Miksi tämän nyt sitten pitäisi olla kiinnostava tai miksi ylipäätään lähdin tarkemmin kaivamaan jotain infrarakentajaa jenkkimarkkinalta?

QualTek tarttui infrarakentajana kaikenlaisten tukipakettien myötä silmiin viime kesällä, kun yhdistymisestä tiedotettiin ensimmäistä kertaa. Tästä lyhyesti SPAC -ketjussa:

@tedmel muistutti tästä muutama viikko sitten. Otin pienen seurantaposition silloin, jotta mielenkiinto pysyy yllä.

Aloitetaan kuitenkin jatkon arviointi 24kk backlogista, joka on 2,1Mrd$. Tämä on siis yli 3x 2021 liikevaihto.

Reported 24-month backlog at the end of Q4 2021 was $2.1 Billion, an increase of 22.0% over year end 2020

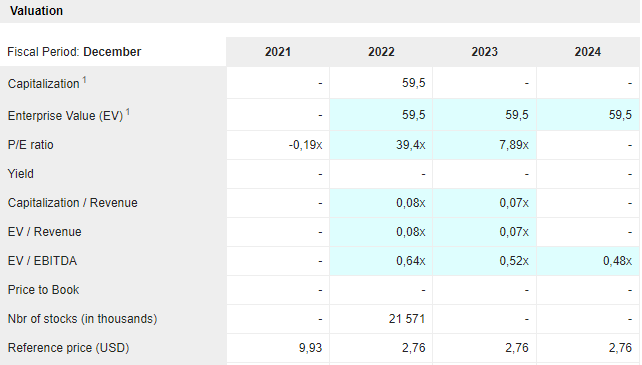

Valuaatio on siis todella edullinen, jos päästään ennusteisiin. Tämä tietysti on hyvin epäselvää vielä ja varsinkin SPAC mergerien kanssa näissä on ollut haasteita ![]()

lähde: marketscreener

EV/Sales 0,08 ! Market Cap / Sales n. 0,1 (Edit: tarkistettu lukuja)

EV/Sales noin 0,9-1,0. Odottaa tarkennettuja lukuja.

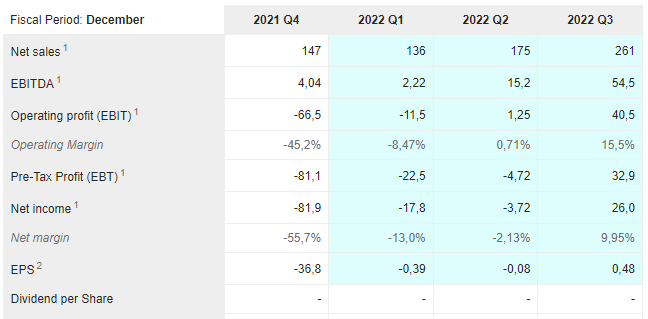

Huomattavaa on kuitenkin merkittävät sulkeisiin jenkkityyliin piilotettu tappio, Markerscreener näyttää tutummin luvut miinuksella.

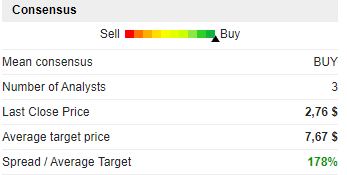

Laitetaan nyt vielä analyytikkojen ennusteet, vaikka Inderesin laatuun suhteuttaen näitä saa katsella huomattavan kriittisesti.

Disclaimer:

- itsellä on pieni seurantapositio, tutustuminen menossa ja lisäapua siihen kaivataan

- deSPAC yrityksissä on isompi riski kuin monissa muissa kohteissa

- paljon yritysostoja, joten potentiaalin lisäksi riskiä lisää