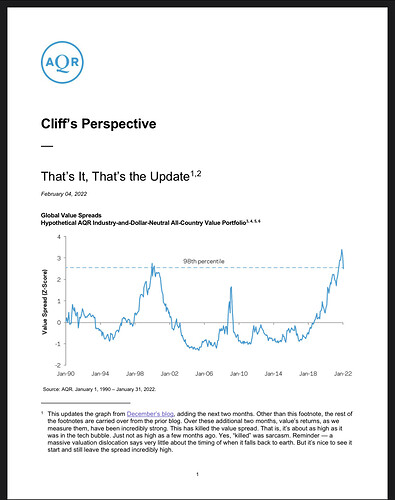

Akateeminen HmL (Long value - Short growth) on ollut todella tuottoisa viime vuoden lopulta lähtien. Käytännössä retail sijoittajalle halvoissa osakkeissa kiinni oleminen on tarkoittanut sitä, ettei ole hävinnyt rahaa. Oma salkku jotain -2% ytd. Tästä on hyvä jatkaa to the Moon ![]()

E: Lisäys mahtava vastaus Ken Frenchiltä.

Since we moved in this direction, I just want to ask one more question about narratives around those big growth companies. One of the other things that we hear about value investing is that using book to scale doesn’t make sense anymore because all of these companies have all intangible assets and things like that. Do you have thoughts on whether or not book is still the right way to measure value?

I don’t want to argue that book is the only way to measure value. The way I think about what we’re trying to do when we look at book-to-market or earnings-to-price or any of the fundamental to price ratios, I would love to know future expected cash flows. If you gave me those, give me price, give me a future expected cash flows, I can easily calculate an internal rate of return, the discount rate that links those future expected cash flows to the current price. That is the long run expected return on that stock, it’s a tautology. There is one number here that’s going to link price to future expected cash flows. Higher expected return, lower price relative to the future expected cash flows. Low expected return, high price relative to the future expected cash flows.

And then the only argument here is, what’s the best way to proxy for those future expected cash flows? What we learn is there’s a lot of different ways to proxy for those future expected cash flows. Book tends to work well, earnings tend to work well. Cash flows, current cash flows work well. Dividends, it depends on whether companies are paying dividends. But if you give me international markets where we get most companies paying dividends, dividend to price works well, sales to price works well. Number of employees to price probably works well. I could probably use the size of the company headquarters to price. Give me something with price in the denominator, high expected return, low price relative to that measure of future expected cash flows, that proxy for future expected cash flows.

The reason I like book is because I care a lot about transaction costs. I don’t want to have a portfolio that’s turning over all the time just because my signal is so noisy. So if I’m basically capturing the same thing with book that I’d be capturing with some other numerator in my ratio, I’m going to go with book. And I have run this experiment lots of times, this is not the first time I’ve heard it’s about intangibles. If you experienced 1999, for example, that was all about high tech, this time it’s different. It turned out it wasn’t. But when we ran the experiments and we looked at sorts, sorting on book-to-market was giving us essentially the same spreads in terms of characteristics as sorting on earnings, price, cashflow to price, all the other variables that people throw around.

And again, these things are so noisy that if somebody says, “No, you’re absolutely wrong,” I can’t prove I’m right. It’s a judgment call, and that’s what it comes down to. What I do know is if I use something that’s going to create lots of turnover, that’s going to impose costs on investors. I know that. So then the question is, how should I design my portfolio given I’m trying to deliver an effective, efficient portfolio? Books seems like a great measure to me.