Yleinen trendi on ollut jo reilun vuoden, että länkkärifirmat ovat siirtäneet tuotantoa pois Kiinasta. Moni asiakas vaatii muualla kuin Kiinassa tuotettuja tuotteita ja Kiina ei ole enää niin kovin halpakaan. On Kambodzaa, Vietnamia ja Mexicoa. Voivat olla jopa ahkerampia ja taatusti rehellisempiä.

Hyvä tieto, mutta kuitenkin suurten tehtaiden siirto pois Kiinasta lienee lähes mahdotonta. Tuo rehellisyys ja luotettavuus on erittäin tärkeä tekijä, sehän luo aika lailla tärkeitä puitteita toiminnalle. Jo pelkästään tuotannossa sen puute aiheuttaa pahoja ongelmia, mutta tuotekehityksessä, asiakassuhteiden hoidossa ja muita erittäin luottamuksellisia tietoja ja asioita käsitellessä se johtaa hyvin pahoihin ongelmiin. Ymmärrän @Oxymoron_007 kannan, mutta jos kyseessä on yleinen ilmiö on idioottimaista sivuuttaa se. Liiketoimintaympäristöissä on tunnettava ja tiedostettava erilaiset kulttuurilliset seikat vaikkei niiden suoraan sanominen olisikaan korrektia. Se, että tiedostaa esimerkiksi korruption merkityksen tietyissä kulttuureissa ei tarkoita sita, että siihen tulisi lähteä mukaan.

Perustuu henkilökohtaisiin empiirisiin kokemuksiin. Kiinassa et voi luottaa kenenkään sanaan. Quod scripsi, scripsi.

Tuotannon siirron helppous on siinä, että globaalit toimijat käyttävät pääasiassa alihankkijoita tuotannon järjestämiseksi (Jabil, Foxconn, Flex… ). Heillä on tuotantolaitoksia eri maissa ja siirto tapahtuu suhteellisen ketterästi, jos Kiinan viranomaisten kanssa voitelu toimii. Ja vaikka yrityksellä olisi Kiinassa oma tehdas, niin aika nopeasti elektroniikan tuotantolinjan laivaa toiselle tehtaalle, vaikka Taiwaniin ja enää tuotetta ei kuormita made in China leima.

Rakuten ostaa ORAN yhtiön Altiostar Networksin.

After its early investment and collaboration, Rakuten on Wednesday announced plans to acquire Altiostar Networks in a deal that pegs total value of the U.S.-based open RAN vendor at $1 billion.

Veikkaisin sen kummemmin perehtymättä tälläkin palstalla olevien Nokian omistajien luopuvan vastaavilla arvostustasoilla omistuksistaan.

Näyttäisi että #1500 on “nimetty” taas kurssin noustessa uudeksi

eli nyt voisi sanoa että: " #1250 is the new #1500 which was the old #1750 "

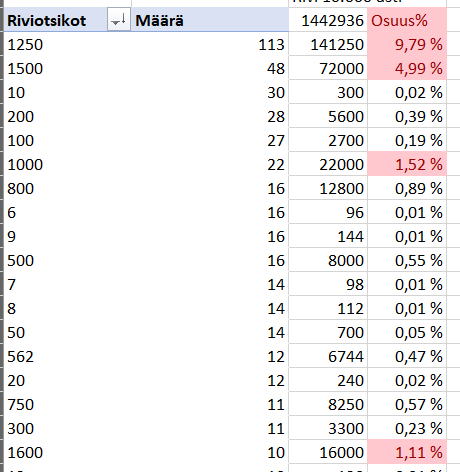

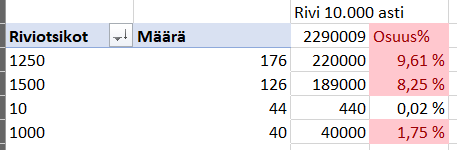

tein nyt #1250 seurantaversion

Update on Robot #1250 so far today in Helsinki Stock Exchange @ 10:58

113 out of 1572 transactions was 1250pcs events ~ 7,19 % of all transactions

(113x1250) out of 1,44m changed total shares ~ Minimum of 13,7% of total shares exchanged

