukseen liittyen, Gary nimesi jossain vaiheessa Real Mattersin, Blendin ja Doman kilpureiksi (tai verrokeiksi) ja nämä kaikki on julkistanut 2022 tuloksensa:

Real Matters (TSE:REAL) Full Year 2022 Results

Key Financial Results

- Revenue: US$339.6m (down 33% from FY 2021).

- Net loss: US$9.27m (down by 128% from US$33.0m profit in FY 2021).

- US$0.12 loss per share (down from US$0.40 profit in FY 2021).

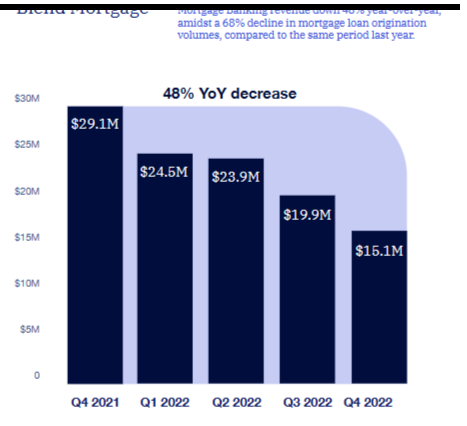

Blend Labs (NYSE:BLND) Full Year 2022 Results

Key Financial Results

- Revenue: US$235.2m (flat on FY 2021).

- Net loss: US$768.6m (loss widened by 349% from FY 2021).

- US$3.28 loss per share (further deteriorated from US$1.30 loss in FY 2021).

Doma teki 440M liikevaihdolla 306M tappiota ![]() Enkä perehtynyt sen tarkemmin tuohon Blendin liikevaihtoon tai tappioon mistä se syntyi mutta rumahan se on.

Enkä perehtynyt sen tarkemmin tuohon Blendin liikevaihtoon tai tappioon mistä se syntyi mutta rumahan se on.

Voxturia varmaan hinnoitellaan samaan joukkoon. Jää nähtäväksi…

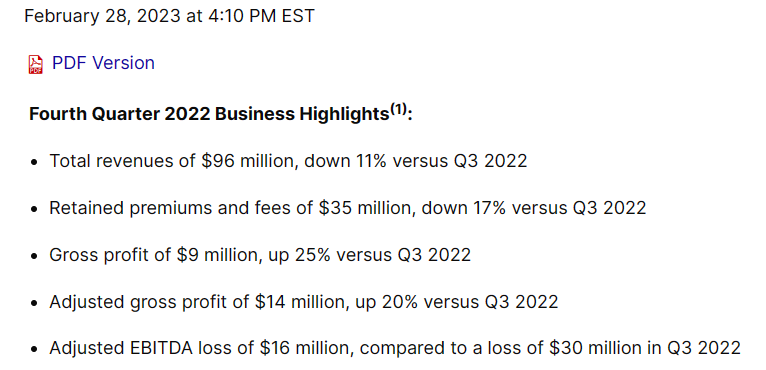

Jos kaivetaan Q4 highlighteja näiden osalta hieman valikoiden, niin todella rumia lukuja sieltä on kyllä tullut ulos ja nähtäväksi jää miten Voxturille on käynyt Q3 jälkeen.

Real Matters Q4:

Blend Labs Q4:

Doma Q4:

Ymmärtääkseni kaikkien osalta on tapahtunut topline tiputusta Q3 → Q4

En tiedä mitä käytännön hyötyä siitä isompaan pörssiin listauksesta on muuta kuin se että omistajat vaihtuvat suuremmalla volyymillä, asia jota yksikään firma ei toimiakseen kaipaa. Paras omistaja firmalle on sen hetkiset omistajat. Jos omistajat vaihtuvat suurella volyymillä niin eihän se kerro muuta kuin että he eivät olleet tyytyväisiä firman toimintaan? Pieni vola taas kertoo muuta…

Hieman tässä Buffettin ajatuksia lainailen…

Kaipaammeko myöskään rahastojen omistusta kun omistuksen perusta olisi se että heidät olisi vain pakotettu ostamaan firmaa? Ei minun mielestäni.

