Mutta manageri tekeekin jotain tarkastuksiin liittyvää, eikä vaan käy asiakkaiden kanssa illallisilla ja laita nimeä soppareihin. ![]()

Onko jollakulla tietoa että minkä tason sisäpiiriostot pitää ylipäätään raportoida ja millä aikataululla TSXVssä? Koskeeko raportointivelvollisuus vain C-tason henkilöitä ja duunarit voi ostaa huoletta koska haluaa?

Itse luulen, että ovat kassan kanssa aika tiukoille Q2:n loppuun asti, sen jälkeen alkaa liiketoiminnoista tulla enemmän rahaa kassaan. Toivottavasti saavat luvan antaa guidancen loppuvuodelle 2023 jossain vaiheessa kun kirjanpitoepäselvyydet hoidetaan alta pois. Muuten tulee turhaa sähinää kun luvut eivät ihan yksi yhteen mene uuden kirjanpitäjän kanssa. Guidance siis tärkeä saada ulos.

Ihan mutuilua, mutta jos nyt sisäpiiriläinen tekisi yhtään isomman oston ja vaikka siitä ei tarvisi mitään numeroa tehdä niin voxtur tekisi tässä tilanteessa silti. Ei se ainakaan firmaa hyödytä että kurssi matelee pohjamudissa ja tuollainen tiedote auttaa asiaan edes jollakin tavalla. Toisaalta voihan se olla niinkin että kassa on kunnossa ja firma takoo voittoa tällä hetkellä niin lyhyen aikavälin kurssi ei sisäpiiriä kiinnosta tällä hetkellä koska tietävät että homma rockaa

E:

also a summary copied from the canadian forum regarding the paywalled gary interview:

This is an summary of the interview Gary did with MCE posted on the mce chatboard. It was sent to me by an MCE member but not the member who wrote this summary. Someone with Inderes account please post this to that forum too. I expect there will be some good discussions there about it. Here is it: My notes with main points from the recent interview with Gary:

-RPTA in Ontario to be approved in the next max 5 weeks → approx. 300k per month profit + potential for growth in the future

-Fannie Title waiver only for about 10% of the market place–> not too much impact on AOL, possibly low-price AOL offering for that segment, project already developed

-gaining market share in valuation business; a number of requests from different entities to buy anow

-individual values of Voxtur’s business units surpass current market value

-sales and transactions are picking up again; back to profitability with valuation BU; default work on valuation side expected

-title and escrow two sides: 1) technology to enable defaults and foreclosures, 2) 30 major banks signed up for AOL

-less than a year ago 200 defaults a month now 800

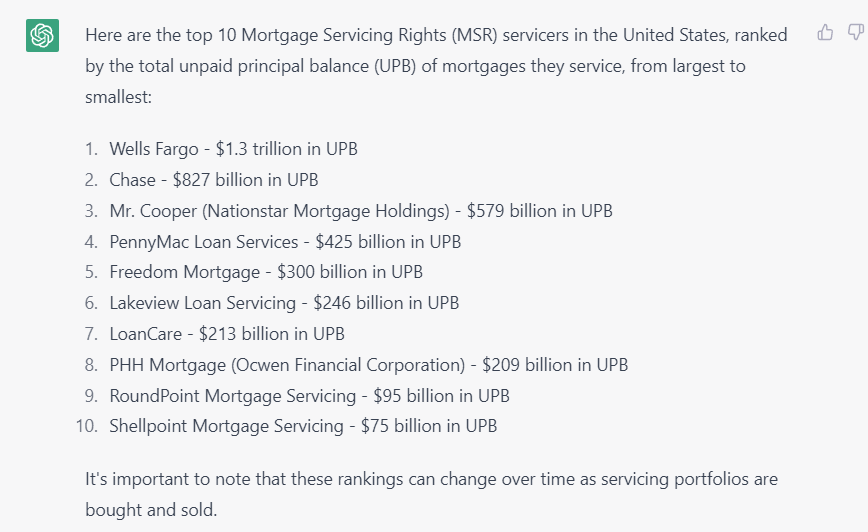

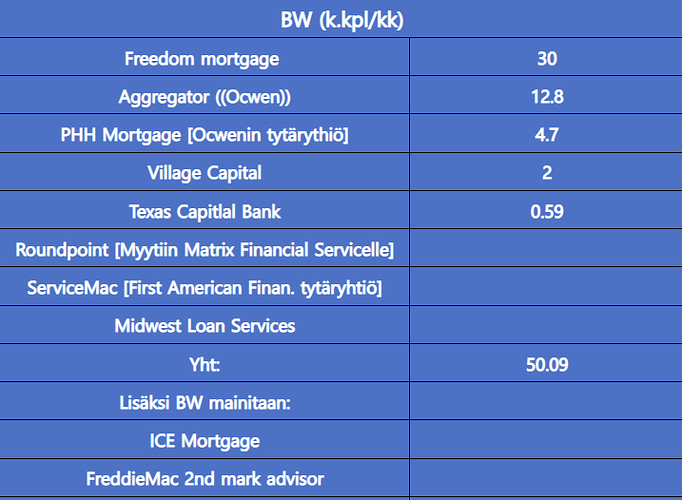

-BW: MSRs, whole loans, non qualified mortgages, scratch and dent; all dependent on banks

