Ei ihan huono. Tietääkseni Appgallerylla on yli 500 miljoonaa aktiivista käyttäjää.

Edit, Piti tarkistaa. Tämä oli Q1/2021 tilanne @ 530 miljoonaa kuukausittaista käyttäjää. Viimeisin tieto minkä toisaalta löysin antoi luvun 560M

Ei ihan huono. Tietääkseni Appgallerylla on yli 500 miljoonaa aktiivista käyttäjää.

Edit, Piti tarkistaa. Tämä oli Q1/2021 tilanne @ 530 miljoonaa kuukausittaista käyttäjää. Viimeisin tieto minkä toisaalta löysin antoi luvun 560M

Kun hinta saadaan kohdilleen ja pörssihistoriaa löytyy yli 6kk, niin alkaa rahastojakin kiinnostamaan.

Rahastojen määrä kasvanut jo 60 ja lähiaikoina lähinnä rahastot ja säätiöt raportoineen ostojaan.

No niin, vhdoinkin johto on ilmeisesti päättänyt lähteä kunnolla ostoksille sen sijaan, että twiittailevat asiasta ja valittelevat sitä, miten alhainen osakkeen kurssi on.

CEO osti 290k lappua ja muu johtoporras 447k lappua.

January 4, 2022, 2:00 pm

LONDON, January 04, 2022 --(BUSINESS WIRE)–Paysafe Limited (NYSE: PSFE), a leading specialized payments platform, today announced that Cannae Holdings, Inc. (“Cannae”) (NYSE: CNNE), through its subsidiary, has purchased approximately 5.7 million shares of Paysafe’s common stock through a series of open market transactions in late December 2021 in accordance with the Company’s securities trading policy and applicable securities laws. As of December 31, 2021, Cannae owned 59,758,641 common shares, which represents approximately 8.26% of Paysafe’s outstanding common shares.

William P. Foley, II, Chairman of Cannae, commented, “Based on our confidence in the path Paysafe is now on, Cannae has acquired an additional 5.7 million shares in open market transactions totaling $22.2 million.”

Ja kurssi odotetusti pomppaa ![]()

Paysafe on kyllä ihme paperi, tulee ihan Nabriva (NBRV) mieleen. Aivan sama vaikka sanoisivat, että tehtiin 1 miljardin diili, niin kurssi droppaa. Nabrivallahan oli aikoinaan tyyliin 10 loistavaa uutista 2 viikon jaksolla putkeen, jonka aikana kurssi putosi varmaan 15 % eikä ole vieläkään noussut siitä.

Kun kerran laitoin lisää pääomaa kiinni, niin pitänee alkaa taas seuraamaan tarkemmin etenemistäkin ![]()

Krypto-kumppani julkaistiin myöskin eilen, eli se on Binance

Binance ottaa Paysafen kautta uudelleen käyttöön SEPA maksut

Binance on kryptomaailmassa sen verran kova nimi, että ei kyllä lainkaan hassumpi diili. Kumma kyllä, jos ei tämäkään saa kurssiin mitään liikettä. Alkaa lafka olemaan kyllä ostohinnoissa.

Ei kannata aliarvioidan tämän osakkeen jäätävää kykyä vastustaa kaikkea kurssinousua, oli ne uutiset miten hyvä tahansa ![]()

Tässä viime kuukaisien aikana on tullut kaikkea mahdollista kuviota lentoliikenteestä kryptoihin, mutta kyseessä on kuitenkin vasta kumppanuuksien aloituksista, joista sitten toivottavasti alkaa tuloutumaan isommin kassavirtaa myöhemmin. Sen verran isosti näitä on kuitenkin nyt tullut ja koska osakkeen kurssi on tosiaan potkittu poikkeuksellisen paljon jopa deSpaciksi (maanantaina käytiin hetkellisesti hiukan päälle 2 miljardin mcapissa, joka on n. 40% siitä, millä hinnalla tämä vietiin yksityiseksi 2017), niin aika vaikea kuvitella, että 2022 lopulla pyöritään enää näissä lukemissa, ellei tästä vedetä kunnon karhu-vuotta koko pörssissä.

