Kävin läpi investor call transkriptiä, samalla tänne muistiin nostoja.

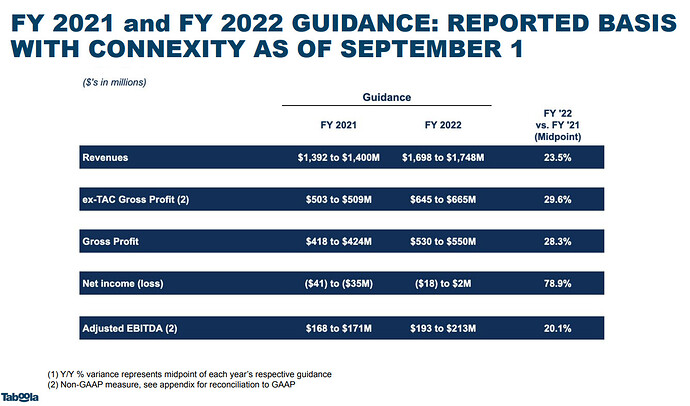

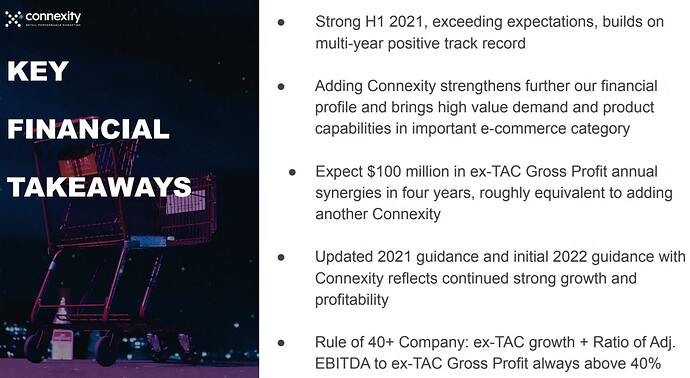

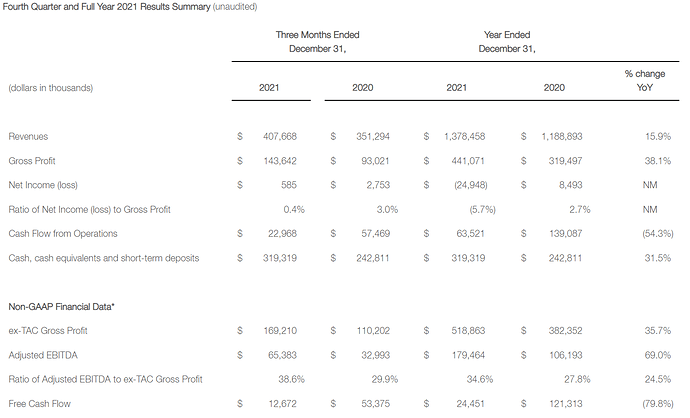

While adjusted EBITDA is a good proxy for profitability, Taboola generates good cash flow. Over the last two years, about 60% of our adjusted EBITDA converted to free cash flow. I’m very happy with the team’s execution, and these results give us confidence to raise our Q4 and full-year 2021 guidance.

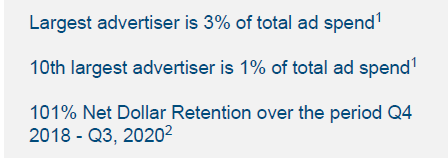

At the center of what we do is proprietary deep learning recommendation engine that is able to infer what a user might be interested in based on context and our own curiosity risk. Looking at what people who read this also read, similar to Amazon, people who bought this also bought. This means that we’re not relying on third-party cookies or IDFA, but whether our own proprietary data

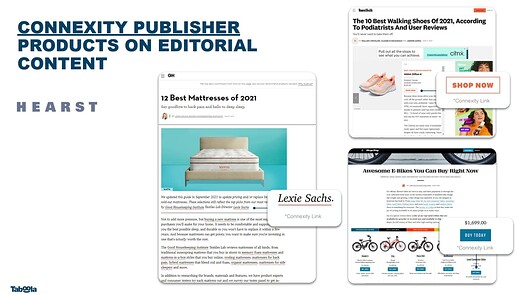

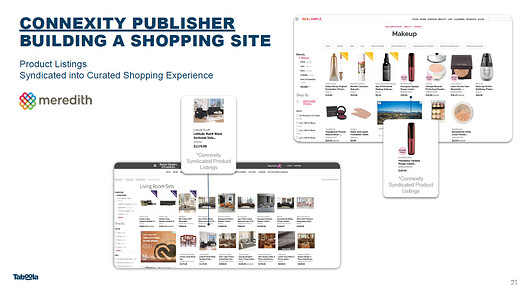

Our Connexity acquisition falls within our recommending anything strategy, allowing us to recommend products and tap into a huge 40 billion open web e-commerce market. Connexity will help us transform the open web into one big shopping cart.

