Translatorilla käännetty teksti. Tässä ei meille mitään uutta.

Smart Eye - Continued growth and equipped for success

One of the most extensive research processes takes place in artificial intelligence (AI) and technology will eventually change the way the world works. If you scale it down to the company level, the company Smart Eye is an example of how AI is used together with eye tracking. The company is a global leader in eye tracking and I welcome the stock into the portfolio.

Smart Eye is today, with 81 design wins received, from 12 car manufacturers and with six cars in series production, the player that can be considered a world leader when it comes to eye tracking for the passenger car industry.

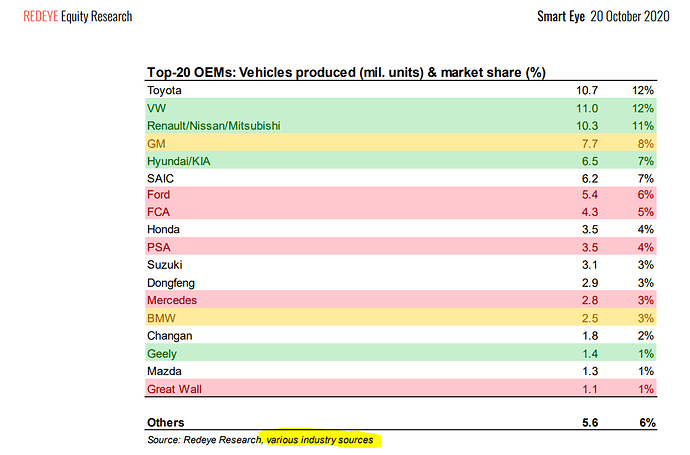

In addition to Smarteye having twelve of the largest car manufacturers as customers, discussions are held with many more. Of these customers, no less than 11 are on the list of the world’s 20 largest vehicle manufacturers measured by the number of vehicles manufactured per year. Smarteye has a clear ambition to continue to be the market leader, and according to the company, the recently completed new share issue must be seen in the light of being able to invest resources where they are most needed.

Smart Eyes’ operations are organized into three business areas:

Research Instruments provides Smart Eye advanced eye tracking systems for measuring and analyzing human behavior. The customers in the area mainly consist of players in academic research, the aerospace and defense industries and the automotive industry.

Automotive Solutions provides the company with eye tracking software for integration into vehicles.

AIS is provided with both software and hardware for the integration of eye tracking in vehicles, specifically designed for the aftermarket, primarily in public transport and commercial vehicles.

When will the company make a profit? It remains to be seen, the company writes in its Q3 report that the total estimated value of the company’s hitherto communicated 83 design lenses currently amounts to at least SEK 2,100 million over the product life cycle. If the company’s system were to be implemented in all car models on the platforms where Smart Eye has already received a design lens from the 12 car manufacturers where this has been communicated, the estimated value currently amounts to at least SEK 5,800 million seen over the product life cycle.

Risk. The share is to be regarded as a hopeful share because the company is not yet making a profit, but there are finished products and I see no real obstacles to the company not succeeding in its business area. There are still risks that are business and industry-related and in the long run can have a negative impact on the company’s operations, earnings and financial position. Therefore, the stock ends up in my portfolio of hope, which is a small part of the total equity portfolio.

Käsitykseni mukaan tätä kaveria huomattavasti paremmin keissiin perehtyneillä ja uskottavilla toimijoilla tämä on huomattavan isoilla painoilla salkuissa (en tarkoita nyt foorumilaisia).

Toivo ei ole strategia, kuten inderesillä sanotaan.