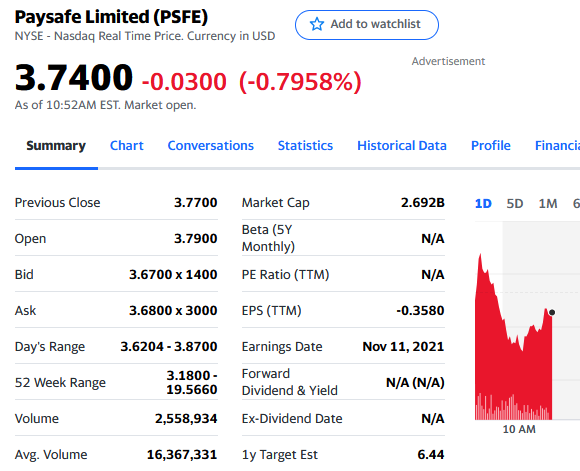

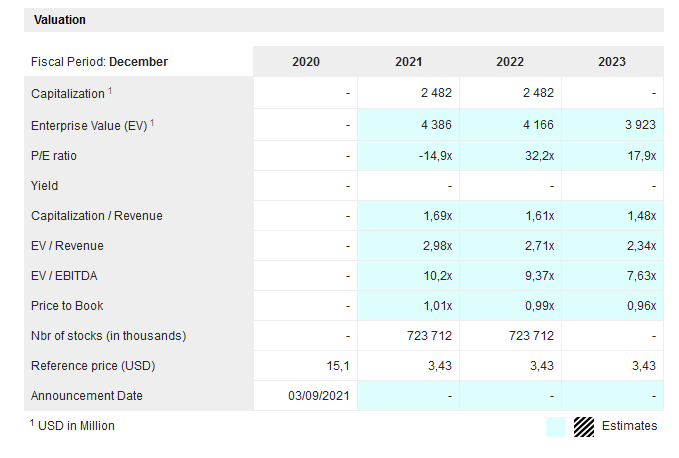

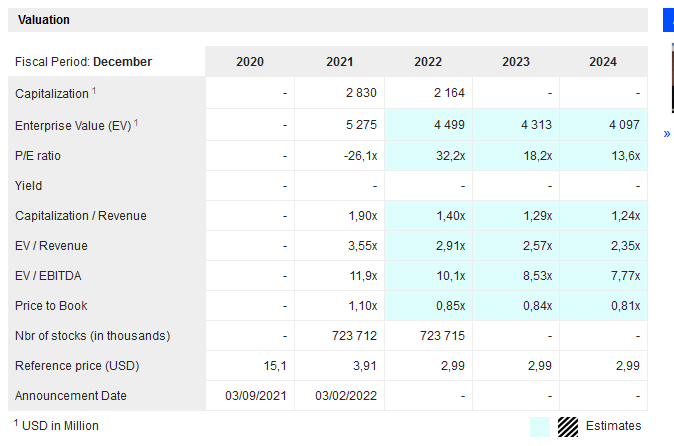

Tässä pieni esimerkki siitä, miksi ainakin omaan silmään Paysafe näyttää melkoisen halvalta tällä hetkellä.

Paysafe

Block

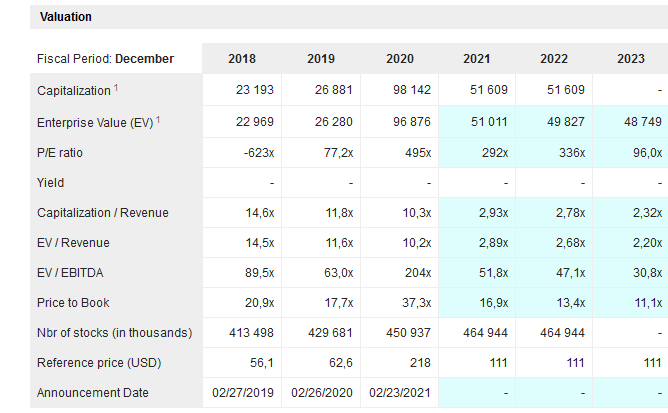

Tietenkään nuo firmat eivät nyt ihan 100% ole verrannollisia toisiinsa, mutta tuosta nyt näkee suuntaa siitä, millaisia kertoimia näille fintecheille jenkkilässä sallitaan. Ja nuo kertoimet Blockilla ovat kuitenkin yli 60% laskun jälkeenkin tuollaiset.

