Ok so the 3W is a must ? Where is that statement ?

Likes and comments quickly looked half are insiders from Magna ?

Any price targets for SEE ?

Ok so the 3W is a must ? Where is that statement ?

Likes and comments quickly looked half are insiders from Magna ?

Any price targets for SEE ?

Chinese build Mustang Mach-E will get optional hands free driving (Seeing Machines)

“There is also an optional Co-Pilot360 advanced driver assist upgrade package that enables Ford’s hands-free driving offering to operate vehicles hands-free on prequalified sections of divided highways, and side distance warning system.” https://media.ford.com/content/fordmedia/fap/cn/en/news/2021/04/13/mustang-mach-e-china-open-for-pre-order.html

New Ford EVOS has Seeing Machines https://media.ford.com/content/fordmedia/fap/cn/en/news/2021/04/19/ford-evos-premieres-at-auto-shanghai.html

EVOS is equipped with BlueCruise, a first-for-Ford, SAE Level 2 driver-assist technology that allows drivers to operate truly hands-free on prequalified sections of divided highways called Hands-Free Blue Zones. C-V2X technology is also deployed in EVOS to help drivers navigate potential risks ahead as well as improve automotive safety and traffic efficiency.

Well for that sort of question, you must talk to the Tier 1s. Your favourite independent industry analyst has done that for us. Once he reviewed the available contenders, he started to appear less independent, but he was just working with a far shorter shortlist.

As for price forecasts, the cautious analysts are still working on cost of capital calculations and have revised up to 16p. But that is not valuing aviation or fleet, and doesn’t factor in the imminent growth in Automotive, instead it is based on the laughably conservative 220m AUD confirmed sales (GM is only 7m AUD and Ford only 50m AUD).

However, if you want a chartist’s opinion 30p

En ole Seeingin avoimia paikkoja seuraillut muuten, mutta tämä kertoo kasvavasta bisneksestä. DMS saa vauhtia ![]()

Uusi OEM, uusi Tier 1 ja ekaa kertaa myös OMS mukana:

”Driver and Occupant Monitoring System award brings OEM customer count to seven

Seeing Machines Limited (AIM: SEE, “Seeing Machines” or the “Company”), the advanced computer vision technology company that designs AI-powered operator monitoring systems to improve transport safety, has been appointed by an additional global Automotive Tier 1 supplier to deliver its FOVIO Driver and Occupant Monitoring System (OMS) technology to an additional North America-based OEM.

Delivered via the Company’s embedded Driver Monitoring Engine (FOVIO e-DME software library), this also signals Seeing Machines’ first design award for its recently launched Occupant Monitoring System technology, which extends its highly effective attention, distraction, impairment, identification, and other human state measures, from the vehicle driver to vehicle passenger(s) concurrently and also supports a range of interior monitoring features.

Mass production is scheduled from late 2022 with an initial lifetime award value of A$7m.

Seeing Machines continues to grow as an automotive leader in Driver Monitoring System (DMS) technology, having now won contracts with a total of seven automotive Tier 1 customers for a growing number of programs across seven global carmakers.

Nick DiFiore, SVP and GM Automotive commented: "We are delighted to expand our customer base with such a globally capable Tier 1 supplying a highly innovative OEM. I expect this to be the first of many collaboration opportunities as we together target new business across the fast expanding interior monitoring market.

“Having articulated our detailed embedded product strategy late last year and launched our OMS roadmap soon after that, receiving this order affirms both our strategic and technology direction, and our continued leadership position in the DMS market.”

Thanks for the answer . Well I thought it was Colin ![]()

Now I see the difference how you " SEE " people look at this DMS . You are in "love " with this product while most of us here is more like fundamental reasons. It is just an investing case. Hope you understand that . But I really would be glad if someone would have done fundamental forecast like timontti and others in Smart eye. We have in this forum very good TA guys that can help with these technical analyst.I hope all DMS are doing good win win situation.

Ah Piit, you beat me to the post. It has been a long drought, but nice to wake up to news.

Excited by the new Tier1, looks like Magna. Not too concerned which of the new EVs is the customer perhaps Fisker fits the bill.

What is the spread of Smart Eye Tier 1s? There is Aptiv but not sure how many others at the moment.

Honestly, I don’t go for fancy spreadsheets. We can see DMS taking more of the world production in the future years. Magna (and Gentex) will take a large share of the “chip and camera in mirror” market as it is easy for OEMs to implement. Qualcomm, will take much of the infotainment. I guess Seeing Machines, Smart Eye and Cepia will share the rest

Veoneer results day. https://vp283.alertir.com/sites/default/files/report/vne_q1.2021_presentation_final.pdf

Nice to see another DMS starting production. It was RNSed at just AUD6m which would have been the engineering fees. A little late due to Corona

Long term holders of Seeing Machines are well aware that it is the global leader in Driver/Occupant Monitoring and seems set to take a 60-75%, chunk of the automotive market driver/occupant monitoring by 2026.

Now estimates of the size of the light vehicle automotive market by this date do differ but not hugely. IHS estimates 110m light vehicles will be sold annually by 2026. Cenkos estimates 112m and a penetration rate for DMS of 67%, with Seeing Machines estimated to win 38% market share in calendar year 2026 producing an annual revenue figure of A$248m from auto alone. (You can see this information on Page 8 of its note issued on 2 February 2021).

