Kysymys suomeksi tähän väliin, koska se ei mielestäni liity englanninkieliseen osakeskusteluun. Tässä on monesti todettu että markkinaa riittää molemmille toimijoille. Miksi SM osake ei ole keulinut yhtään vaan käyttäytynyt aika stabiilisti. Luulisi että Seeing osake kirmaisi vastaavasti yläviistoon myös. Toki viimeaikainen kehitus näin on jossain määrin ollutkin…

It is probably as Seeing2020 says, complex. Those with any real understanding on how important that 5bn km is, is SEE. Who are not going to (naturally) give a conclusive or perfectly accurate answer. It is also the case that it is immensely difficult to say how important the 20 years of SEYE is. Both are most definitely protecting their data.

I think the best answer to this we are going to get for a long time that the 5bn km is anywhere from minimal to very important.

Naturally, landing the Ford F150 would be very impressive. If this would have happened, I would think SEE would gladly inform about it in some way.

Does SEE inform on new models in any way? Do they provide a number on the won models inside a programme?

Aston (I think) made some on the note calculations on this some time ago. I think the conclusion was that the valuations were conservative, this is also something (I think) that the Red Eye analyst’s said (believe it as you may).

Yeah. Good point.

Its only a subjective view… but knowing that 12 OEMs are about to roll out 83 car models with advanced SEYE algoritms included… it feels like ”not a game changer”.

I have a pretty solid feeling that more models and OEMs are coming.

And 11/12 of these OEMs are in top20. Volvo is most likely the one outside of top20.

So im not worried. There are good OEMs for all companies, altough its a game of two for major OEMs.

My estimate is that SEE is currently in troubles for the ongoing procurement round of DMS deals worth over 1 billion €.

@Seeing2020 Can you tell what is your relationship with SEE? Worker, close to it, fan, investor etc? Just to have a perspective for your replies.

Camp SM seems to emphasize integrated solutions and 5bn km fleet experience of collecting data and explaining that this brings high performance.

What is the actual high performance edge on DMS? If the system is required to immediately react to observed reduction in driver capabilities wouldn’t this kinda assume that 1) the symptoms of drowsiness are ignored until the driver falls asleep and 2) cars do not provide any autopilot capabilities like lane control or rear collision prevention which would give the system the extra second it needs to wake the driver/pull over/alert other vehicles of impeded performance and safety?

Like, if I had some device monitor me while I’m standing, I’d much prefer it to ask me to take a break or tell me that my predicted future performance is impaired rather than wait for the last moment and catch me as I collapse.

Can you help me understand the high performance argument in hw agnostic / integrated system discourse? Others are welcome to chip in too, naturally ![]() Thanks everyone!

Thanks everyone!

Investor since 2014.

Why do SEYE still count BMW when SM won gen2. It was Mike Lenne from SM guest presenting on the BMW stage at CES 2020 not the SEYE head of human factors if they have one.

So from 2021 all new BMW have SM

What i dont understand is what happened to JLR models due out 2019?

Also Audi, why have the company not told us about the delays?

@Seeing2020 thanks for joining the discussion. Very interesting to hear your side of the story.

How do you see the strategic shift from Fovio chip (only) with Xilinx to providing Occula also in asic form after the Qualcomm collaboration? Ref. SEYE’s hardware agnosticism.

Regarding the same topic I also refer to EE Times article (link below) on Qualcomm-Veoneer collaboration. The article points out that they are still challengers (ADAS and AV) vs Intel-Mobileye and Nvidia and my feeling (after reading the artlcle) is that it was a forced move by Qualcomm. Do you see the case totally different with SEE-Qualcomm collaboration?

I’d also like to hear your view on the management changes 1-2 years (?) ago. Poor results or what was the reason for the change? If results, what were the poor results?

Again a fallacy picked up by Viktor.

SEE never have been chip only.

They were software only, then added xilinx chip as an option for oems, which turned out to be a success as Ford was won.

Why did Seye lose the Ford RFQ?