Parissa viime osarissa kurssia on kyllä rankaistua tarkoituksella kunnolla, varsinkin kun kyseessä on ollut margeristä sekä virtuaalilompakoiden resetoinnista johtuneista kertakuluista ja muutamista kymmenistä miljoonista koostuva lv missaus 1,5 miljardin liikevaihdon firmalla. Luonollisesti tämä on koettu vajaan 7 miljardin laskun arvoiseksi. 10 taalan NAVilla Paysafe oli kyllä hiukan turhan arvokkaasti hinnoiteltu 2020/2021 spacien tyyliin, vaikka ei kyllä niin räikeästi, mitä suurin osa spaceista on.

Ennusteet ylitetty ja myös 2022 yli ennusteiden. Ainakin premarketiin maistui, mutta katsotaan nyt sitten…

Ja uusi hallituksen pj Foleyn tilalle

“Free cash flow was $53.1 million, compared to $116.8 million in the prior year.”

“Free cash flow was $286.3 million, compared to $356.3 million in the prior year.”

Tästä lähti nousu - kun aletaan ylittämään guidancea niin se on positiivista. Hieman on kurssissa nousuvaraa kun laiva kääntyy. Tuotteet (digilompakko Skrill ainakin) on erittäin hyviä käyttäjälleen ja käytän päivittäin vedonlyönnissä. Ja mulla volyymit tässä lajissa miljoonaluokassa vuosittain joten PSFE myös tienaa minusta hyvin. Uskoisin että ongelma Skrillin kanssa ainaki ollut liian raskas välistäveto operaattorilta - ja Skrill toimii tavallaan vain kuorena luottokortin / pankkitilin välillä ja vetää välistä. Edut on silti huomattavat kun ei tartte veivata oman pankin kanssa ja nykyisin tulee Nordeaan ainakin sekunnissa nostot.

Eilen oli Q&A tilausuus Paysafen CEOn kanssa, eli tässä koottuna läpikäydyt kysymykset ja vastaukset niihin. Mielenkiintoisia juttuja. Varsinkin tuo Binancelle/Bifinitylle toteutettu järjestelmä sekä tulevat laajennukset kuulostavat sellaiselta asialta, jotka saattavat tuoda kunnon liikevaihtoa lähivuosina.

Paysafe Q&A with CEO Philip McHugh provided by Public.com

- What is your mission statement and how important is it to your overall company growth?

- Thanks for the question, Jason. We are driven to help merchants grow and make it easier for consumers to pay. Today, payments are more complex than ever for a merchant. The global consumer has more choices in how to pay than ever before. Risk management and regulatory challenges have also gotten more complex. We simplify these factors for the merchant via a single API integration, so that they can focus on running their business

- What was your biggest roadblock in the last quarter and FY2021?

- Hi, Shawn. We reported strong Q4 results relative to our revised guidance, but over the course of 2021 we had factors that impacted our growth. Two main things: First, our Direct Marketing business (within Integrated Processing) exited a discrete set of clients in order to align with new compliance requirements. That was a meaningful headwind in 2021, not factored into our original guidance, but the business is now recovering in line with our expectations, and we expect to see growth in 2022. Second, in the Digital Wallets business, we have been impacted by regulatory changes in European markets. We’ve discussed several actions we are taking to improve the core digital wallets business and get back on a path to growth. We are seeing progress as a result of enhancements we’ve made to pricing and user experience, but we do continue to expect 2022 to be a transitional year for the business. Importantly, recent wins such as Binance and our progress in North America iGaming with our Skrill digital wallet pilot are positioning the business for long term growth. Additionally, the rest of Paysafe performed very well relative to our expectations, offsetting some of the headwinds in direct marketing and digital wallet. We talked about this at length on our Q3 and Q4 earnings calls if you’re interested in more detail.