Mielestäni myöskin raportointi pitää saada kuntoon, ei siksi että listaus sitä vaatii, vaan siksi että sen pitää olla kunnossa.

No jos ei muuta niin ainakin se osoittaisi että ollaan “salonkikuntoisia” ![]() Etenkin tällä Voxturin ketjussa on haukuttu Venturea joka kantilta. Ja kyllähän tuosta pieni epäilys ainakin minulle jää, että eikö vain onnistunut uplistaus vielä jostain syystä. Tammikuussa Gary kertoi vielä asiaa työstävänsä ja nyt sitten potkaisi tölkin horisonttiin.

Etenkin tällä Voxturin ketjussa on haukuttu Venturea joka kantilta. Ja kyllähän tuosta pieni epäilys ainakin minulle jää, että eikö vain onnistunut uplistaus vielä jostain syystä. Tammikuussa Gary kertoi vielä asiaa työstävänsä ja nyt sitten potkaisi tölkin horisonttiin.

Näin Gary kirjoitti siis tammikuun 24 pv “Working on it. Trying to tie our year end financials as part of their 180page questionnaire/declaration”.

E. Ja jotain positiivistakin:

Eli 1.5 jälkeen voisi ehkä olla jotain tiedossa tämän suhteen.

Laitoin Jimille luvatusti pari päivää sitten vastausta tähän suomalaisten sijoittajien kysymyksiin vastaamisesta. Kertoilin että tunnelma on vähän odottava ja että kaikki haluaa odottaa 2022 lukuja eikä intoa ja halukkaita mihinkään organisoidumpaan eventtiin tunnu löytyvän.

Jim ehdotti sitten itse että josko hän aktivoituisi Twitterissä ja voisi sitä kautta vastailla suoraan sijoittajille.

Jim löytyy Twitteristä @VoxturCEO eli sinne nyt sitten voi kaikki halukkaat postailla mieltä askarruttavia kyssäreitä. Kävin jo yhden heittämässä josta nyt ainakin selvisi että tämä koko ALAWn velka on kuitattu sillä 10M maksulla.

En tutkinut sen tarkemmin enkä muista mitkä kaikki on täällä mainittu, mutta ChatGPT mainitsee seuraavat kilpailijat:

Voxtur competitors

Voxtur operates in the real estate technology and data analytics space, where there are several other companies offering similar services. Some of Voxtur’s competitors include:

-

CoreLogic: A global property information, analytics, and data-enabled solutions provider that offers real estate data and analytics services, as well as property valuation and title and settlement services.

-

First American Financial Corporation: A financial services company that provides title insurance, settlement services, property data, and analytics solutions to the real estate industry.

-

HouseCanary: A real estate technology company that offers property valuation and data analytics solutions, including automated valuations, appraisal management, and real estate market data.

-

Redfin: A real estate brokerage and technology company that offers an online platform for buying and selling homes, as well as data analytics and market insights.

-

Zillow Group: A real estate technology company that operates several online real estate marketplaces, including Zillow, Trulia, and StreetEasy, and also offers data and analytics solutions for real estate professionals.

-

RealPage, Inc.: A provider of property management software and data analytics solutions for the multifamily real estate industry.

These are just a few examples of companies that compete with Voxtur in the real estate technology and data analytics space.

NewRezin Product Profilessa (for self-employed borrowers) kerrotaan, että “Acceptable Sources for Title Transfer Verification

• Title commitments, preliminary title, full attorney’s title opinion, short form title policy”

ja

“Loans must be covered by an American Land Title Association mortgagee title insurance policy

or other generally acceptable form of policy or insurance acceptable under the Fannie Mae

Selling and Servicing Guides or Freddie Mac Sellers’ and Servicers’ Guide, issued by a title

insurer generally acceptable under the Fannie Mae Selling and Servicing Guides or Freddie Mac

Sellers’ and Servicers’ Guide insuring the Originator, its successors and assigns.”

Kyseinen dokumentti on ilmeisesti vuodelta 2019, joten mitään muutosta tuohon ei vissiin ole tullut tämän Fannien AOL ilmoituksen myötä, elleivät sitten ole päivittäneet dokumenttia päivittämättä dokumentin päiväystä.

Mutta tässä mielenkiintoista se, että kaikkien lendereiden ei tarvitse selvästi edes päivittää tuote/palvelukuvauksiaan jotta voisivat hyväksyä AOLn käytön. Ei mitään tietoa tietysti meneekö näissä Voxturin AOLää ja vaikka menisi niin tiedossa on että volyymit ovat ainakin vielä hyvin pieniä. Mutta F&Fn hyväksyntä ja vakuutus siinä pitää olla niin ei pitäisi jäädä paljon vaihtoehtoja ![]()

NewRez oli vuonna 2022 kolmanneksi suurin correspondent lainaaja PennyMacin ja Amerihomen jälkeen.

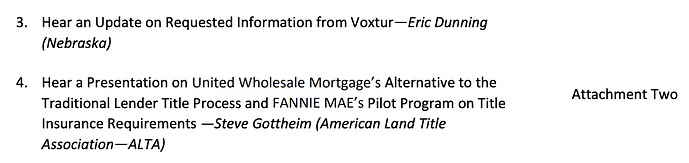

NAICS Title Insurance Task Force on taas käsitellyt AOL:ia eilisessä kokouksessaan. Asialistalla oli Voxturilta kuultu päivitys aiheesta, mutta siitä ei ollut esitysmateriaaleja tai muistiinpanoja. Toisena AOL-aiheisena kohtana oli UWM TRAC:n esittely, siitä on juttua esitysmateriaalien sivulta 11 alkaen.

Agenda: https://content.naic.org/sites/default/files/national_meeting/Title%20TF%20Agenda_0.pdf

Materiaalit: https://content.naic.org/sites/default/files/national_meeting/Title%20Insurance%20Task%20Force%20Materials%201_0.pdf

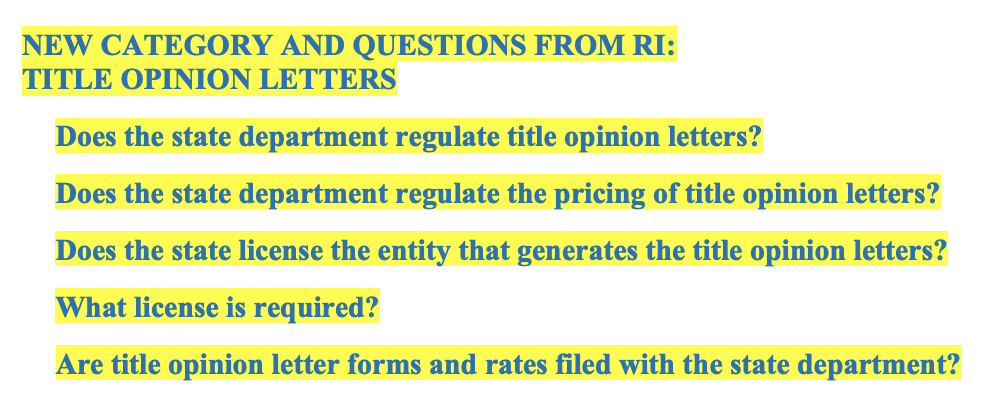

Lisäksi oli ilmeisesti lainsäädäntötyötä varten listattu kysymyksiä, joissa nämä AOL-aiheiset mukana:

According to Stacy/Voxtur: " With the insurance wrapper, there is no gap in coverage between the Voxtur AOL and title insurance, because the Voxtur AOL coverage extends through recording. When an AOL is produced using the same rails as title insurance—i.e., the same data, examination, and processes—the results are the same in that if something is missed, it is covered. Title insurance typically includes exceptions to coverage that exempt matters not shown in the public records from coverage. The claims process for an AOL is quicker and simpler than the title claims process. All Voxtur’s carriers are AM Best rated multiline carriers that are accustomed to paying claims. The

Greenberg Traurig LLP comparison analysis of Voxtur’s AOL and title insurance that has been circulated does not use the Voxtur AOL."

Eli lyhyesti, Voxturin AOLn vakuutus kattaa vähintään saman kuin Title insurance (ja on edullisempi)! ![]()

E. Heetkinen, toi Voxturin osuushan oli tosiaan se sama vanha ![]() No mutta siis ainakin Voxtur on sitä mieltä, että mitään coverage gappiä ei ole.

No mutta siis ainakin Voxtur on sitä mieltä, että mitään coverage gappiä ei ole.

Tässä on tuosta materiaalista poimittuna Voxturille esitetyt kysymykset ja vastaukset:

- Heard a Presentation on New Title Insurance-Like Alternatives that Use AOLs Backed by an Enhanced Errors and Omissions Policy Through the Surplus Lines Market

According to Stacy Mestayer (Voxtur), Voxtur is a licensed title and escrow agent in over 30 states. It has been working in this space for over 20 years. Title insurance costs have doubled in the last 15 years, despite advances in property data collection and technology. The Voxtur Attorney Opinion Letter (AOL) product is not the same AOL of the past. It is a viable alternative to title insurance, as it offers the same basic benefits and protection. The use of standardized letter templates and processes produced in the same manner as title insurance offer consistency that was not available with traditional AOLs. Technology allows these new AOLs to be produced at scale, minimizing attorney time and costs. The Voxtur AOL also offers the same insurance coverage, beyond the traditional professional liability for the attorney. The Voxtur AOL is a viable alternative that has the potential to meaningfully benefit consumers.

According to Mestayer, various comparisons that have been circulated since the Federal National Mortgage Association (FNMA) announced its acceptance of AOLs are based on limited information and do not apply to all versions of the AOL. One version of the AOL alternative product that has been used in comparisons was created by a lender and is being used internally at the lender’s business. This product’s property restrictions do not apply to all the properties that the Voxtur AOL would apply to and is only available in certain states. It also offers no owner’s coverage, has no fraud protection, and is more expensive. In contrast, the Voxtur AOL is available in all 50 states; has a flat fee; offers a closing protection letter (CPL); and offers protection to the lender, investor, and consumer for the life of the loan through an insurance wrapper.

According to Mestayer, an AOL can be used in refinance transactions. Voxtur offers both lender’s and owner’s coverage in the same way as title insurance with appropriate insurance backing. Unlike some other AOLs, the coverage can follow the loan into the secondary market for the life of the loan. If there is no owner’s coverage, it is not likely that a bar will obtain its own insurance coverage, as most do not understand it. This creates a serious risk for homeowners. The attorneys issuing the opinions are regulated by the state bar association, and the underlying carriers who are producing the liability coverage are regulated by the insurance department of each state. With the insurance wrapper, there is no gap in coverage between the Voxtur AOL and title insurance, because the Voxtur AOL coverage extends through recording. When an AOL is produced using the same rails as title insurance—i.e., the same data, examination, and processes—the results are the same in that if something is missed, it is covered. Title insurance typically includes exceptions to coverage that exempt matters not shown in the public records from coverage. The claims process for an AOL is quicker and simpler than the title claims process. All Voxtur’s carriers are AM Best rated multiline carriers that are accustomed to paying claims. The Greenberg Traurig LLP comparison analysis of Voxtur’s AOL and title insurance that has been circulated does not use the Voxtur AOL.

According to Mestayer, there is often a disincentive for title insurers to pay claims, which is why the claims are pushed to the agents who get most of the premiums. It is the title agents’ errors and omissions insurance that covers them in many cases. In states where title rates are promulgated, the Voxtur AOL can save the consumer 20–70%. In other states with inexpensive title insurance, the Voxtur AOL may not be competitive.

