H1 raportin myötä tulikin paljon purtavaa ![]()

Sijoittajapresis

Nekkar ASA_Q2_2023_presentation.pdf (5,0 Mt)

Ja luvut

Nekkar ASA Financial Statement Q2 H1 2023.pdf (589,7 Kt)

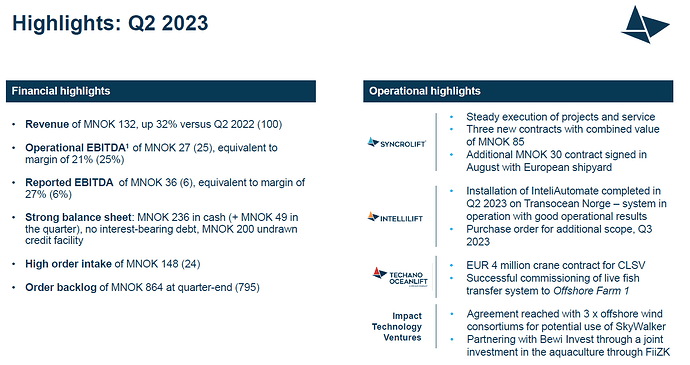

30 August 2023 - Nekkar ASA (Nekkar) delivered revenue of NOK 132 million in the

second quarter of 2023, up 32 percent from the same quarter last year (Q2 2022:

100). Operational EBITDA was NOK 27 million (25), equivalent to an operational

EBITDA margin of 20.6 percent (24.7).“We delivered another solid quarterly financial result. Coupled with a more

diversified revenue base, healthy order intake and high tender activity, we

believe that we are well positioned to generate further growth in the coming

years,” says Ole Falk Hansen, CEO of Nekkar.Order intake in the second quarter of 2023 was NOK 148 million, a significant

improvement from the same quarter last year (24). The order intake includes

three shiplift and ship transfer system contracts for Syncrolift worth

approximately NOK 85 million, and a EUR 4 million crane contract for Techano

Oceanlift.Nekkar’s order backlog stood at NOK 864 million (795) as of 30 June 2023, which

provides excellent visibility for Nekkar’s subsidiary Syncrolift in the next

couple of years.Nekkar reported revenue of NOK 132 million (100) in the second quarter. The

company’s operational EBITDA* was NOK 27 million (25), representing a margin of

20.6% (24.7%). Reported EBITDA was NOK 36 million (6), while EBIT was NOK 34

million (4).Cash conversion has been very strong in the first half of 2023. Cash flow from

operations was NOK 81.7 million in H1 2023 versus NOK 21.9 million in the same

period last year. Net cash flow was NOK 54.8 million in H1 2023 compared to NOK

13.7 million in H1 2022.Consequently, Nekkar’s balance sheet remains solid. At the end of the second

quarter 2023, the company had NOK 236 million in cash, no interest-bearing debt,

and an undrawn NOK 200 million credit facility available for future investments.

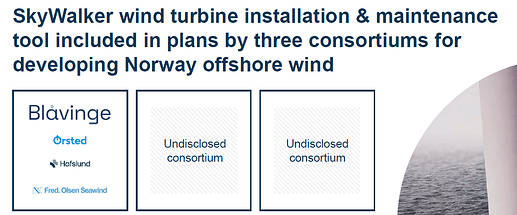

Skywalkerin kaupallistamiseen ensimmäiset näkyvämmät askeleet

During the second quarter, Nekkar entered into agreements with three different offshore wind consortiums that aim to utilize SkyWalker as major component exchange tool on wind turbine generators should the consortiums’ bids be successful in Norway’s first offshore wind licensing round.

Samoin Starfish, kaupallistaminen edistyy

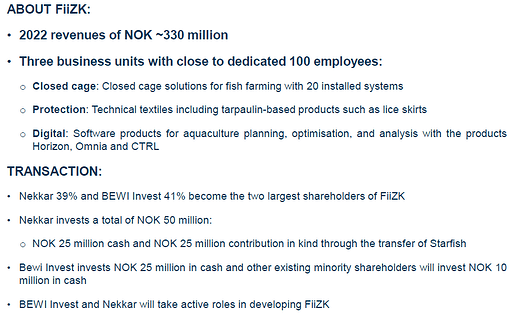

For Starfish, we are pleased to announce that we partner with BEWI Invest through a joint investment in the aquaculture industry supplier FiiZK. FiiZK is the leading provider of closed cage systems for fish farming. The company also provides software tools for optimizing fish farming planning, operations, and analysis.

“The integration of FiiZK’s established market position and Nekkar’s Starfish technology strengthens the company’s position as the market leading provider of closed cage solutions and aquaculture software,” says Ole Falk Hansen. See separate stock exchange announcement for more details.

Yhdessä BEWI Investin kanssa osuus FiiZK, joka toimittaa suljettuja kasvattamoita.

Odotettu lähtökohta, että toteutus tehdään yhdessä jonkin toimijan kanssa.

Muiltakin osin vallan mieluisaa luettavaa.

- Techano jatkaa siitä mihin aiemmin jäi, sopiva lisäys portfolioon

- Intellilift alkaa näkymään tulosriveillä.

- Synchrolift 4 uutta sopimusta 115MNOK arvosta, backlogiin täydennystä

- Vahva kassavirta Q2:lla ja velaton

- Omien ostot, jopa 10% osakekannasta (!)

![]()