Medexus uutisoi ensimmäisen kaupallisen toimituksen Treosulfanista tapahtuneen Kanadan markkinoille. (Kulkee tuotenimellä Trecondyv). Toimari ennustaa nopeaa ramp uppia myynnissä.

2021-09-21_Medexus_Announces_Expanded_Availability_of_96.pdf (60,9 Kt)

Tätä on odotettu. Myynnin starttaaminen käsittääkseni vähentää painetta rahoituksen hakeminen Annin kautta.![]()

Kanadan markkinat taisi kuitenkin olla toooosi pienet vrt. Jenkkeihin. Löytääkö joku presiksistä markkinan kokoa? Posia kyllä että saatu lääkettä etiäppäin.

Aika aggressiivista ostamista näyttää olevan 3CAD alueella. Yrittänyt kuumeisesti etsiä jotain uutta tietoa firman toiminnasta tuloksetta.

Mielestäni tällä hetkellä merkittävät katalyytit

- FDA lupaprosessi käynnissä

- milestone maksujen hoitaminen

- myyjien palkat, jotka palkattu ennen lupien saamista.

Jäikö jotain puuttumaan?

Edit:

Loppuvuodesta lupahakemus sisään 2 tai 6 kuukauden käsittelyaika

Oletettu myynnin alku 10/2022

Myyjiä ei palkattu(trisulfant)

Lähde

Earnings call tekstinä. Ixinityn tuotannosta paljon puhetta. Vakuutetaan prosessin parantuneen uudistuksien myötä ja tuotannon vastanneen kysyntää. Treosulfanin odotetaan pääsevän FDA:n käsittelyyn uudestaan Q2 alkupuolella. Käsittelyn kestoksi kerrotaan joko 2kk tai 6kk riippuen hakemuksen luokituksesta.

Miten konkarit näette tuon Treosulfanin mahdollisuudet FDA-läpäisyyn näin uudessa käsittelyssä?

Entä mitä asioita seuraatte erityisellä silmällä Medexuksen osalta kuluvan vuoden aikana?

“Within 30 days of resubmission, the FDA will communicate the timeline for their review. We and our partners at medac look forward to an FDA decision within six months from resubmission. An FDA approval would then pave the way for a commercial launch of Treosulfan in the United States within Medexus’s fiscal year 2023.”

Treosulfan NDA Resubmitted to FDA

2-6kk odotettu vastausaika. Ulkomuistista firman kassa riitti lokakuulle(?), ennen lisärahoituksen tarvetta.

Onko jollain muulla parempaa muistikuvaa asiasta?

https://www.medexus.com/en_US/news-media/press-releases/detail/118/treosulfan-nda-resubmitted-to-fda

Eilisestä earnings callista tallenne ja teksti versio.

Tälläiseen videoon törmäsin youtubessa. Kaveri oikeastaan kertoo samat ajatukset kuin itselläni on tällä hetkellä. Näyttää todella hyvältä.

MDP:TSX, MEDXF:OTC

Medexus is clearly headed to over US$100M in revenue. US$23M in revenue in Q1, a 33% increase from the previous year. Gleolan will further increase US based revenue in Q2 and beyond and an FDA decision on the Treosufan submission expected in the next few weeks, Medexus is certainly looking like a company on the move in 2022 and beyond. A NASDAQ listing cannot be too far away. Excellent results. (MDP:TSX, MEDXF:OTC)

Results include first U.S. revenue from Gleolan, full commercial launch expected in fiscal Q2

Treosulfan NDA resubmitted to the FDA, regulatory milestone payments deferred to October 2023

Management to host conference call at 8:00 AM Eastern Time on Tuesday, August 9, 2022

TORONTO and CHICAGO, Aug. 08, 2022 (GLOBE NEWSWIRE) – Medexus Pharmaceuticals (Medexus) (TSX: MDP) (OTCQX: MEDXF) today announced its operating and financial results and provided a business update for the company’s first fiscal quarter ended June 30, 2022. All dollar amounts in this press release are in United States dollars unless specified otherwise.

