Naurettavan pieni sakko, varmaan ennemmin nostaa pörssikurssia kun riski sakosta kadonnut.

Tietoja kindredin loppuvuoden ja mm kisojen sujumisesta. Ei mennyt ihan putkeen.

Tälläistä toimia luvassa:

While the weaker than expected performance during the fourth quarter can largely be attributed to a few one-off events explained above and the headwinds in Belgium and Norway, actions are being taken to further improve profitability in the short- and medium-term. These include but are not limited to:

Reducing losses in North America by decreasing marketing spend prior to the Kindred platform being launched

Re-prioritising investment projects to free up capacity for key strategic initiatives and reduce short-term costs

Further optimising the Group’s operating expenses to reduce cost growth and improve scalability

Voiko tarkoittaa että laittaisivat omat vedonlyönti alustan teon tauolle vai että nopeuttavat kehitystä

Premarketissa tarjoukset isolla dropilla, lähes -20%. Ylilyöntiä ilmassa?

Tässä Kindredin webari inderesTV:ssä.

Sakkoja Britanniasta:

https://www.kindredgroup.com/media/press-releases/2023/kindred-concludes-uk-regulatory-review-of-its-32red-and-unibet-brands/

Kindred Group will pay GBP 7.1 million and has received a warning to conclude regulatory reviews by the UK Gambling Commission related to historic AML (affordability) and social responsibility shortcomings.

Kindred accepts that certain systems and processes in place in 2020 and early 2021 were not in line with Commission expectations around affordability. As a result of those actions taken, Kindred recognises that similar cases to those highlighted by the Commission are unlikely to happen today within its new framework.

Mikäköhän tuossa on tarkalleen ottaen ollut taustalla?

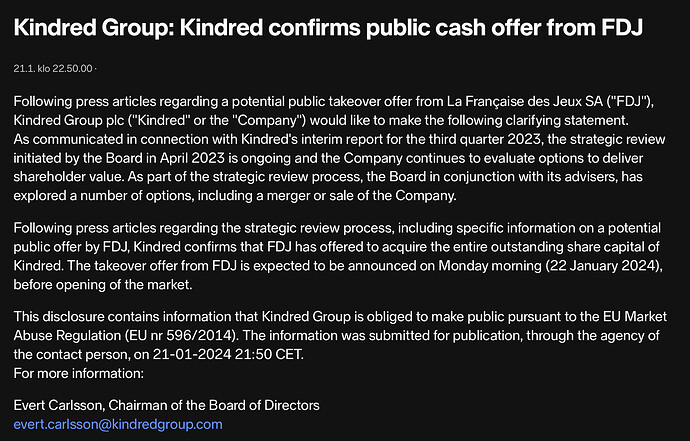

130kr/osake, 25% preemio siis. Ihan ok👍 Etenkin kun kurssi noussu viikossa 10%.

Ensimmäistä kertaa mukana että tulee ostotarjous yhtiöstä.

Mitäs tässä nyt kannatti tehdä kun ostotarjous on tullut? Kannattaako myydä heti tuohon hinnalla vai miten tuo lopulta realisoidaan rahaksi? Valuuttakurssi ainakin on vielä yhtenä tekijänä että milloin kannattaa irtaantua jos kruunun kurssi nousee?

Ainakin kannattaa ottaa huomioon, että aina mahdollista että tulee kilpaileva ostotarjous. Niitähän nähtiin jokunen viime vuonna Helsingin pörssissä. Sekin kait mahdollista, että ostotarjous hylätään kokouksessa, jolloin kurssi tippunee jonkun verran. Pitkiä prosesseja nuo on ennen kuin ostotarjouksen rahat omalta tililtä löytyy monesti.

Itsellä ei kiirettä myydä, joten jään odottelemaan rauhassa mitä tapahtuu👍

Tämmöinen löytyi nopealla googlettelulla:Helsingin pörssissä nyt paljon ostotarjouksia – mitä ne ovat ja miksi sijoittajan kannattaa olla niistä kiinnostunut? | OP Media

Kurssi reilu 6% alle ostotarjouksen. Hyväksyntäaika Marraskuulla vasta. Joten myytkö nyt pois ja sijoitat rahat muualle vai otatko 6% -7% tuoton kun holdailet marraskuulle. Siinäpä kysymys.

Itsekkään en haluaisi myydä mutta…, 27,9 prosentin omistusosuutta hallitsevat omistajat ovat jo sitoutuneet hyväksymään tarjouksen.