(113x1250) out of 1,27m changed total shares, without morning auction ~ Minimum of 15,52% of total shares exchanged

This between 10:00 and 10:58 today, with avg price of 5,34

Edit:12:10

onkohan sittenkään vaan ajaako kahdella robolla, tai toinen huono ja tunnistettava robottiyrittäjä myös liikkeellä ![]()

lisätään tähän samaan

tilanne 13:45

Update on Robot #1250 so far today in Helsinki Stock Exchange @ 13:45

219 out of 3476 transactions was 1250pcs events ~ 6,3 % of all transactions

(219x1250) out of 3m changed total shares ~ Minimum of 9,11% of total shares exchanged

(219x1250) out of 2,84m changed total shares, without morning auction ~ Minimum of 9,66% of total shares exchanged

This between 10:00 and 13:45 today, with avg price of 5,33

Update on Robot #1500 so far today in Helsinki Stock Exchange @ 13:45

193 out of 3476 transactions was 1500pcs events ~ 5,55 % of all transactions

(193x1500) out of 3m changed total shares ~ Minimum of 9,64% of total shares exchanged

(193x1500) out of 2,84m changed total shares, without morning auction ~ Minimum of 10,21% of total shares exchanged

This between 10:00 and 13:45 today, with avg price of 5,33

AEROFARMS AND NOKIA UNVEIL PARTNERSHIP FOR NEXT GENERATION AI-ENABLED PLANT VISION TECHNOLOGY

AeroFarms and Nokia Bell Labs today unveiled a groundbreaking multi-year partnership to combine their expertise and expand their joint capabilities in cutting-edge networking, autonomous systems, and integrated machine vision and machine learning technologies to identify and track plant interactions at the most advanced levels.

As part of this partnership, AeroFarms, a Certified B Corporation and global leader in indoor vertical farming, contributes its commercial growing expertise, comprehensive environmental controls, an agriculture-focused data platform, and machine vision core foundation. Nokia Bell Labs, the world-renowned industrial research arm of Nokia, contributes its groundbreaking autonomous drone control and orchestration systems, private wireless networks, robust image and sensor data pipelines, and innovative artificial intelligence (AI) enabled mobile sensor technologies. This combination of innovative technologies allows AeroFarms to reach the next level of imaging insights that further enhance its capabilities as an industry leading operator of world-class, fully-connected smart vertical farms that grow the highest quality plants all year round.

Nokia Bell Labs’ machine vision technology has enabled the most precise data capture yet, down to the level of individual plants, using leaf size segmentation, quantification, and pixel-based scanning to identify consistency and variation. Going beyond what even the human eye can perceive, this state-of-the art imaging technology enables the gathering of immense insights about a plant including its leaf size, stem length, coloration, curvature, spotting, and tearing. The end-to-end system is flexible and robust, built to take advantage of Nokia’s industry-leading 5G private wireless network with cloud processing technology, designed for low latency and high privacy in an on-premises network. It also provides intelligent industrial analytics capabilities as an integrated service that can be deployed quickly and efficiently anywhere.

Thierry Klein, VP, Integrated Solutions and Experiences Research Lab at Nokia, said: “Nokia Bell Labs is driven to solve hard and impactful problems, and together with AeroFarms, we are building the ability to see and identify plant interactions at unprecedented levels. The fundamental technologies of this partnership are our strength, and vertical farming is just the beginning. With the AeroFarms platform, we are exploring the power of network driven intelligence for industrial outcomes. These capabilities can expand into a multitude of indoor industrial operations, including logistics, warehousing, distribution hubs, and manufacturing.”

The multi-year partnership between AeroFarms and Nokia is anchored on shared values as mission-driven companies with the vision to scale technologies for the greater good. AeroFarms’ vertical farming platform is more sustainable than traditional farming with up to 390 times greater productivity per square foot annually, while using up to 95% less water and zero pesticides. In addition, vertical farming provides local food options for communities, reducing the environmental impact of trucking and shipping produce long distances and helping combat food waste.