- What innovations do you have planned for the next 5 years?

- We have exciting innovation plans underpinning our strategic priorities. I see Paysafe as the de facto leader in payments for North America iGaming, with this sector being a larger portion of Paysafe as the market continues to open up. Similarly, I see us having a scaled business across digital commerce for crypto, where we will continue to advance innovations such as our newly developed white label solution. We also see real time banking as a fast-growing payment form and, with SafetyPay’s extensive bank network in LATAM, coupled with our existing capabilities, we’re building out this platform and driving innovation. Lastly, we have to stay at the top of our game when it comes to the risk & regulatory demands of our markets, info security, and other critical functions. This requires investment and innovation as well.

- Does the current state of world affair cause $PSFE to increase spending on IT specifically security ?

- Hi, Lorenzo. At Paysafe, we have something called “the Top 10,” which are the biggest priorities across the company and Info Security is absolutely on that list. We have a leading, mature, and robust capability in place which has routinely responded to the latest threats. The rise in fraud, cyberattacks and associated malicious behavior is a big challenge globally, particularly as the pandemic accelerated wider adoption of digital payments. While this continues to be an area of investment, we’ve also prioritized becoming more efficient, and we are not expecting incremental spend above our existing plans.

- Hi There - how are you affected by Russia situation?

- Thanks for the question. Like most of the world, we have been deeply saddened by Russia’s unprovoked attack on Ukraine. Importantly, we only had a very small team in Ukraine who we have been in close contact with and are providing relief and assistance to. Like many companies, we are finding ways to play our part in order to lessen the growing crisis including making donations and helping get provisions to those in need. From a business perspective our team moved quickly to ensure we comply with all sanctions. Fortunately, our exposure in Russia is relatively small — on an annualized basis ~1% of our total revenue comes from across Russia and Ukraine combined. On the InfoSec front, and the potentially heightened risks, we have implemented additional preventative measures and monitoring to ensure our data and customers remain protected.

- Why did ecash margin drop 1%? Is this temporary? Do you plan on breaking out any numbers on acquiring companies financials?

- Hi, John. I think you may be referring to the year-over-year change in take rate, which dipped due to the acquired businesses which have a higher take rate than Paysafe in total, but a lower take rate than the organic eCash business. In turn, this reduces eCash’s take rate, but contributes strong gross margins and EBITDA margins. It is worth pointing out that both gross margin and EBITDA margin improved in 4Q’21 and for 2021FY vs 2020. Overall, solid performance. We expect the recent acquisitions (PagoEfectivo, SafetyPay and viafintech) to contribute ~$60m in revenue and ~$20m in EBITDA in 2022. I hope this helps, but if I didn’t answer your question, please reach out to investorrelations@paysafe.com and Kirsten will get back to you.

- For all of 2020, investors were given breakdowns of transactional volume, revenue, gross profit margin per vertical. We were also given revenue by geography and direct marketing breakout as a part of your 6k filings. Now, (again in 6ks) we are getting far less data on the the two split verticals. Why should trust this is not hiding bad news?

- I’ll take a step back and address why we realigned the segments into Digital Commerce and US Acquiring. First, this change is driven by our customer proposition for both businesses. Second, we’ve really been moving towards this over the last year. Our eComm gateway, our eCash solution, our Wallet platform, our real time banking, along with access to 100 APMs are being sold as one proposition to global enterprise clients across iGaming, Digital Goods, Crypto, Travel and Financial Services. Third, in the US, our focus is scaled SMB processing — high automation and highly scalable. US Acquiring serves a different customer base and skews more card present, while digital commerce is 100% online. For all of 2021, we provided the same level of detail across our reporting segments: Digital Wallet, eCash and Integrated Processing (volume, revenue, margins, etc.). Have a look at our earnings presentations here or reach out to investorrelations@paysafe.com and we’ll help you access the details you are looking for. We provide a lot of detail relative to many of our peers. Going forward, we’ll continue to provide revenue visibility throughout the year for the legacy segment structure and help you with key KPIs.