Toki eikös 80-90% vaadita toteumiseen?

Edit: 90% vaaditaan.

Yes, 90% “the Offer being accepted to such an extent that FDJ becomes the owner of shares in Kindred representing more than 90 per cent of the total number of shares in Kindred”.

Johto suosittelee hyväksymään tarjouksen, joten eiköhän tuo läpi mene.

Onko ostotarjoukseen tullut mitään päivitystä?

Q2 näytti ihan hyvältä.

Moikka,

Täällä taitaa pyöriä Kindrediä seuranneita ja asiaan perehtyneitä niin osaisiko joku auttaa aloittelijaa seuraavissa kysymyksissä:

A) Oliko nyt niin että Kindred myynti on mennyt lopullisesti läpi ja poistuu pörssistä? Milloin on viimeinen kauppapäivä?

B) Jos jää odottelemaan rahoja kaupasta niin meneekö automaattisesti joku lähdevero Ruotsiin vai tuleeko rahat täysimääräisenä tilille?

C) Paljonko about kestää rahojen tulemisessa jos ei itse myy osaketta pörssissä?

Kiitos vastauksista

Tender offer

Announcement text :

This event it is an extension on the event id *** event as the offer is now unconditional, the shareholders

who have already accepted or are accepting the offer during the extended acceptance period do not have the

right to withdraw their acceptances.

All conditions are met or have been waived.

Deadline extension will be applicable only those clients who have instructed as no action or not instructed.

Once instructions have been submitted, will be irrevocable

Clients are advised that instructions submitted for non default option can’t be changed or amended after

deadline is passed.

Further, clients are advised to not to sell the holdings once they instruct to exchange.

Holdings instructed to exchange will be blocked for trading.

Any charges or fee for the failed trade will be passed to clients.

In the case where scaleback of exchange occurs, holdings not accepted will be unblocked and proceeds for the

accepted exchange instructions will be booked as soon as practical upon receipt from the agent.

Exchange may be subject to scaleback based at the account level.

We hereby inform the client that, according to the laws of the country of its incorporation or the laws of the

country of residence of its customers and the laws applicable to an issuer of securities which are subject to

corporate actions, the client, will decide to participate or not to such corporate actions upon its sole and

Corporate Action

Tarjousanti

Instrumentti: KIND_SDB:xome (ISIN: SE0007871645)

Event Id: 9285988

Effective Date: 16-loka-2024

Reply Deadline: 15-loka-2024 21.00.00

Maksupäivä: 29-loka-2024 00.00.00

exclusive discretion and judgement.

The client will bear any detrimental consequence arising out of or connected to such instruction.

For the avoidance of doubt, any information in relation to the corporate actions sent to the client may have

been obtained from sources which are not under the bank’s control and accordingly, the bank shall not be held

responsible for the truth and the accuracy of this information.

Please refer to the prospectus of the event for any further details.

Noudatettavat tiedot

Restrictions: the offer document is not an offer, whether directly or indirectly, in australia, hong kong japan,

new zealand or south africa or in any other jurisdictions where such offerpursuant to legislation and

regulations in such relevant jurisdictions would be prohibited by applicable law.

Mitenkäs tämä nyt menee, kun en ole hyväksynyt tarjousta mutta ilmeisesti anti on jo läpimennyt kun FDJllä jo 92% osakkeista? Maksetaanko rahat myöhemmin kuin niille ketkä hyväksyvät tarjouksen 16.10 mennessä…?

Hyväksyin alkuperäisen tarjouksen ja rahat tuli perjantaina.

Kopsasin hiukan sijoitustiedon puolelta ja muokkasin:

Milloin Kindred poistuu pörssistä? Milloin on viimeinen kauppapäivä?

B) Jos jää odottelemaan rahoja kaupasta niin meneekö automaattisesti joku lähdevero Ruotsiin vai tuleeko rahat täysimääräisenä tilille?

C) Paljonko about kestää rahojen tulemisessa jos ei itse myy osaketta pörssissä?

Tietääkö kukaan, itsellä vielä ainakin Kindredit näkyy salkussa AOT:n puolella

viimeinen kauppapäivä 11.11, hyväksymällä tarjouksen rahat saa arviolta 22.01. Lähdeveroa tuosta ei kai mitenkään voi mennä kun kyseessä on myynti.