Financial Highlights

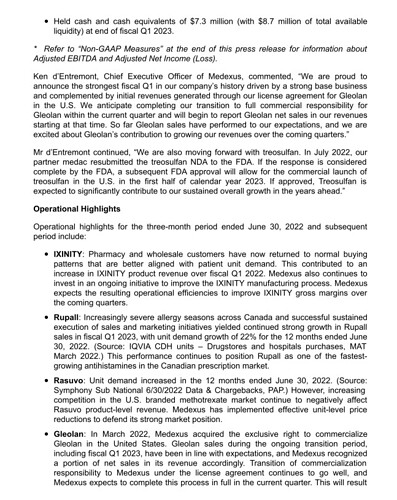

Delivered record total revenue of $23.0 million in fiscal Q1 2023, an increase of 33% compared to $17.3 million in fiscal Q1 2022 and an increase of 13% compared to $20.3 million in fiscal Q4 2022. This represents the strongest fiscal Q1 in Medexus’s history. Primary drivers for the $5.7 million increase over fiscal Q1 2022 were an increase in net sales of IXINITY and recognition of a portion of revenue from Gleolan sales in the United States.

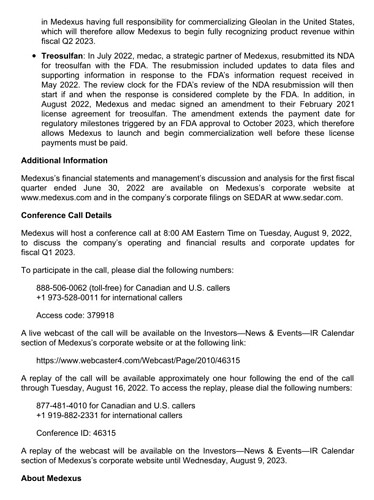

Achieved Adjusted EBITDA* of 1.9 million in fiscal Q1 2023 compared to (4.9) million in fiscal Q1 2022 and $1.1 million in fiscal Q4 2022. Organic increases in product revenue, a reduction in research & development costs, and recognition of a portion of revenue from Gleolan sales in the United States were the primary drivers of the $6.8 million increase over fiscal Q1 2022. Medexus achieved this Adjusted EBITDA increase while continuing to maintain appropriate investments in preparations for a commercial launch of treosulfan in the United States.

Yielded operating profit of $0.0 million in fiscal Q1 2023, a $7.2 million improvement compared to operating loss of $7.2 million in fiscal Q1 2022.

Produced net loss of $1.4 million in fiscal Q1 2023, a $5.2 million improvement compared to $6.6 million in fiscal Q1 2022.

Generated Adjusted Net Loss* of $3.6 million in fiscal Q1 2023, a $6.2 million improvement compared to $9.8 million in fiscal Q1 2022.

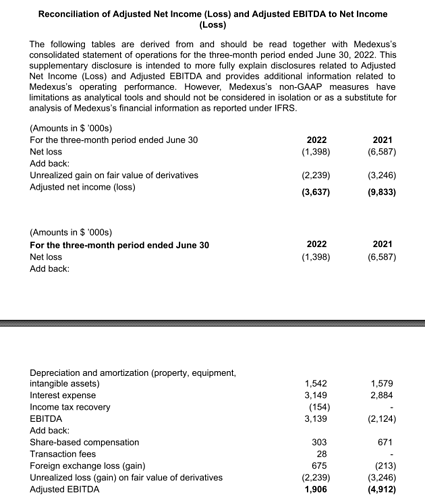

Held cash and cash equivalents of $7.3 million (with $8.7 million of total available liquidity) at end of fiscal Q1 2023.* Refer to “Non-GAAP Measures” at the end of this press release for information about Adjusted EBITDA and Adjusted Net Income (Loss).