- Really appreciate the opportunity Philip. What are our thoughts about consolidating Netellar and Skrill into just Skrill, help build greater brand recognition and more focus on just one. Thanks

- Good question. As of January 2021, the Skrill and NETELLER operating platforms were consolidated into one, best in class tech platform which has enabled us to consolidate a lot of the back office and streamline processes. Both Skrill and NETELLER are strong brands in their respective operating markets, and, at this time, we don’t see value in consolidating the two brands.

- Is Paysafe actively looking for a buyer?

- Hi, Scott. No, we are not looking for a buyer. We know that last year’s reset of the financial outlook was disappointing, and we have to rebuild credibility and deliver on our commitments including our financial guidance for 2022. We are confident in the path we are now on. We are making strong progress on the turnaround of digital wallets, we’re winning competitive deals across North American iGaming and crypto, and we remain very excited about the business and our long-term growth potential. All of that said, the Company and Board are focused on what is best for shareholders. At this point, we believe that we will have success as a standalone public company.

- How does PaySafe plan to adapt to the growth of cryptocurrency?

- Hi, Krishna. Thanks for the question. The emerging opportunity of Web 3.0 as virtual currency, virtual reality, and virtual products create a new set of growth and opportunities. Paysafe is uniquely positioned to support the full end-to-end product needs, demanding growth requirements, and complex risk and regulatory challenges in this space. Most recent, we announced an exciting partnership with Binance, the world’s largest crypto exchange by volume. This win builds on existing partnerships we have with leading crypto players. Right now, for Binance, we’re providing an embedded, white label wallet solution that allows customers to deposit, store and use funds to purchase crypto on Binance and to receive the proceeds of any sale of crypto. We’re excited about the long-term potential of our partnership as we add additional services and geographies. The broader pipeline for our solution is very strong, so more to come!

- Where do you see the company at in 5 years?

- Thanks, Quintin. When I look out over the next few years, I see Paysafe as the de facto leader in payments for North America iGaming, with this sector being a larger portion of Paysafe as the market continues to open up. Similarly, I see us having a scaled business across digital commerce for Crypto, where we will continue to advance innovations like our newly-developed white label solution. We also see real time banking as a fast-growing payment method; and, with SafetyPay’s extensive bank network in LATAM, coupled with our existing capabilities, we’re building out this platform and driving innovation. I also see the combination of crypto, NFTs, and the fast-emerging web3 as a major trend unleashing a new generation of digital entrepreneurs. I think this will be really interesting for Paysafe because we have all the right assets to enable new ways to buy and sell in a virtual environment.

- Online payments seems to be becoming an increasingly crowded space (I know I have multiple

) What’s the best way to think about how Paysafe is different from other payments tech players?

- We’re a global, scaled and specialized payments platform and we solve for however a consumer wants to pay. With one integration you can plug into debit or credit processing. A lot of players can do that. We can do it in many markets. The list of players doing what we can do starts to get smaller. With a single integration, we offer access to digital wallets, digital cash, and real-time bank payments. Next, we further differentiate with deep risk & regulatory experience (>300 risk management professionals), which is highly valuable in demanding markets. Lastly, we are deeply focused on specialized verticals such as iGaming, Crypto, Travel, financial services and digital goods. While there’s a lot of talk about consolidation in the sector, I believe there will continue to be a lot of activity with new players entering in the space as well. We’ll stay focused on this powerful combination of our single API, multiple payment types, risk management and industry-focus.

- Paysafe seems to be making some moves in the online gaming and betting space. Where do you see PSFE fitting within that ecosystem, and how does regulation impact how these decisions are made?

- Thanks for the question, Josh. iGaming is in our DNA and we’ve established ourselves as a global leader over the past 20+ years. We have the widest breadth of payment options in the market. Additionally, we are incredibly well positioned in the North American market, which is expanding rapidly, with an exceptionally talented team under the leadership of Zak Cutler who is a former operator. iGaming is highly regulated and requires significant technology development and compliance infrastructure and our deep expertise on the risk and regulatory side sets us apart.

- What trends in culture and the way people buy things are most impactful to Paysafe today?

