Jos Plugista on shortti-rapsoja kypsymässä (kuten varmasti onkin), niin tämä kirjanpitosotku tarjoaa kyllä tuhannen taalan paikan pistää sellainen eetteriin. Kurssi tod.näk. kyykkäisi kunnolla hiukan löyhemmistäkin syytöksistä tällä hetkellä.

PLUG_RothCompanyNote_3.17.21.pdf (197,0 Kt)

Plugin IR laittaa ilmeisesti tämän päivän esityksen jakoon myöhemmin.

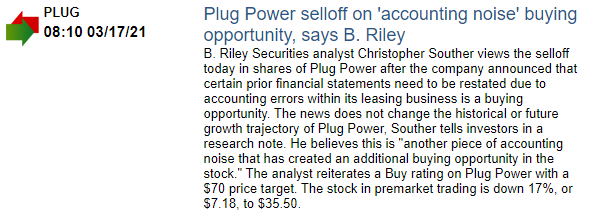

Tuommoinen saattaisi säikäyttää jotakuta

https://www.ir.plugpower.com/Press-Releases/Press-Release-Details/2021/Plug-Power-Receives-Expected-Notification-from-Nasdaq-Related-to-Delayed-Annual-Report-on-Form-10-K/default.aspx

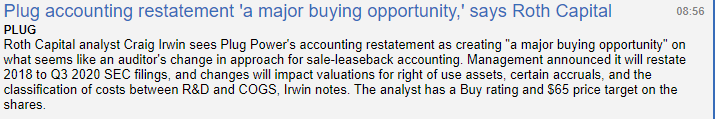

Tämmöinen sitten taas antaa vähän toivoa elämään

“Nasdaq indicated that the Company has 60 calendar days, or until May 17, 2021, to file the 2020 Form 10-K with the SEC. If the Company is unable to file the 2020 Form 10-K with the SEC by May 17, 2021, the Company intends to submit a plan to regain compliance with the Nasdaq Listing Rules on or prior to that date. If Nasdaq accepts the Company’s plan, then Nasdaq may grant an extension of up to 180 calendar days from the due date of the 2020 Form 10-K, or until September 13, 2021, to regain compliance.”

Onhan tämä huimaa. Nyt Andyn pitää laittaa vaan niistä saaduista rahoista tämän roskan hoitamiseen. Itse en aio kylläkään koskea lappuun enää ennen toukokuuta. Ei tämä mikään NKLA ole, mutta kyllähän tässä vähän miettimistä tulee.

Eikö tuossa nyt pyydetä toimittamaan korjatut tiedot epäselvyyksistä? Ikävä tahra tämä kyllä on…

Tuolta löytyy eilisen webcast

Juuri näin. Ja ilmeisesti tilintarkastusfirma on vaihtunut, ja löysivät sieltä jotain kuprua. Nämä ovat niin isoja juttuja pörssiyhtiöille, joten ei ihme, että reaktio oli tuollainen. Vaikuttavat toki kyllä jatkoon (ainakin minun arviolla), koska voi olla vaikea saada uusia asiakkaita, jos maine on mennyt. Toivottavasti olen väärässä.

Käsittääkseni tilintarkastusfirman sisällä heidän omassa rotaatiossa vaihtui ”päätarkastaja”, joka nämä huomasi.

![]() Mitä tietoja siellä sitten oli pimitelty tms liikaa? Vai miten asia meni?

Mitä tietoja siellä sitten oli pimitelty tms liikaa? Vai miten asia meni? ![]()

Sehän se tässä onkin epäselvää ja hämärää ![]() Tuolla FB-ryhmässä on muutama ihan mielenkiintoinen postaus, jossa ryhmän ylläpitäjä on ollut zoomin kautta yhteydessä Plugin PR-janariin. En viitsi niitä tänne kopioida, kun on niin ehdottomasti kieltänyt levittämisen muualle, mutt ryhmässä olevien kannattaa vilkaista.

Tuolla FB-ryhmässä on muutama ihan mielenkiintoinen postaus, jossa ryhmän ylläpitäjä on ollut zoomin kautta yhteydessä Plugin PR-janariin. En viitsi niitä tänne kopioida, kun on niin ehdottomasti kieltänyt levittämisen muualle, mutt ryhmässä olevien kannattaa vilkaista.

Kannatta katsella tuo webcast joka on eilisestä investor conferencesta, joka pidettiin instikoille.

Tässä pitää myös muistaa että Plugi on ihan oikea firma tällä hetkellä ja jos siellä on jotain sähläyksiä tehty ja homma vielä pitkittyy ja kurssi jatkaa laskua, niin joku isompi firma kiittää ja korjaa pois. Kyllä ottajia varmaan on jos kurssi vielä isommin kyykkää.

Kiitti! Oli ihan kiva pikku höpötysesitys. Yritin katsoa, että onko siellä myös Andyn juttu samalta päivältä jaossa, ja onhan se, mutta maksaa 250 dollaria. ![]()

Mitkä mietteet @jaska1:lla on asian suhteen? Olet pitkään/tarkasti seurannut Plugia ja arvostaisin näkemystäsi?

Eipä tuossa Plugin uusimmassa Nasdaqilta saamassa kirjeessä ole mitään uutta vaan kuten Plugin lehdistötietottessakin todetaan:

As previously disclosed in the Company’s Form 8-K filed with the SEC on March 16, 2021, the Company has determined to restate certain prior period financial statements to be included in the 2020 Form 10-K. Plug Power continues to work diligently to finalize its restated financials and file the 2020 Form 10-K as soon as possible.

Eli raportti on myöhästynyt, koska sitä joudutaan oikaisemaan, ja tästä syystä yhtiö on saanut Nasdaqilta muistutuksen. En näe mitään syytä, miksi yhtiö ei onnistuisi tekemään oikaisua annetussa määräajassa ja siten julkaisemaan vaaditun vuosiraportin. Eli tämä on vain luontainen jatko aikaisempaa, joka ei muuta tilannetta suuntaan tai toiseen.

Paha tuosta nyt on sanoa mitään. Katsotaan kun kirjanpitäjä tekee työnsä ja saadaan laput kuntoon. Toistaiseksi ihan luottavainen olen.

Amazon&Walmartin warrantti kuvio on alkujaan erittäin epäselvä ja eiköhän näistä ole kyse.

Johto on kuitenkin lupauksensa tähän asti pitänyt jos lähtökohdaksi ottaa symposiumin vuodelta 2019. Ovat jopa hieman konservatiivisia, mitä tulee ennusteisiin.

Markkina-arvo on tämän päivän päätöskurssilla 21 miljardia dollaria. Vaikka arvo romahtaisi olisi se silti reippaasti yli 10 miljardia. Kuka tai ketkä voisivat olla potentiaalisia ostajia tuolla arvostustasolla tällaiselle firmalle?

Alfa Laval???