Raymond James’ Simon Leopold increased his 2021 sales estimate from €22.1/$26.3 billion to €22.1/ $26.2 billion and raised the EPS estimate from €0.28/$0.34 to €0.37/$0.43.

Jos Leopold on oikeassa Nokia on nähdäkseni edelleen vahvasti aliarvostettu (vaikka Leopold onkin tyytyväinen nykykurssiin). Jokainen voi laskea, mitä kurssiksi tulisi jos jatkossakin tulosparannuksia tekevän Nokian EPS 0,37 euroa arvostetaan P/E-luvulla 20…

Olympialaisia katsellessa väliin myös uutinen.

Hiukan huonolle kuulostaa, Intian Vodafone Idealla maksuongelmia.

Some of the vendors have started holding internal meetings to discuss the situation and gauge their exposure to the telecom operator.

A person at Nokia told ET that there haven’t been any internal meetings just yet, but the company is closely watching the fast-paced developments at Vi.

“While the vendors were already cautious in the last few months in terms of accepting new purchase orders from Vi, they still have an exposure of about $200 million in total,” Ashwinder Sethi, principal at Analysys Mason, told ET.

Eihän tämä hyvältä kuulosta, mutta Intia on Intia. Laitetoimittajat ovat varmasti laskeneet riskit tässä toimintaympäristössä. Intialaisoperaattorien maksuhalukkuus on tunnetusti varsin köykäistä.

Tässähän on nyt monta monessa. Pandemia on heikentänyt tulovirtoja ja jo vuosikausia jatkunut liittymien halpamyynti ei varmasti auta. Muistan elävästi intialaiskollegani tarinan Intian ilmaisliittymistä muutaman vuoden takaa ja ihmettelin jo silloin, mitenkähän tässä mahtaa käydä. Kyseessähän on ns. “Ericsson-resepti”, eli liittymiä myytiin persnetolla asiakaskunnan kartuttamiseksi tulevien vuosien voittojen kiillellessä jo silmissä. Nyt sitten yks sun toinen operaattori ihmettelee, millä laskut maksetaan. Kun tähän lisää Intian hallituksen keksinnön periä menneiden vuosien valtavia lisenssi- ja kaistamaksuja operaattoreilta jälkikäteen… ei hyvää päivää.

No, Intiassa löydetään kyllä keinot. Väittäisin jopa, että Bhartin, Vodafone Idean ja muiden intialaisoperaattorien vaikeudet ovat terve merkki – Intian ollessa kyseessä.

eilinen koko päivä roboille (tai siis vain nämä 2) ilman huutareita >20%

(502x1250) out of 7,41m changed total shares, without auctions ~ Minimum of 8,47% of total shares exchanged

(596x1500) out of 7,41m changed total shares, without auctions ~ Minimum of 12,07% of total shares exchanged

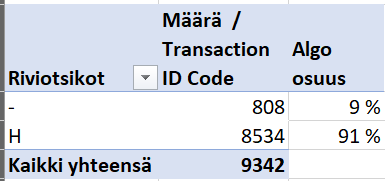

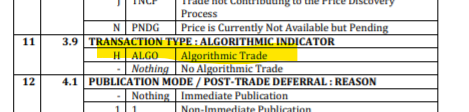

niin ettei jää epäselväksi suurin osa kaupasta on Algoritmi kauppaa, eilinen

löytyy tuolta kaupoista (MMT flags) ja dokkari täältä sivu 14 alkaen selitteet

millä perustein tuo muodostuu on itselleni vielä epäselvä, koska jonkun kauppa Nordnetissä täällä tai KL raportoitu oli algoritmi kauppaa (aiheuttaako SOR sen vai ei, en osaa sanoa)

Intiassa operaattoreilla on ollut säännöllisesti ongelmia maksujen kanssa ja aina ne rahat jostain löytyy. Nokia on kuitenkin ottanut varovaisen linjan ja maksuihin on haettu pankeilta takauksia. En siis olisi erityisen huolissaan.

