Tasaista tekemistä. Valuutoista negaa ja jonkin verran viime vuoden alle.

10MUSD palvelusopimuksen lisäksi ei ilmeisesti mitään muuta olennaista backlogiin lisätty

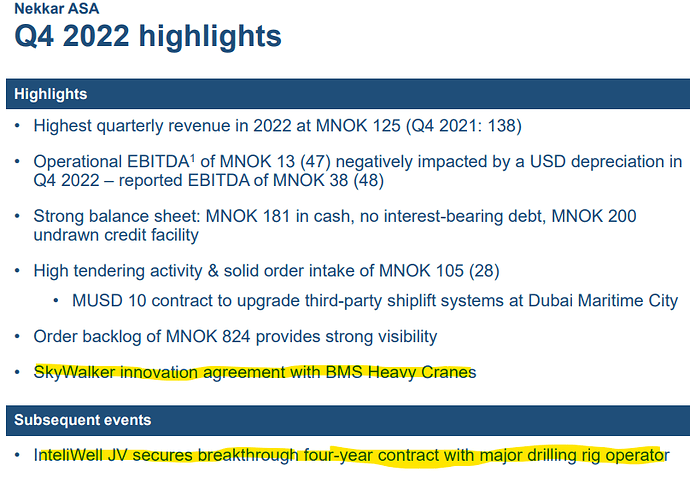

16 February 2023 - The fourth quarter was Nekkar ASA’s (Nekkar) strongest

revenue-wise in 2022 with revenue of NOK 125 million (Q4 2021: 138). EBIT in the

fourth quarter ended at NOK 34 million (45). Order intake was NOK 105 million

(28) resulting at a healthy order backlog of NOK 824 at the end of 2022. The

company’s balance sheet remains solid, with NOK 181 million in net cash.

Subsequent to year-end, the company signed a breakthrough contract for the

InteliWell joint venture.

“Our operational performance in the fourth quarter has been good, reflecting

strong revenues from both newbuild and aftermarket projects. Our order intake

echoes continued high tendering activity within Shipyard Solutions, and we

experience encouraging progress for our impact technologies. Overall, the fourth

quarter was another step in the right direction for all our business areas,”

says Ole Falk Hansen, CEO of Nekkar.

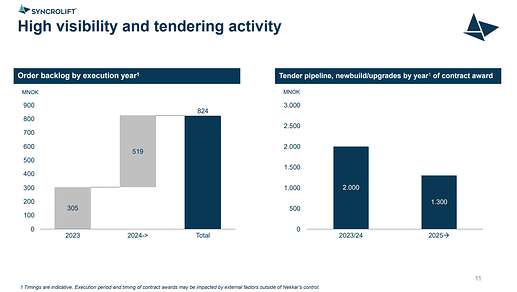

Order intake in the fourth quarter was NOK 105 million (28), close to four

times as high as the corresponding quarter in 2021. The order intake includes a

USD 10 million contract for upgrade of third-party shiplift systems in Dubai

Maritime City. Nekkar’s order backlog remains strong at NOK 824 million as of 31

December 2022, providing excellent visibility for the Shipyard Solutions

business area in the coming years.

Nekkar reported revenue of NOK 125 million (138) in the fourth quarter 2022.

The company’s operational EBITDA was NOK 13 million (47), negatively affected by

a USD depreciation versus NOK during the fourth quarter 2022. Reported EBITDA

was NOK 38 million (48), positively affected by gain on FX contracts, and EBIT

was NOK 34 million (45).

“As the majority of Nekkar’s projects are invoiced in USD, both operational and

reported EBITDA become impacted - in opposite directions. However, the

underlying operational and financial performance is good in Nekkar,” adds Ole

Falk Hansen.

Nekkar’s balance sheet remains solid. At year-end 2022, the company had NOK 181

million in cash, no interest-bearing debt, and an undrawn NOK 200 million credit

facility available for future investments.

IMPACT TECHNOLOGIES

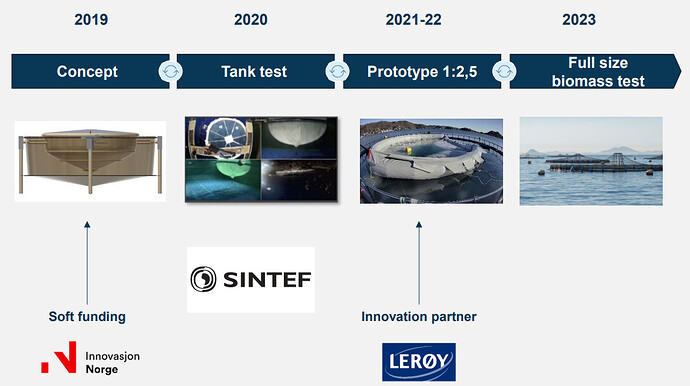

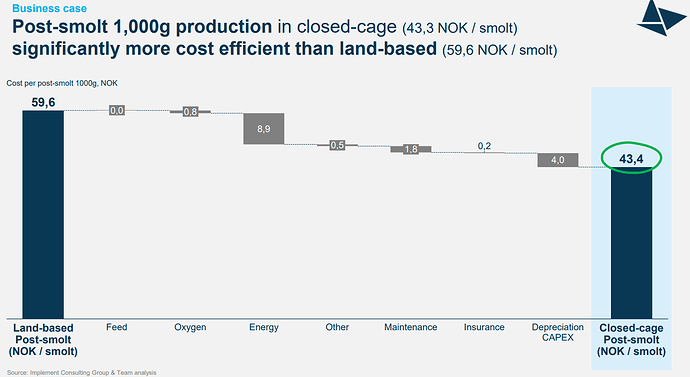

Nekkar is currently developing sustainable and digitalized impact technologies

that aim to unlock customer value in ocean-based industries. These technologies

include the InteliWell rig automation solution, SkyWalker wind turbine

installation tool, and Starfish closed fish cage. The fourth quarter of 2022 and

subsequent months have been productive for Nekkar’s drive towards

commercialization of these impact technologies.