-rates doubling in December caused a pause in the MSR market due to uncertainties in evaluating MSRs, starting to come back

-all top three servicers are BW clients

-Freedom sold BU with 1million a month in revenue–>Freedom to return in May

-BW issues: disposed BU of Freedom can’t use BW because of a clause in the sale; first 5 months since acquisition losing money/barely break-even; cost 600k per month; one of the bigger BW competitors (non-technology) went bust–>potential for new business

-interest from top three servicers in API integration with BW

-much demand for each BU

-in case of panic–>break up company and sell individual BUs

-effectively break-even/making a little bit of money at the moment

-by fall 1000 AOL transactions per month expected; AOL integration not an issue; by year-end significant revenue is expected

-done with acquisitions

-raising money: short term would help the balance sheet–>not a lot to be raised if at all; or strategic investor–>larger amount with institutional backing

-no raise expected/actively pursued at the moment

-Voxtur can be cash-flow positive in the current economic environment

-biggest obstacle is time for execution

-how much time can Voxtur afford before profitability: over last 3 months reduction in manpower by over 30%; -cost reduction by 1.5 million per month

-over entire 2023 good profitability is expected

-between cash and working capital approx. 20 mil in cash

-at the moment finishing a technology offering project with major bank -->300k a month, mostly profit

-4th quarter should be more of the same from 3Q

-Angela Little leaving–>more independence from Law-firm

-COO brought in by Jim–>increase profitability in title/escrow and valuations; Jim reduced compensation to allow COO to come on board

-virtual presentation day maybe in summer in the market needed

-up-listing: TSX for sure–>early summer; NASDAQ if market improves but definitely a goal given the large US operations

-no regrets on acquisitions

-Voxtur-Wealth: on halt until profitability is sufficient to bear the cost

Elikkäs Kanadan foorumia lueskeltuani bluewater menetti suurimman asiakkaan voxturin ostettua sen… siksi Q4 ei nähdä ilmeisesti kasvua liikevaihdossa mikä olikin jo tiedossa. Eli bluewater on ainoastaan näiden uusien asiakkaiden varassa, mutta onneksi niitä tuntuu olevan ihan kivasti

Samaa tässä juuri märehdin aamukahvin kera. Eli Freedom möi Rounpointin elokuussa 2022 ja ko kaupan pitäisi nyt 2023 closaantua. Roundpointin osti Matrix Financial Services Corp joka on alla olevan artikkelin mukaan Freedomin “major competitor”.

“The buyer, Matrix Financial Services, is a major competitor with Freedom in the massive mortgage-servicing rights market”

Tämän voi varmaan nyt nähdä kahdella tavalla. Huono on, että Voxtur menettää Roundpointin etenkin jos/kun sen kautta on tullut lähes koko BW liikevaihto. Ehkä kuitenkin jotenkin positiivista että BWn MSR-X on (ehkä) niin merkittävä juttu, että sen osalta on erikseen tarvinnut kauppaan määritellä että Roundpoint ei sitä saa enää käyttää ja Freedom ottaa sen nyt käyttöön?

Mutu sanoo, että Freedom on Roundpointtia suurempi peluri ja Garyn mukaan kolme suurinta “serviceriä” on joka tapauksessa BWn asiakkaina, joten sekin on toki positiivista.

Ilo myös huomata, että kaikki ylimääräinen “massive” ja yli-bullish-juttu puuttuu, ainakin tuosta yhteenvedosta. Tai sitten ko yhteenvedon kirjoittaja on vain siivonnut ne Garyn jutuista. Aletaan olla perusasioiden äärellä. Muita juttuja ei viitsi kommentoida kun lasit on niin kirkkaat…

E. Roundpointin MSR-X kauppapaikan osoite ohjaa nyt siis Freedom Mortgagen MSR-X kauppapaikalle.

E2. @Porssipeto alla listasi MSR kauppiaat ja näyttäisi volyymien mukaan Freedom olevan Roundpointia kolme kertaa suurempi. Jos/kun MSR kauppa taas vilkastuu, niin ei tämä Roundpointin “vaihto” Freedomiin välttämättä mikään katastrofi ole.

Jos hetken sallitaan spekulointi, nuo top 3 voisivat olla:

Tuollahan on tuttuja nimiä. Olen kallistunut sille puolelle, että aggregator olisi Ocwen mm. koska PHH tukisi kohtaa ” wholly owned capital markets division” ja PHH:sta on löydetty BW:n white label ja sopisi muiltakin osin aggregatorin kuvailuun.

Jimbon tykkäily linkkarin postauksesta tukisi myös WF:n BW-asiakkuutta ja edelleen koska Ocwen ja WF ovat vanhastaan bisneskumppaneita. Muiden osalta en viitsi lähteä arvailemaan keitä voisi olla kyseessä.

Tuossa vielä noita BW:n asiakkaita. