(investors.com - hyvä lyhyt katsaus 28.12.2021)

Best EV Stocks To Buy Or Watch

The charts of several EV stocks are improving after severe damage in the past year. But these stocks had the best mix of fundamentals and technicals, as of Dec. 28.

Tesla stock has an IBD Composite Rating of 99 and an EPS Rating of 72. Shares are forming a double-bottom base with a 1,202.05 buy point. That’s after a rapid 38% gain from a 900.50 buy point triggered the eight-week hold rule. The buy range for the new entry goes to 1,262.15. TSLA stock is back above the 10-line, after a strong rally last week.

The top auto and EV stock by market cap predicts 50% average annual growth in vehicle deliveries, with 2021 expected to be faster than that pace. In 2020, deliveries grew 36% to 499,647. Its first electric pickup truck, the Cybertruck, is due in late 2022. The new Model S Plaid is Telsa’s fastest car yet, going from zero to 60 miles per hour in less than two seconds.

GM stock has an IBD Composite Rating of 75 and an EPS Rating of 43. Shares recently triggered a sell signal from a breakout past 59.44. It’s now back above the 40-week line, though still below the 10-week line. General Motors is spending $35 billion to develop electric and autonomous vehicles through 2025. It aims to launch 30 new EVs around the world by then. Those vehicles will include a Hummer electric truck and a BrightDrop delivery van, both set to arrive by year-end. The luxury Cadillac Lyriq electric SUV is due by mid-2022, with a Hummer electric SUV and GMC Silverado EV pickup due by early 2023.

Ford stock has a Composite Rating of 87 and an EPS Rating of 37. After vaulting above a 16.55 entry from a cup base in late October on earnings, Ford stock consolidated for several weeks. Shares then surged 9.6% on Dec. 10 to a 20-year high. Ford that day announced that it plans to make 200,000 Mustang Mach-E crossovers in 2023 for the North America and European markets, up from above 50,000 electric crossovers in 2021. But Ford shares have wiped out much of that gain.

The company recently reinstated the Ford stock dividend and hiked full-year outlook. In late May, Ford hiked spending on electric vehicles to more than $30 billion by 2025, and expects 40% of its global sales to be fully electric by 2030. Its goal is to launch 16 fully electric cars by 2022. Ford has closed reservations for the F-150 Lightning, its first electric truck, after they reached 200,000. That Cybertruck rival is due by mid-2022. Ford also owns 12% of Rivian.

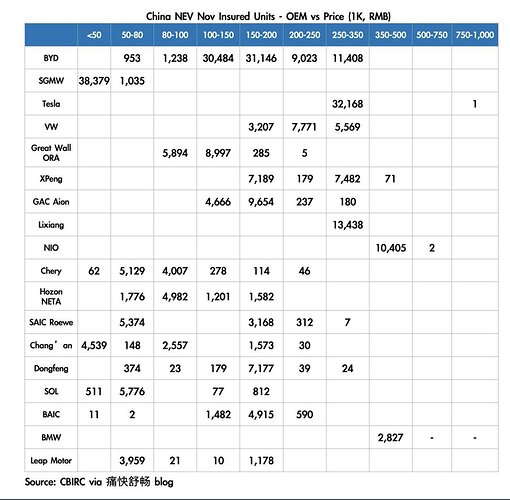

BYD (BYDDF) has no Composite Rating and an EPS Rating of 23, but it is profitable. Shares failed a breakout past 35.35 and are now under the 50-day/10-week lines. BYD is Hong Kong-listed, trading over the counter in the U.S.

The Chinese car and battery giant is making a big shift to electrification. November sales of BYD’s electric and hybrid-electric vehicles topped 91,000, rising by roughly 10,000 for a sixth straight month. BYD, a long-time holding of Warren Buffett’s Berkshire Hathaway (BRKB), also has begun selling EVs in Norway, starting with the Tang SUV. BYD will likely substantially increase exports in the coming year, with Europe and Australia among the key markets. BYD also is major EV battery maker, supplying some other automakers. It makes its own chips, a key reason why BYD has been able to expand rapidly in 2021.