Mielestäni on vain positiivista, että saadaan kilpailijoiden kommentteja myös, joka haastaa myös omaa näkemystä.

Kyllä nuo kommentit saavat itseni ainakin miettimään casea uudelleen.

Alunperin mietin teknologian toimivuutta eri olosuhteissa ja sen tarkkuutta, mutta nyt on kuvioon tullut myös vakavasti otettava kilpailija ainakin näiden viestien perusteella.

Kyllä tässä silti melko luottavaisin mielin ollaan mukana ellei tule oikeasti jotain uutista esiin.

Tuo “2021 kaikki uudet bmw ovat SEE” oli ainut joka vähän särähtää negatiivisesti, onko tälle mitään perää?

Ei ole ainakaan toistaiseksi todettu, mutta JOS näissä olisikin jotain perää.

Kannattaa aina mielestäni kuitenkin olla varuillaan suuntaan tai toiseen kunnes saadaan varmistusta asioille tai muuta uutista.

Hi! Nice to meet new people in here. Glad to see, that you can give some kind of answers to us, unlike colin for example. Im curious about your sources, because you wrote a lot of things, which could change my mind, if you can prove them.

If seeing machines get all of the bmw models, why they dont give any press release about that?

And how about that ford f-150 deal, is this your source?

https://www.safestocks.co.uk/2018/06/04/a50m-ford-win-for-seeing-machines/

I believe not all bmw models from 2021 will have SM. I will be happy to prove your saying wrong next year ![]() Theres now many statements without proofs

Theres now many statements without proofs ![]()

What do you think about dual sourcing? For example between FAAR(UKL) and CLAR?

Jaguar case on mielenkiintoinen. Logo löytyy yhä smartin yhtiöesitteessä.

DMS-alana alkaa vaikuttaa dual sourcing-peliltä. OEM:it on monen pelurin kanssa kimpassa - winner takes it all on silloin väärä ajatus. Esim. Jaguar vehdannut see:n ja smartin kanssa.

https://media.jaguarlandrover.com/en-us/news/2015/01/jaguar-land-rover-intel-and-seeing-machines-showcase-innovative-driver-attention

Onhan see:n market cappi huomattavasti smarttia pienempi, eli siinäkin on mahdollisuuksia…

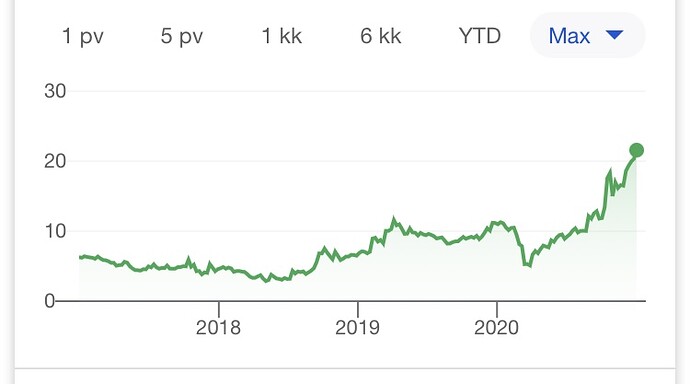

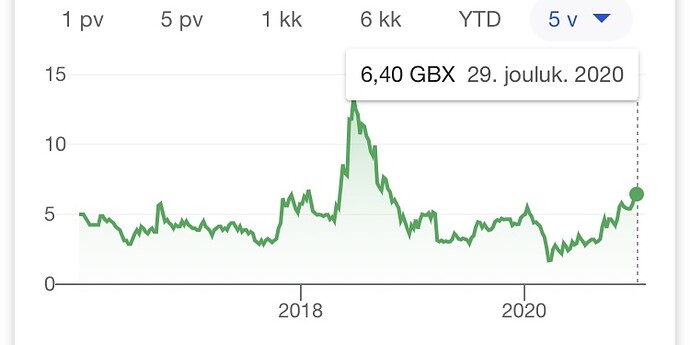

April 26, 2018 German premium OEM design win was announced. Stock climbed from 4,5 to 7.

https://www.seeingmachines.com/wp-content/uploads/2018/04/SEE-RNS-OEM3-Design-Win-final-26-04-18.pdf

“planned for mass production from 2021”

June 4, 2018 US OEM (told to be Ford) was announced. Stock went up from 7,5, piked at 14.