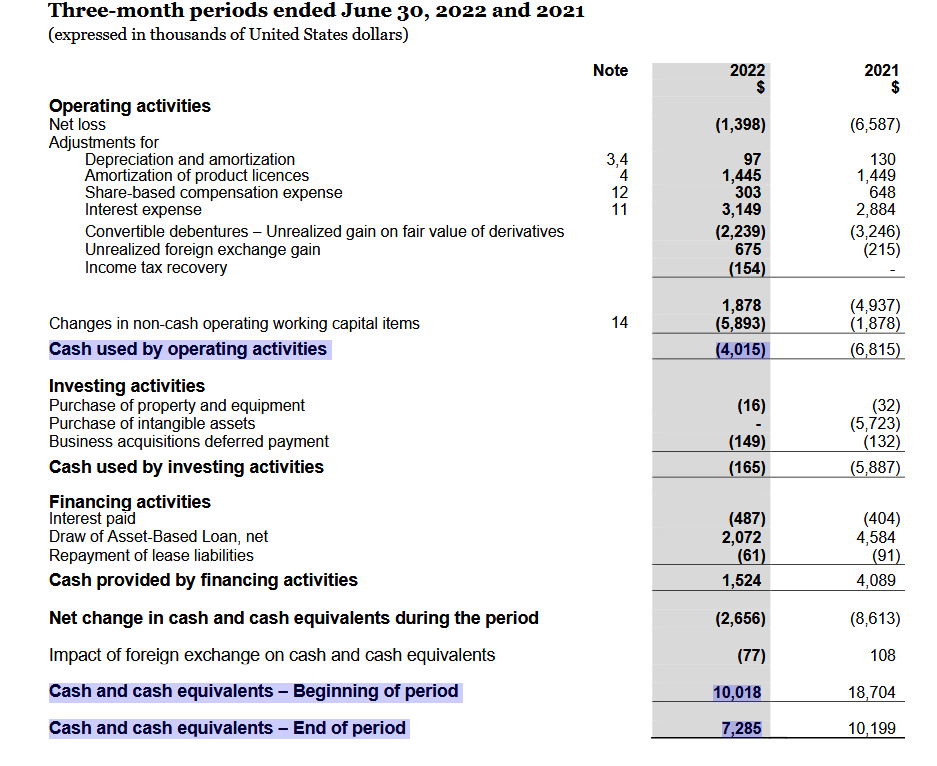

Ken d’Entremont, Chief Executive Officer of Medexus, commented, “We are proud to announce the strongest fiscal Q1 in our company’s history driven by a strong base business and complemented by initial revenues generated through our license agreement for Gleolan in the U.S. We anticipate completing our transition to full commercial responsibility for Gleolan within the current quarter and will begin to report Gleolan net sales in our revenues starting at that time. So far Gleolan sales have performed to our expectations, and we are excited about Gleolan’s contribution to growing our revenues over the coming quarters.”

Mr d’Entremont continued, “We are also moving forward with treosulfan. In July 2022, our partner medac resubmitted the treosulfan NDA to the FDA. If the response is considered complete by the FDA, a subsequent FDA approval will allow for the commercial launch of treosulfan in the U.S. in the first half of calendar year 2023. If approved, Treosulfan is expected to significantly contribute to our sustained overall growth in the years ahead.”

Operational Highlights

Operational highlights for the three-month period ended June 30, 2022 and subsequent period include:IXINITY: Pharmacy and wholesale customers have now returned to normal buying patterns that are better aligned with patient unit demand. This contributed to an increase in IXINITY product revenue over fiscal Q1 2022. Medexus also continues to invest in an ongoing initiative to improve the IXINITY manufacturing process. Medexus expects the resulting operational efficiencies to improve IXINITY gross margins over the coming quarters.

Rupall: Increasingly severe allergy seasons across Canada and successful sustained execution of sales and marketing initiatives yielded continued strong growth in Rupall sales in fiscal Q1 2023, with unit demand growth of 22% for the 12 months ended June 30, 2022. (Source: IQVIA CDH units – Drugstores and hospitals purchases, MAT March 2022.) This performance continues to position Rupall as one of the fastest-growing antihistamines in the Canadian prescription market.

Rasuvo: Unit demand increased in the 12 months ended June 30, 2022. (Source: Symphony Sub National 6/30/2022 Data & Chargebacks, PAP.) However, increasing competition in the U.S. branded methotrexate market continue to negatively affect Rasuvo product-level revenue. Medexus has implemented effective unit-level price reductions to defend its strong market position.

Gleolan: In March 2022, Medexus acquired the exclusive right to commercialize Gleolan in the United States. Gleolan sales during the ongoing transition period, including fiscal Q1 2023, have been in line with expectations, and Medexus recognized a portion of net sales in its revenue accordingly. Transition of commercialization responsibility to Medexus under the license agreement continues to go well, and Medexus expects to complete this process in full in the current quarter. This will result in Medexus having full responsibility for commercializing Gleolan in the United States, which will therefore allow Medexus to begin fully recognizing product revenue within fiscal Q2 2023.

Treosulfan: In July 2022, medac, a strategic partner of Medexus, resubmitted its NDA for treosulfan with the FDA. The resubmission included updates to data files and supporting information in response to the FDA’s information request received in May 2022. The review clock for the FDA’s review of the NDA resubmission will then start if and when the response is considered complete by the FDA. In addition, in August 2022, Medexus and medac signed an amendment to their February 2021 license agreement for treosulfan. The amendment extends the payment date for regulatory milestones triggered by an FDA approval to October 2023, which therefore allows Medexus to launch and begin commercialization well before these license payments must be paid.