- Hi, Katey. We regularly conduct consumer research and it’s clear that consumers want more ways to pay and are more open to use emerging or alternative payment methods such as digital wallets, real time banking and eCash. This has been a growing trend for some years, and the pandemic just accelerated this. We believe this shift is set to last. People are often surprised by the need for eCash solutions, but the need for underbanked or younger customers to transact online is greater than ever, and eCash is an important driver of financial inclusion.

- I noticed that the Binance deal included an “embedded finance solution.” Could you explain a bit what embedded finance means?

- Hi Taylor, yes, that’s correct, Paysafe has developed an embedded finance solution for Bifinity, the new payments arm of Binance, which is essentially like a white label wallet that’s integrated into their platform and enables consumers to seamlessly deposit, store and use funds to purchase crypto on Binance and to receive the proceeds of any sale of crypto. We’ve built it for them using our tried and tested digital wallet technology. The initial deposit method into the wallet is bank payments but we will be adding other payment options over time. This is just the start of how we’re working with the Bifinity team and next we’re planning to roll out other Paysafe payments services for them including card processing in Europe and real-time payments in LATAM. Over time, this should develop into a large relationship. We also have other crypto opportunities in the pipeline and are seeing strong interest with some large eCommerce players.

- There’s been a lot of volatility in the markets lately. As CEO, how do you balance navigating the geopolitical uncertainty with focusing on your mission and goals?

- Hi Michael, Thanks for the question. We are staying focused on what is within our control and delivering on our strategic priorities. For example: • Executing the Digital Wallet turnaround; • Further expansion across North America iGaming, including increasing our penetration with Skrill USA digital wallet; • Growing our partnership with Bifinity and other pipeline opportunities in iGaming, Crypto and digital commerce; • and managing costs. Lastly, I’ll reiterate my earlier comments on the Russia situation. Our exposure in Russia and Ukraine is relatively small and we are monitoring to ensure our data and customers remain protected.

This concludes today’s Town Hall. Thanks for joining!

*** Disclosures: Our responses may contain forward-looking statements and information that are based on the beliefs of, and assumptions made by, our management using information currently available to them. These forward-looking statements may include but are not limited to statements about future financial performance, plans, strategies, and expectations. Our forward-looking statements and information are subject to uncertainties and risks, many of which are beyond our control. These risks and uncertainties could cause our actual results and performance, including our financial results to differ materially from any projections expressed in or implied by our forward-looking statements. The risks and uncertainties are discussed more fully in Paysafe Limited’s filings with the U.S. Securities and Exchange Commission. Readers should review these documents to understand the risks and uncertainties. Given these uncertainties, readers should not put undue reliance on any forward-looking statements. The information contained in these responses are subject to change without notice and Paysafe Limited does not undertake any duty to update the forward-looking statements, and the estimates and assumptions associated with them, except to the extent required by applicable laws and regulations ***

https://seekingalpha.com/pr/18742295-paysafe-announces-new-ceo

Throughout his career, Lowthers has earned a strong reputation as a results-focused leader who has driven transformation, innovated at speed and enhanced customer experiences for multiple global organizations. He joins Paysafe after a 15-year tenure at FIS, one of the world’s leading fintech companies, where he modernized and accelerated the growth of the Fortune 250 company.

Kiva firma kun toimari vaihtuu about vuoden jälkeen ![]() Huhujahan oli jo peräti 6 kk jälkeen:

Huhujahan oli jo peräti 6 kk jälkeen:

Afterin ja ulkomaisten foorumien perusteella tuo oli hyvä juttu. Retailihan on kyllä Philipiä inhonnut varsinkin legendaarisen Q3 sokerikuorrutus-kommentin jälkeen ![]()

Uusi kaveri näyttäisi olevan kunnolla team Foleytä, eli josko tämä liike nyt osoittaisi, ettei Foley ole irtautumassa Paysafesta, vaikka niin onkin kovasti huhuttu siitä saakka, kun ilmoitti lopettavansa hallituksessa ja että nyt on vihdoin alettu kunnolla ns. siivoamaan firmaa kevät-kuntoon.