"Chinese vendors may find it harder to get their money back as the orders are not backed by letters of credit (LCs). Money owed to European vendors have a stronger chance of recovering some if Vi collapses, since their partnerships are backed by LCs, market watchers said.

An LC is a letter from a bank guaranteeing the payment to the vendor. If the buyer is unable to make the payment, the bank will have to cover it."

Merkit vahvistuvat, myös carrier business liikevaihto laskenut vuoden ensimmäisellä puoliskolla yli 14 %. Tämä siitä huolimatta että Kiina boostaa maansisäisesti Huawein liiketoimintaa. Länsimaissa markkinaosuustappiot ovat olleet merkittävät.

[Shenzhen, China, August 6, 2021] Huawei released its business results for the first half of 2021 today. Its overall performance was in line with forecast.

In H1, Huawei generated CNY320.4 billion in revenue, with its net profit margin reaching 9.8%[1].

- Carrier business revenue: CNY136.9 billion

- Enterprise business revenue: CNY42.9 billion

- Consumer business revenue: CNY135.7 billion

“We’ve set our strategic goals for the next five years,” said Eric Xu, Huawei’s Rotating Chairman. “Our aim is to survive, and to do so sustainably. We’ll do this by creating practical value for our customers and partners. Despite a decline in revenue from our consumer business caused by external factors, we are confident that our carrier and enterprise businesses will continue to grow steadily.”

Xu continued, “These have been challenging times, and all of our employees have been pushing forward with extraordinary determination and strength. I want to thank every single member of the Huawei team for their incredible effort. Going forward, we continue to believe deeply in the power of digital technology to provide fresh solutions to the problems the world is facing right now. We will keep on innovating to help build a low-carbon, intelligent world.”

Ja vertailuna viime vuoden H1.

[Shenzhen, China, July 13, 2020] Huawei announced its business results for the first half of 2020 today. The company generated CNY454 billion in revenue during this period, a 13.1% increase year-on-year, with a net profit margin of 9.2%.[1] Huawei’s carrier, enterprise, and consumer businesses achieved CNY159.6 billion, CNY36.3 billion, and CNY255.8 billion in revenue, respectively.

Tuo Carrier business siis “vain” 18mrd€ (H1:llä) ![]() ja kun “tietää” minkälaisia summia esim Pelkästään ChinaMobile käyttää Huaweihin (700Mhz= 61% *2mrd€ =1200m€ ja 3,5Ghz 04/2020 = 58% * 4,3mrd€ =2,5mrd€), niin alkaa kyllä ilmeisesti sakata muualla maailmassa

ja kun “tietää” minkälaisia summia esim Pelkästään ChinaMobile käyttää Huaweihin (700Mhz= 61% *2mrd€ =1200m€ ja 3,5Ghz 04/2020 = 58% * 4,3mrd€ =2,5mrd€), niin alkaa kyllä ilmeisesti sakata muualla maailmassa

eli siis vaivaiset 3mrd€ pudonnut liikevaihto ![]()

Ps tuolla tuo talouselämän juttu, hyvää luettavaa, ei uutta…

DELL’ORO: FULL SPEED AHEAD FOR BROADBAND TECH SPENDING

Noting that broadband subscriber additions continue to grow at a furious pace around the world, analyst Dell’Oro is predicting that global spending on broadband access equipment and CPE will achieve a 3% CAGR (compound annual growth rate) from 2020-2025. In an update to the Broadband access and home networking 5-year forecast report it published in July 2021, the analyst said the projected growth would represent a “solid” increase from a 0% CAGR in its January 2021 5-year forecast edition. It said the equipment spending slump that the industry had expected to see in 2021 after the increased investment levels of 2020 was not going to materialise.

Drilling deeper into the prospects for specific areas, Dell’Oro said it expected passive optical network (PON) equipment spending to remain solid. The analyst increased its five-year CAGR for PON equipment to 5% from 3%. Dell’Oro said that after two years of under-investing in infrastructure, the overall cable infrastructure market will see a steady increase in revenue throughout the forecast period, as mid- and high-split projects in North America and Western Europe, designed to increase upstream capacity, are accelerated.