Cenkos has a price target of 16p, which certainly appears miserly given the massive revenues that are coming further down the line. The reason for this is two-fold:

Discount rate to fall

This year, as auto contracts are won – and they will be won – I’d expect a double whammy to significantly increase the Cenkos target price as future guaranteed revenues rise and its discount rate falls.

I’d argue that even now a discount rate of 7% based purely on the conservative (how I dislike that word) figures from Cenkos would be more appropriate given the quantum of risk. Were that to be applied, the price target from Cenkos would be nearer 40p right now.

[For the purposes of simplicity I’ve ignored the accelerating revenues from its driver monitoring as a service Guardian products that feature in trucks. I’ve also ignored its products in aviation — though, they’re expected to be very significant in time.]

Despite the po-faced analytical rigour adopted by many analysts when discussing equity risk premiums it’s hardly an exact science, more of an art. The disparate factors you need to take into account are the stuff of which academic careers are made. And anyone who doubts the complexity in modelling them should read this paper by Aswath Damodaran.

Conclusion

What I’m trying to convey is that Seeing Machines is grossly undervalued currently and, though I expect it to hit 40p this year as Cenkos ups its price target due to increased future auto revenues and a reduced risk rate, I don’t expect it to hit fair value even then.

Only when people realise Seeing Machines’ market share is going to be in the 60%-75% region and that it is likely to be bought for many billions as Mobileye was (US$15.3bn), will Seeing Machines price come close to matching its intrinsic value.

My guess is that uninformed observers will wonder in awe as Seeing Machines’ share price accelerates over the coming 12 months. My view is that it’s all very predictable if only you’d conducted sufficient research.

The writer holds stock in Seeing Machines.

Olikohan tämä nyt sama kirjoittaja joka spekuloi erästä OEM:ää Seeingille, minkä johdosta Seeing joutui antamaan pörssitiedotteen asian korjaamiseksi…? ![]()

![]()

Näköjään on takertunut colinin vanhoihin satuiluihin markkinaosuuksista.

Rohkeaa laskea perusskenaario 65% osuudella kuitenkaan mainitsematta tosielämän totuuksia kuten esim. isojen OEM dual sourcing. (Huom. yhtiön oma long target 30%)

Kaiken lisäksi sivujen nimi on vielä safestocks ![]()

Tässä. Taattua safestocks-laatua.

https://www.safestocks.co.uk/2019/07/11/volvo-xc90-another-win-for-see/

Ps. Sanotaan nyt vaikka omasta tekemisestä sen verran, että pyrin esittämään näkemykset spekulaationa enkä totuutena. Pyrin myös tuomaan tutkimustyön todisteet valoon tukemaan näkemystäni/arviotani/arvaustani enkä huutele siten perusteettomia näkemyksiä ![]() erehdyn kyllä varmasti kuten me kaikki

erehdyn kyllä varmasti kuten me kaikki

Well, I guess you are now informed observers ![]()

Don’t say that we didn’t try to tell you. Martin hasn’t announced much recently, and seems a bit down in the dumps. Apparently, when you submit to an RFQ, you get told when you are unsuccessful. But everyone is under NDA just like the winner.

Seems that Seeing Machines are hiring a lot of new staff. ![]()

Design win and new product. ![]()

You should watch the videos from 2020,2019,2018. He seems a bit down in those also… After 83 design wins. He is humble and modest guy. But still, “best leader i have ever had” told by several Smart Eye employees.

This is probably good news for Seeing Machines… unless they have high turnover rates…

From Smart Eye’s annual report:

“The capacity to retain current staff, and potential to hire

new staff, are critical to the company’s future progress. If key staff leave the company, or if the company is unable to attract qualified staff, this may negatively impact on the company’s operating activities.”

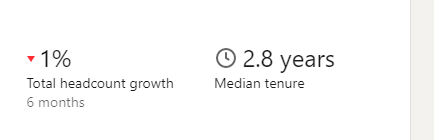

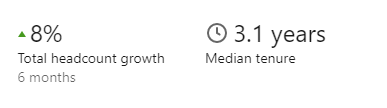

Seeing Machines:

vs.

Smart Eye

![]()

Lobbausta NTSB:n suuntaan ![]()

![]()

![]()

![]()

Toyota menossa Seeingille?

Saatko tuosta postauksesta kuvakaappauksen? ![]() Tainnut blokata linkkarissakin meikäläisen

Tainnut blokata linkkarissakin meikäläisen

ZF:n Toyota sopimus ei sisältänyt DMS/OMS-teknologiaa. Selvittelin, että ZF ei tuollaista tekniikkaa edes tuota.

Että se näistä Holehousen ja kumppaneiden huuteluista. Taas.

Not sure whose DMS he is using?

ZF on Automotive News Shift podcast

Christophe Marnat, executive vice president of electronics and advanced safety systems at global supplier ZF, discusses the evolution of driver monitoring into occupant monitoring, clarity in naming assist systems and new advances on the sensor front.