“The first material production revenue is expected to be recognised in Seeing Machines’ 2021 financial year”

By end of the 2018, these gains were basically wiped out by the market. I am not sure why? We know that basically no new design win announcements have been given by SEE after beginning of 2019.

Olikos näiden yritysten sisäpiiriomistuksista tai yleisesti omistusrakenteesta tietoa?

EDIT:

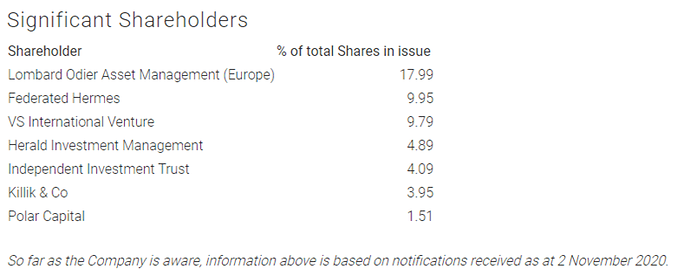

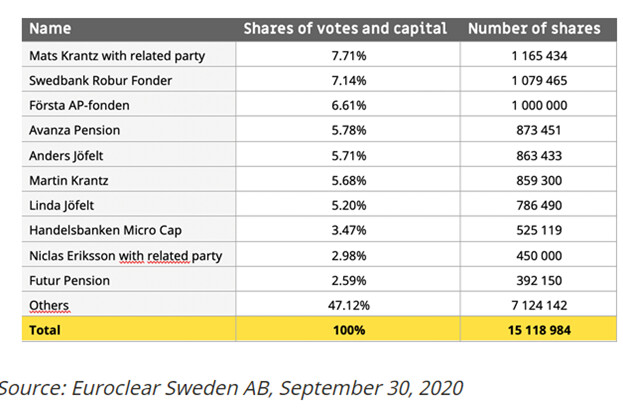

Smart Eye - suurimmat osakkeenomistajat

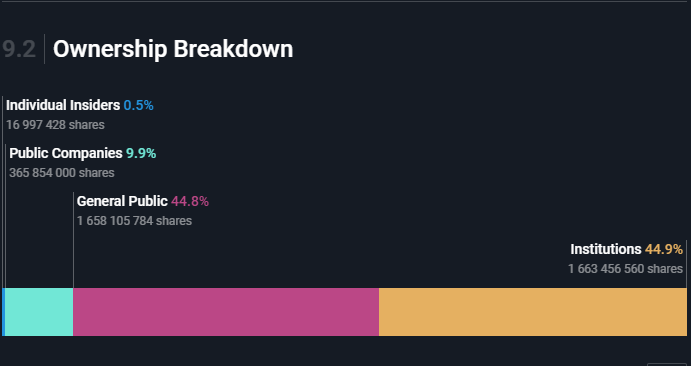

Seeing Machines - suurimmat osakkeenomistajat

Tätä saatettiin jo aiemmin käsitellä, mutta omaa uskoani yritykseen vahvistaa kyllä sisäpiirin omistukset ja nopealla tonkimisella Smart Eyen sisäpiirin henkilökohtaisessa omistuksessa on lähes 30% osakkeista.

Vastaavasti Seeing Machinesin sisäpiirin omistuksista oli hankala löytää mitään heidän sivuiltaan. Yllä oleva taulukko tosin paljastaa, että Seeing Machinesin sisäpiirillä ei ole samalla tavalla omaa rahaa kiinni johtamassaan yrityksessä kuin Smart Eyellä.

Tässä löytämäni arvio Seeing Machinesin omistajuuksista. Ajantasaisuudesta ei ole tosin takuita. Tämän mukaan sisäpiirillä on alle 1% osakkeista.