Additional Information

Medexus’s financial statements and management’s discussion and analysis for the first fiscal quarter ended June 30, 2022 are available on Medexus’s corporate website at www.medexus.com and in the company’s corporate filings on SEDAR at www.sedar.com.

Conference Call Details

Medexus will host a conference call at 8:00 AM Eastern Time on Tuesday, August 9, 2022, to discuss the company’s operating and financial results and corporate updates for fiscal Q1 2023.

To participate in the call, please dial the following numbers:

888-506-0062 (toll-free) for Canadian and U.S. callers

+1 973-528-0011 for international callers

Access code: 379918

A live webcast of the call will be available on the Investors—News & Events—IR Calendar section of Medexus’s corporate website or at the following link:

https://www.webcaster4.com/Webcast/Page/2010/46315

A replay of the call will be available approximately one hour following the end of the call through Tuesday, August 16, 2022. To access the replay, please dial the following numbers:

877-481-4010 for Canadian and U.S. callers

+1 919-882-2331 for international callers

Conference ID: 46315

A replay of the webcast will be available on the Investors—News & Events—IR Calendar section of Medexus’s corporate website until Wednesday, August 9, 2023.

About Medexus

Medexus is a leader in innovative rare disease treatment solutions with a strong North American commercial platform and a portfolio of proven best-in-class products. Our current focus is on the therapeutic areas of hematology, auto-immune diseases, and allergy. We continue to build a highly differentiated company with a growing portfolio of innovative and high-value orphan and rare disease products that will underpin our growth for the next decade.

Our current leading products are Rasuvo™ and Metoject®, a unique formulation of methotrexate (auto-pen and pre-filled syringe) designed to treat rheumatoid arthritis and other auto-immune diseases; IXINITY®, an intravenous recombinant factor IX therapeutic for use in patients 12 years of age or older with Hemophilia B (a hereditary bleeding disorder characterized by a deficiency of clotting factor IX in the blood, which is necessary to control bleeding); and Rupall®, an innovative prescription allergy medication with a unique mode of action. We also hold exclusive US and Canadian rights to commercialize Gleolan™ (aminolevulinic acid hydrochloride or ALA HCl), an FDA-approved, orphan drug designated optical imaging agent currently indicated in patients with glioma (suspected World Health Organization Grades III or IV on preoperative imaging) as an adjunct for the visualization of malignant tissue during surgery.

We have also licensed treosulfan, part of a preparative regimen for allogeneic hematopoietic stem cell transplantation to be used in combination with fludarabine, for commercialization in the United States and Canada. Treosulfan was approved by Health Canada in June 2021 and is marketed in Canada as Trecondyv®. Treosulfan is currently the subject of a regulatory review process with the U.S. Food and Drug Administration.

Our mission is to provide the best healthcare products to healthcare professionals and patients. We strive to deliver on this mission by acting on our core values: Quality, Innovation, Customer Service, and Collaboration.

Uusi lisäselvityspyyntö FDAlta.

Olikos tässä se pulma eritoten, että tämä ei vain siirrä Treosulfanista odotettuja kassavirtoja, vaan samalla joudutaan maksamaan myyjäjengille, jolla ei ole myytävää?

Miten erityisesti @Pohjolan_Eka näkee Medexuksen casena - mitä pitää tapahtua, että norsupyssy laulaa?

Tarina on rikki ja kassan kanssa on merkittäviä haasteita.

Seuraan toisella silmällä tuota Treosulfanin prosessia, mutta yhtiöhän ylilupasi ja alisuoriutui jo Ixinityn kanssa, joten luottoa johtoon ei hirveästi löydy ja mielestäni tässä markkinassa löytää helposti paljon parempiakin sijoituskohteita, nyt kun olemme palanneet maan pinnalle kuplamarkkinasta.

Eihän tuo hyvältä taas tunnu. Treosulfania tosiaan markkinoitiin lähes varmana läpimenona ja nyt FDA pyytää toista kertaa lisätietoja Medacilta. Tiedotteessa pettymystä kokeillaan pehmentää tällä: "Overall, our monthly results so far suggest that we are heading towards another strong quarter.”

Samaan aikaan All time low lukemia paukkuu pörssissä.

Q1 2023 raportissa oli “Held cash and cash equivalents of $7.3 million” joka on lähes sama lukema kuin 2022 jälkeen.

Ixinityn ongelmat onneksi ovat ainakin Q1 raportin mukaan takanapäin. En silti kovin luottavainen ole, johto ei ole tosiaan vakuuttanut.