Kuplalta näyttää ja ui kuplan lailla!

January 24, 2021 09:03 a.m. EST

By James Mackintosh

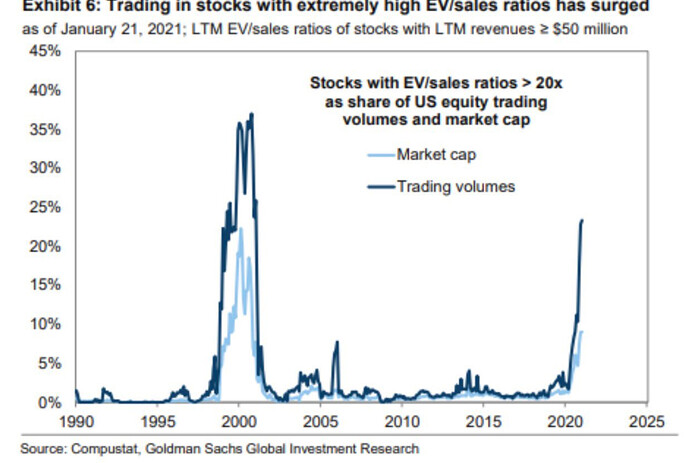

I have been resisting the comparison between the dot-com bubble and today’s stock market, but the similarities have grown too strong to ignore. Here are five areas where the paral-lels are strong, along with one caution about applying the bubble label to the broader market.

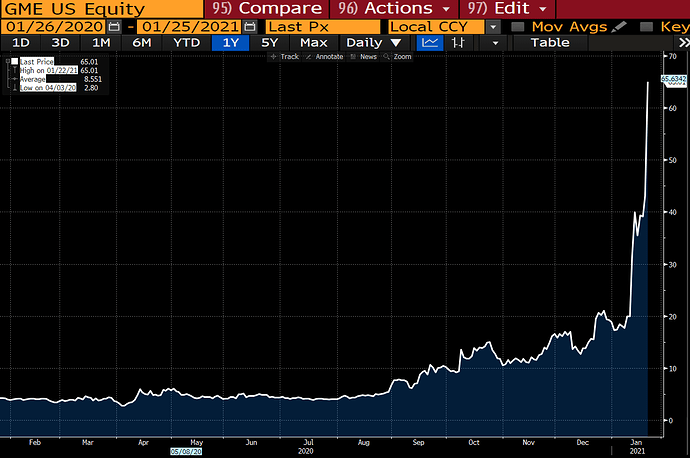

Exponential growth in the price of story stocks

Anything connected to electric vehicles or clean energy has gone ballistic in the past few months. Elec-tric-car maker Tesla is the most obvious example, becoming the fifth-largest U.S. com-pany by value after rising eightfold last year. This year so far, it has added …

A flood of early-stage IPOs tapping into the popular themes

Initial public offerings and the cash shells of special-purpose acquisition compa-nies, or SPACs, now used as an alternative have been booming, attracting celebrity backers and allowing companies without any revenue, let alone profit, to join the market. The Renaissance IPO index, which tracks new listings, more than doubled last year, by far the best performance since it started in 2009. Perhaps most extreme was QuantumScape, part-owned by Volkswagen, which hopes to commercial-ize its experimental solid-state batteries. It tripled in value to more than …

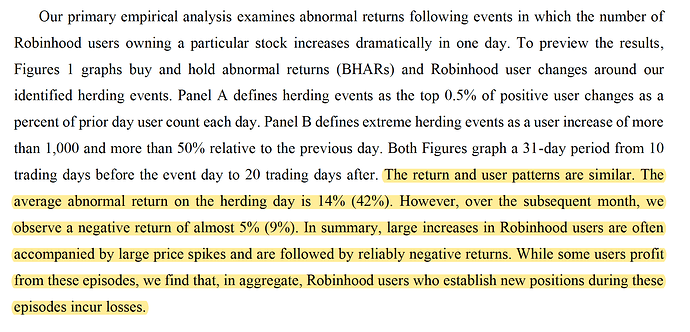

New investors who don’t know what they are doing

Don’t get me wrong, there are plenty of smart and well-informed small in-vestors. But stocks are again being swung about by the sort of amateur mistakes made by a beginner hoping to win big. One I wrote about recently is to buy a stock purely because its share price is low, which should be all but irrelevant but which drove perfor-mance in the first couple of weeks of this year.

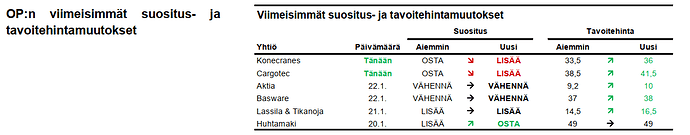

Old-economy stocks soaring as they tap into the popular theme

Early investors who rode the stocks up selling out

The Federal Reserve has the market’s back

![]()