Beatty said if he were to go to his local county courthouse and see that someone else filed a lean on his property and the title company missed it, the title company has a contractual obligation to defend the title. With the Voxtur AOL, there could be a claim against the lawyer, but it will be passed off to an insurance company. The insurance company does not have a contractual relationship with him, but rather a duty to defend the lawyer. With title insurance, a complaint can be filed with the department of insurance (DOI). The company is subject to the Unfair Claim Settlement Practices Act (#900), and the issue is often resolved without having to go to court. The AOL insurance wrapper is a surplus lines product, so the DOI cannot help the consumer and does not approve the policy form, which could have provisions of limited liability. Beatty asked about how the Voxtur AOL places the consumer in a better legal position if an issue occurs. He also asked if the attorney would be able to raise its rates for opinion letters in response to title claims.

According to Ms. Mestayer, Voxtur’s policies are issued as master policies, where the lender, service provider, and borrower are insured under the policy, so they have the property of contract with the insurer and can file a claim directly. Those policies are subject to review by state insurance departments because the insurers are regulated. However, if the carrier is a surplus lines company, it limits the insurance department’s role. The insurer would pay the claims, so it should not affect the attorney’s premium, as it is a claims-based policy. Voxtur partners with several title service providers to offer this solution under their own names but using the Voxtur platform. These title service providers license the platform, and Voxtur caps what they can charge. Voxtur partners with several other title service providers to offer this solution. A surplus lines broker places the insurance.

Gaffney said Voxtur’s rates are not regulated and filed. He asked for an example of how the flat fee works.

According to Mestayer, Voxtur uses a tiered fee structure. For example, refinance transactions are $495 in every state and include the insurance wrapper. For purchase transactions, the fee is $695–$995 based on the purchase price.

Meyers asked which insurance companies are issuing the coverage and how fraud is protected.

Chris Mallon (Voxtur) replied that Hallmark Insurance is the insurer. According to him, the CPL includes the same protections against fraud that would be seen in a CPL issued with title insurance. Borrower fraud is covered in the master policy that wraps around the letter.

Brangaccio said surplus lines carriers only write in lines where there is no admitted coverage in Florida. He asked what Voxtur’s operations are in Florida, given Florida’s stipulation that the surplus lines market cannot compete with the admitted market if it is available in the admitted market. He also asked if Voxtur’s forms have a prominent notice that they do not participate in the guarantee fund.

Mestayer replied she would take this information back to Voxtur’s carrier. Voxtur has had discussions with a couple other states that the coverage is positioned as errors and omissions insurance rather than title insurance.

Gaffney said only Texas and Maryland have guarantee funds for title insurance.

Smock said title insurers are subject to statutory oversight in Rhode Island. Copies of forms, insurance policies, and CPLs are filed with the DOI. Title insurers are also expected to notify the insurance department immediately if they or their title agents are subject to any enforcement action. Smock asked what the oversight process is for Voxtur’s AOL and if it knows how the carrier is reserving.

According to Mestayer, Voxtur has a network of contracted attorneys that are vetted through an automatic electronic process before being onboarded. Vetting includes annually verifying the attorneys’ credentials, standing, resumes, and licensure. Anyone who has an expired license will be temporarily locked out of the system and unable to complete their letters. Only law firms are onboarded, then the firms’ attorneys are separately onboarded. This ensures that the law firms are also in good standing. Voxtur is required by all its client contracts to notify any client if their attorney has an enforcement action. The carriers have not shared their reserving methods.

Zuppan said title companies in Arizona are required to provide access to a title plan. He asked how this operates with Voxtur.

According to Mestayer, Voxtur pulls title data from various sources for refinances and produces a decisioning report based on the data. For purchases, it has access to abstracts, pulls property data and voluntary lean data from various sources, and examines it with the same process that would occur to issue a title insurance policy.

Hatchell asked for clarification on whether FNMA and U.S. Department of Veterans Affairs (VA) accept AOLs.