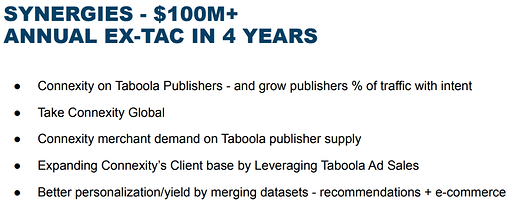

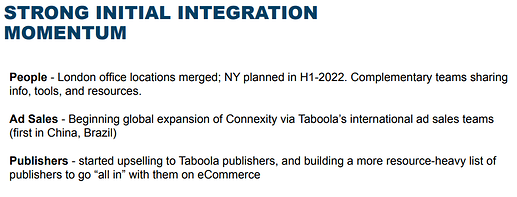

It’s only been a few months and I like seeing these early signs of the market reacting positively. This is only the beginning. Since the acquisition closed, we have worked through the details of our integration and our plan is to capture $100 million of synergies we outlined in our e-commerce with Connexity Information Session in late September

This is also true for Connexity where the e-commerce recommendations are solely intent driven. This quarter, there was a lot of conversation on privacy, impacts on IOS changes and IDFA. We did not see impact from these on our business. Taboola’s yield keep growing through our ability to leverage contextual signals due to our Hearst coated integrations with 9,000 publishers, through which we reach 500 million active users every single day. This is important now and will become even more important over time as advertisers look for alternatives to the walled garden.

So, I would say that the most immediate thing which we’re working on is to bring Connexity demand on to Taboola’s core experiences or Taboola Feeds all around the world on 9,000 publishers. We’ve mentioned that we believe a single-digit percent of our traffic has high intent already and is able to basically absorb those high paying and premium retailers that are looking to convert in the open web. So that’s something that we expect to happen. It’s one of the synergies.

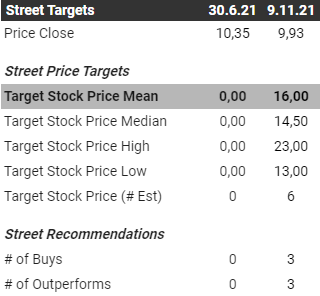

22 näkymien päivitys Q4 tulosten yhteydessä. Muutenkin konservatiivinen ennusteissa, haluaa nähdä tuloksia ensin ja korjataan ylöspäin tarvittaessa.

I think we have very good strength going into 2022 and we’re looking forward to talking to you in February about our Q4 results and then probably revising expectations for 2022 at that point.

Todella paljon asiaa ja hyvää meininkiä. Jos yhtään kiinnostaa niin kannattaa lukea läpi. Videot iso osa toimintaa, merkittävä tulojen lähde ja kasvaa.

Paljon uusia lähtöjä ja synergioista tulossa merkittävästi hyötyä.

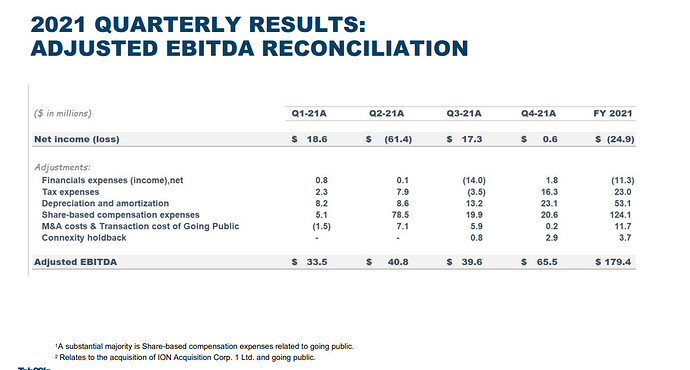

Kertakuluja Q2-Q3 paljon, joita ei samassa mittakaavassa tule jatkossa. Toki aina jotain, mutta selkeästi poikkeavia Connexityn ostoon, listautumisen osakepalkkioihin ja muihin listautumiskuluihin.

Nyt alkaa näkyä ne syyt, miksi tähän lähdin mukaan hieman reilummalla sijoituksella. Vahvaa kasvua ja tasaista, ennustettavaa tulosta yhdistettynä vapaaseen kassavirtaan

![]()

![]()