Robotilasto tälle päivälle

Update on Robot #1250 so far today in Helsinki Stock Exchange @ 14:43

160 out of 3036 transactions was 1250pcs events ~ 5,27 % of all transactions

(160x1250) out of 2,2m changed total shares ~ Minimum of 9,09% of total shares exchanged

(160x1250) out of 2,13m changed total shares, without morning auction ~ Minimum of 9,4% of total shares exchanged

Update on Robot #1500 so far today in Helsinki Stock Exchange @ 14:43

189 out of 3036 transactions was 1500pcs events ~ 6,23 % of all transactions

(189x1500) out of 2,2m changed total shares ~ Minimum of 12,88% of total shares exchanged

(189x1500) out of 2,13m changed total shares, without morning auction ~ Minimum of 13,33% of total shares exchanged

This between 10:00 and 14:43 today, with avg price of 5,25

vkonloppuja

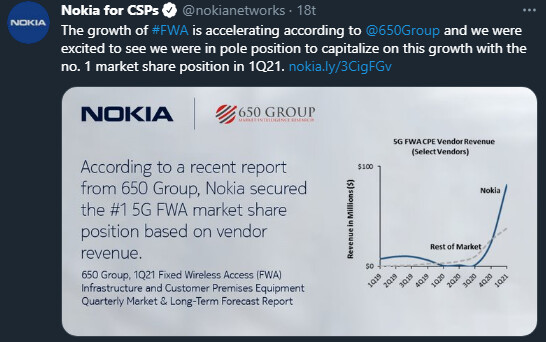

5G fixed wireless access (FWA) Nokia on sijalla numero 1 markkinaosuuksissa. Kuvaajaan perusteella Nokia kehitys on ollut tässä hyvin nopeaa. Ei muuta kuin kaikkialle vain fastmileä ja muuta asiaan liittyvää.

JP Morganin analyytikko Sandeep Deshpande pitää Nokian toista neljännestä samanlaisena kännekohtana Nokialle kuin hetkeä jolloin Ericssonin marginaali nousi 31,6 prosentista 40,4 prosenttiin.

Seuraavan linkin kautta löytyy kopio Barron’sin tänään ilmestyneestä artikkelista: https://whatsnew2day.com/nokia-stock-is-riding-the-5g-wave-why-the-rally-could-continue/ Tässä alkuperäinen lähde, johon tarvitsee lukuoikeuden: Why Nokia Stock’s Rally Could Continue | Barron's

Viikon päätteeksi saatu viisi sopparia ja yksi live päivitettyä lisää.

175

commercial 5G deals

68

live 5G operator networks

230+

A public notice from the Federal Communications Commission this week is illustrative in that it shows which vendors expect to reap big rewards from the FCC’s upcoming program to rip and replace Huawei and ZTE equipment from U.S. networks.

Nokia asked the commission for a couple of modifications based on timelines. It wanted the FCC to allow applicants to submit cost estimates based on costs incurred over an 18-month project timeline. But the FCC declined that request. “The removal, replacement, and disposal term provided for in the Secure Networks Act and the Commission’s rules ends one year after the participant receives its initial disbursement of support,” stated the FCC. (Editor’s note: This is America where we’re always on a tight deadline!)

Nokia (and also the Competitive Carriers Association) requested a blanket six-month extension of time, noting that many applicants will have difficulty adhering to a one-year deadline for removal, replacement and disposal because under normal circumstances the process would take approximately one to three years.

The FCC declined to give a general six-month extension, saying, “We find it premature to consider a general extension before the Reimbursement Program is even launched and any removal, replacement and disposal terms are established.”

Interestingly, Nokia also requested that the FCC remove fields indicating that applicants selected open RAN solutions because the fields show a preference for open RAN. But the FCC declined that request, saying these questions are merely intended to help it keep track of technology choices by providers. (Editor’s note: Nokia tells the trade press that it likes open RAN).