Lisäksi tämä kohta oli mukava kuulla:

Paysafe reaffirms its revenue and adjusted EBITDA guidance for the first quarter and full year 2022, previously announced on March 2, 2022. Paysafe plans to release its first quarter financial results on Wednesday, May 11, 2022.

Eli veikkaisin jälleen ainakin pientä ylitystä Q1 osarissa, jonka jälkeen se olisi kaksi osaria putkeen ennusteet yli.

Josko tuo Q1 julkaisu olisi sitten vihdoinkin kääntöpiste, mistä lähdetään hiljalleen takaisin ylös jaa nähtäväksi. Toivossa on hyvä elää ![]()

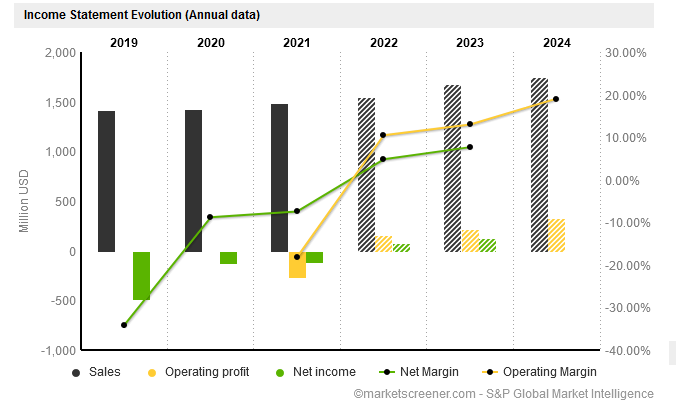

Edit: Marketscreenerin kautta alkaa kieltämättä näyttämään aika hyvältä jenkki-fintec firmaksi eilisen päätöskurssin perusteella:

Vielä kun velkaa saadaan maksettua pois, niin hyvä tästä (ehkä) tulee ![]()

Mielenkiintoista myöskin, että fintelissä ei näy instikka-puolella yhtään ainoaa myyntiä 24.2.2022 jälkeen ja rahastot ovat alkaneet kunnolla tankkailemaan:

Tietenkin tässä on vielä vajaa 30 päivää instikoiden aikaa raportoida noita Q1 osalta, mutta menisin melkein väittämään, että kyllä tätä on ruhjottu menemään shorttien ja panikoivan retailin avulla kellariin. Sen verran pienellä alle 50% normivaihdosta tiputtiin tälläkin viikolla.

Oletko miettinyt, mitä Strike ja sen luoma maksuvälinekonversio/käytännön reaaliaikaisuus siirrossa (asiakas->myyjä) tulee tälle markkinalle tarkoittamaan? Striken perimä fee on pieni, mikä pitkässä juoksussa voisi pakottaa myös muiden perinteisempien kilpailijoiden alentamaan palkkioitaan, mikä sitten luo sen tuloksenteko-ongelman? Strike on pikku hiljaa nousemassa ihan merkittäväksi vaihtoehdoksi.

Todennäköisesti Strike tulee kyllä aiheuttamaan painetta koko alalle, varsinkin jos lähtee kunnolla rullaamaan. Lisäksi applen uusi maksuappi tulee tuoman lisäpainetta markkinoille. Näkisin kuitenkin, että Paysafe ei ole niin kovassa paineessa ainakaan Striken suunnalta, koska suurin osa liikevaihdosta tulee kuitenkin muualta, kuin Striken tyyppisestä suoramaksusta. Lisäksi Paysafe on menossa oikeaan suuntaan sillä, että se tuntuu alkaneen painottamaan yhä enemmän iGaming puoleen, joka on kuitenkin niin reguloitu ja firmalla on sieltä todella pitkää historiaa ja siitä voitaisiin saada se kaivattu vallihauta. Paha tietenkin sanoa vielä, että onko se polku lopulta oikea vai ei.

Omaa mutuilua tämä kylläkin, eikä pysty sanomaan, mihin saakka Strike ja sen tyyppiset uudet pelurit alkavat paisumaan lähivuosina. Toi Payment sektori on kyllä kovin kilpailtu osasto.