According to Mestayer, that is correct. The FNMA issued a release in April stating that it would accept AOLs as alternatives to title insurance. Voxtur worked closely with the FNMA and the Federal Home Loan Mortgage Corporation (FHLMC) before this to ensure that they were comfortable with its program. Several aggregators have also looked at the program. The Federal Home Loan Bank (FHLB) also approved of it in its guidelines.

Birny Birnbaum (Center for Economic Justice—CEJ) said the title industry has made tremendous progress in data collection and innovative use of technology over the last few decades. However, there has been no reduction in price for consumers. For example, in Texas, the median home has a title insurance policy cost of thousands of dollars. Claims by title insurers about lesser consumer protections should be carefully examined for subdivision homes where the developer has already purchased a title policy. The CEJ also shares concerns about the use of a surplus lines product. However, this should be taken in context with the lesser concern for surplus lines products for things such as private flood, which are far more challenging. It is unclear why the availability of admitted title insurance would bar the use of this surplus lines product because it is not title insurance. Any insurer who issues a policy for any line of insurance should have established reserves since their actuaries must certify the reserves, and they are subject to audit. State insurance regulators can also do an examination of any company if they have concerns. The title industry is most in need of a competitive alternative insurance product.

Director Dunning asked Voxtur to clarify what it means when it says it is licensed in over 30 states. He also asked for feedback on why Voxtur would not comply with a request to supply the Task Force with a copy of their standard letters and policy so it can verify the information provided.

According to Mestayer, Voxtur is in the process of working with a law firm to do a proper comparison of the Voxtur AOL and title insurance. The law firm is also a licensed title agent. The insurers that are issuing the policies are regulated, so Voxtur is not comfortable supplying copies of its letters and policies, as they are proprietary. They will be issuing a white paper addressing conflicting characterizations.

Director Dunning said Voxtur is relying on the regulatory structure built around the policy offered by the surplus lines carrier. He asked how state insurance regulators get access to these documents so they can verify the information provided by Voxtur. He also asked if Voxtur would use its influence to bring its carriers in to discuss these matters with the Task Force.

According to Mestayer, she is not employed by the insurers and does not have knowledge of the insurance practice in detail. State insurance regulators should be able to go to those carriers directly for the information. Mestayer said Voxtur would be happy to have a conversation about bringing in its insurers for conversations with the Task Force in a non-public forum.

Meyers asked if Voxtur is moving away from the title insurance industry in its settlement services.

According to Mestayer, Voxtur is offering both settlement services in conjunction with the AOL.

Steve Gottheim (American Land Title Association—ALTA) said title costs have only gone up over the last 15 years. However, the cost of title insurance has gone down by 7.8% over the last 10 years due to technology. The high costs of adopting new technology do not reduce costs immediately but over time. The claim that title insurers do not pay claims is false. Title insurers paid almost $600 million in claims in 2021. The duty to defend makes title insurance different from other lines. Title insurers close about 40% of claims every year. Looking only at total claims paid out is not always the most accurate assessment of how consumers are helped after they have been issued a policy.

Voxtuuri rakentaa alustaa AOLn käyttöönoton helpottamiseen/nopeuttamiseen ![]()

“Today, Jaclyn is working closely with Voxtur IT to develop AOL Ready, a platform that streamlines the AOL adoption process for lenders. The platform simplifies workflows for lenders, provides assistance with engaging attorneys, standardizes reviews to meet GSE guidelines, and enables accurate and scalable adoption of AOLs.”

Domain voxturaolready.com on myös näemmä olemassa varattuna jo.

Voxturin ja eXp Realtyn yhteisyrityksen toiminta on näköjään lopetettu vuodenvaihteessa. Harmi, olisi voinut ajatella että tuo olisi ollut hyvä kanava AOL:in tarjoamiseen, kun eXp Realty lienee isona yrityksenä aika monessa asuntokaupassa mukana.

Muutenkaan nuo joint venturet, kuten community settlement services, eivät näyttäisi toistaiseksi oikein mihinkään edenneen ![]()