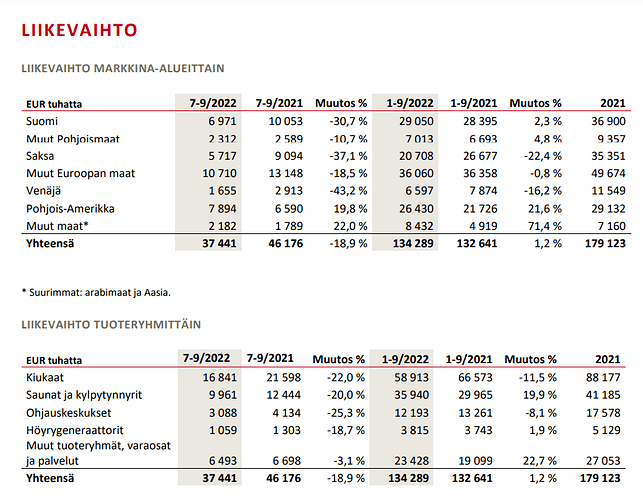

During the third quarter of 2022, we continued to experience extensive direct and indirect impacts of the Russian invasion of Ukraine. In the period, Harvia’s revenue landed at EUR 37.4 million, with decline of 18.9% from Q3 2021. Especially in Europe, high inflation combined with emerging energy shortage reduced consumer confidence. This has impacted the demand of saunas as well as heaters and equipment. In addition, the so-called advance demand caused by the pandemic faded away.

The unfavorable sales development in the third quarter was mainly driven by the demand slowdown in Germany and adjacent markets, combined with the economic uncertainty in Europe. The slowdown has been experienced especially with our wholesalers, sauna builders and major e-commerce clients who have been mainly focused on the entry-level offering. In some other European markets, strong destocking and net working capital programs, especially by our large partners, impacted the volume of the business. This was seen even in markets where the underlying market demand was rather solid. Demand in the European luxury and the professional market has continued close to normal level.

Outside Europe, business continued strong in the third quarter. We maintained strong growth in the large and high-potential North American market. We have also amplified our efforts in the newer sauna markets and are seeing great progress in e.g. Arab countries, Japan and selected other markets. Even in the demanding and complex business environment, we have maintained our ability to take market share, and the awareness and popularity of sauna and its health benefits are still on the rise. Team Harvia and our long-term partners have approached the demanding market situation with a strong professional grip and good spirit.

In Russia, we have discontinued Harvia branded business completely. EOS Russia is finishing the strong base of ongoing and prepaid projects. We aim to finish the projects and aim to exit the Russian business at the year end.

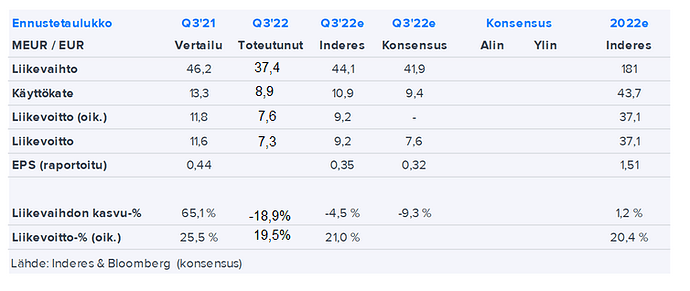

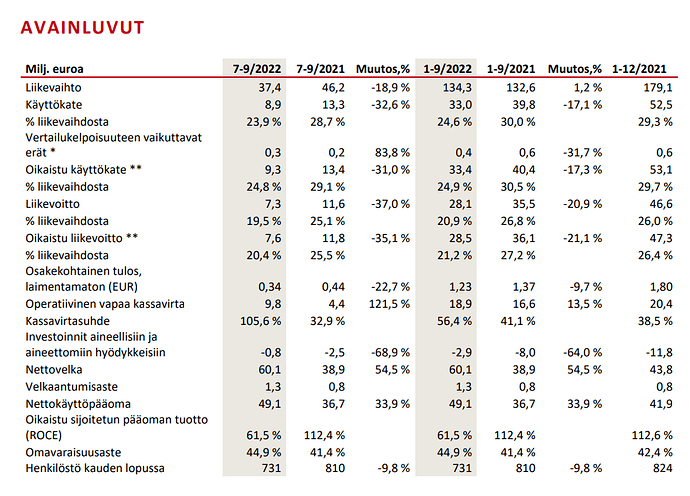

The third quarter’s adjusted operating profit amounted to EUR 7.6 million, decreasing from the high figure of EUR 11.8 million in the comparison period and totaling 20.4% of revenue. Declined sales volume and somewhat unfavorable sales mix lowered relative profitability. The sales of complete saunas developed favorably, which supports Harvia’s strategy, but the more profitable heater and component sales remained soft. However, when comparing our performance to the pre-pandemic times, we have grown very strongly both in terms of net sales and adjusted operating profit, also in pro forma terms.

To adapt to the changes in market environment, demand and inflation, we have already adjusted our capacity, cost levels and net working capital during the period. Most of these taken actions will become fully visible during the remaining part of the year, yet the first results of these actions were already seen at the end of Q3. The decreased net working capital supported our healthy cash conversion of 105.6%. In addition, we have remained proactive and addressed cost increases to the full in our pricing. On top of this, we have increased the efforts in new markets as well as targeting to more professional and premium offering & customer base on our existing markets. We remain very active in adjusting our capacity and cost base when needed. Moving forward, inflation remains high globally for the time being, yet it seems to be balancing in some of the key raw materials.

While the market environment is challenging, it does not affect Harvia’s strategic cornerstones or long-term financial targets. We continue to have full focus on our strategic cornerstones of geographical expansion, increasing the value of average purchase, and improving our productivity. On top of the organic business growth path, we remain active in seeking strategic opportunities on the M&A front. Our innovation pipeline continues to deliver excellent products to the market and we are working on addressing business opportunities connected to energy efficiency and smart energy sauna.

Our mission of healing with heat and providing long and good quality of life has been further supported and amplified by new research and evidence. In recent research by the University of Jyväskylä in Finland, it was shown that combining physical exercise with sauna bathing delivers incremental health benefits.

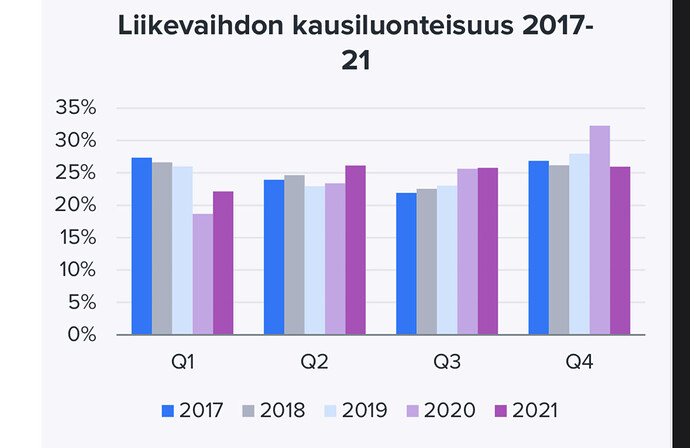

The sauna and spa market has traditionally been very resilient during economically challenging times, and the positive long-term growth outlook for sauna awareness and the sauna and spa market as a whole is intact.