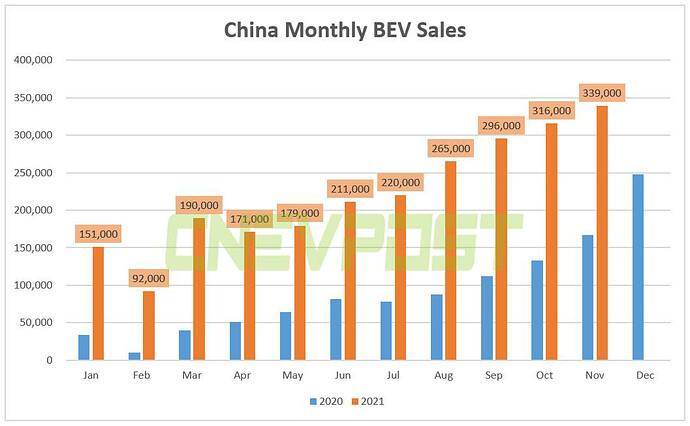

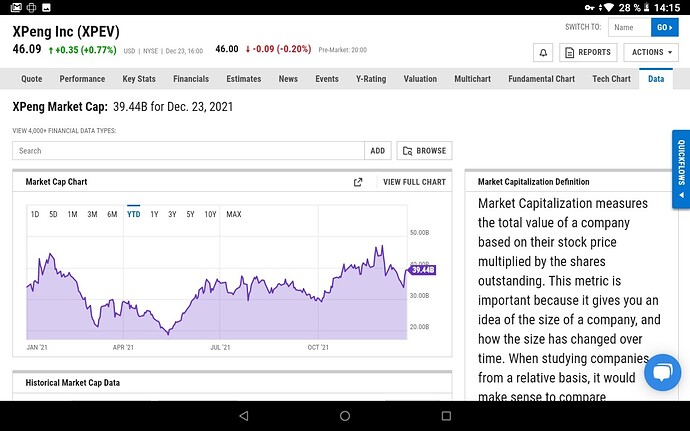

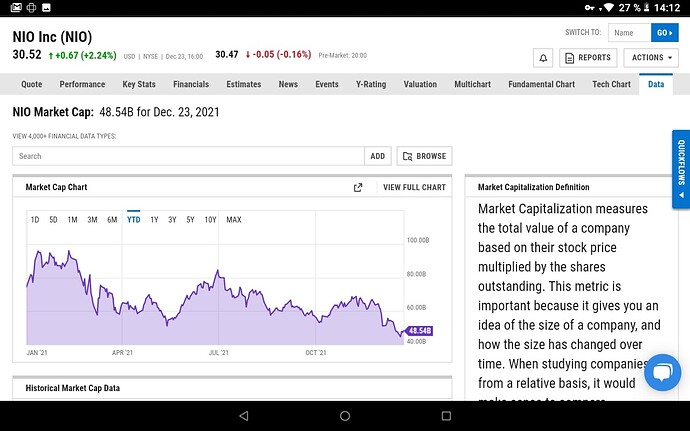

Xpeng stock has a Composite Rating of 70 and an EPS Rating of 8. Shares broke out powerfully on earnings and hit a 10-month high intraday on Dec. 1, when Xpeng (XPEV) released November deliveries. The China EV startup more than tripled sales to top 15,000 for the first time, as industry chip woes start to fade. But Xpeng stock, along with Li Auto and Nio, then sold off sharply, on fears that Chinese stocks will be delisted from U.S. exchanges, either by Beijing or Washington. XPEV stock is trying to retake its 50-day line, after finding support at the 200-day line.

Alibaba (BABA)-backed Xpeng already sells two electric SUVs and two electric sedans, an impressive lineup for a young company. A new flagship SUV, the G9, will be coming in late 2022, along with a highly advanced driver-assist system and a self-driving car service.

In the near term, EV stocks still face chip constrains but those are starting to lessen. Battery costs and shortages could be an issue in the mid-term, as supplies of lithium and other raw materials struggle to rise fast enough to meet battery demands. Longer term, more government support is likely headed for electric vehicles, while greater EV production should help bring down vehicle prices.