In November 2022, BMS Heavy Cranes entered into an innovation agreement for the

development and testing of the SkyWalker wind turbine installation tool.

Moreover, Nekkar has in recent months received approaches from operators of

offshore wind farms who express an interest in utilizing SkyWalker for equipment

replacements at offshore wind farms.

“Our original intention for SkyWalker was to use it solely as a wind turbine

installation tool, first onshore and then for quayside assembly of offshore wind

turbines. However, recent requests from operators indicate that they are

interested in deploying SkyWalker in the operations and maintenance phase of an

offshore wind farm. This could expand its commercial potential significantly,”

adds Ole Falk Hansen.

Subsequent to the end of the fourth quarter, the InteliWell joint venture, which

Nekkar is part of together with Transocean and Viasat, has signed its first

commercial contract. The four-year contract is with an undisclosed major rig

operator. Nekkar’s subsidiary, Intellilift, will execute the project on behalf

of the joint venture during 2023.

FULL-YEAR 2022 RESULTS

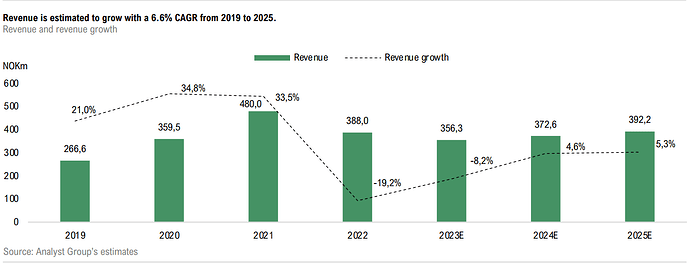

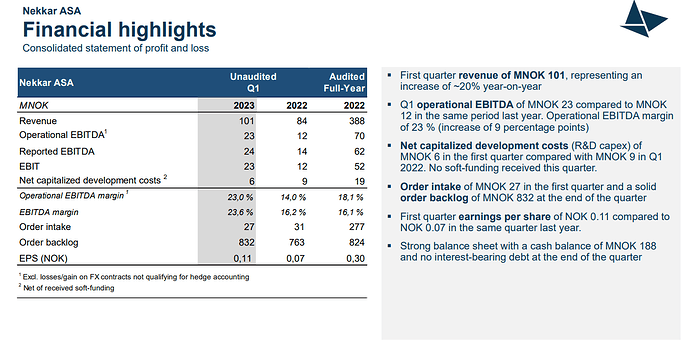

For the full year 2022, Nekkar delivered revenue of NOK 388 million (2021: 480),

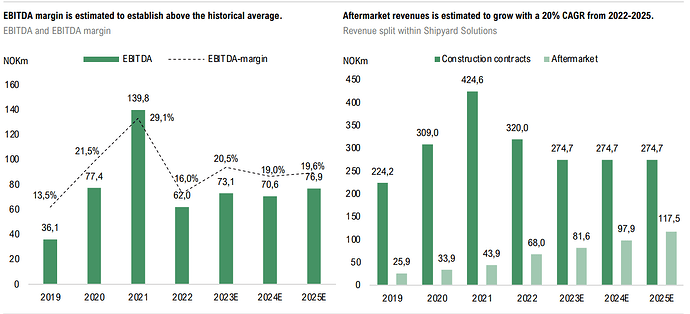

with an operational EBITDA of NOK 70 million (143), reported EBITDA of NOK 62

million (140) and EBIT of NOK 52 million (135). Order intake was NOK 257 million

in 2022, versus NOK 113 million the year before. Net cash flow from operations

was NOK 38 million (-59.6 million).

Since 2019, Nekkar has implemented a strategy to drive more revenue from sales

of services, spare parts and upgrades for shiplifts and transfer systems. This

strategy continues to yield results. In 2022, revenue from service grew by 48

percent to NOK 68 million, while order intake from service increased 30 percent

versus the prior year.

Lähde: https://newsweb.oslobors.no/message/582589

2022 Q4 presis

en_Nekkar ASA_Q4_2022_presentation.pdf (3,6 Mt)

IntelliWell tehnyt 4 vuoden sopimuksen katsauskauden jälkeen. En nyt muista aiemmin nähneeni mainintaa

Lisäksi Skywalkerista tehty innovaatiosopimusta, kaupallistaminen edistyy

Edit: Pitääpä vielä nostaa erikseen tämä maininta CEO:n kommenteista

“Our original intention for SkyWalker was to use it solely as a wind turbine installation tool, first onshore and then for quayside assembly of offshore wind turbines. However, recent requests from operators indicate that they are interested in deploying SkyWalker in the operations and maintenance phase of an offshore wind farm. This could expand its commercial potential significantly,” adds Ole Falk Hansen.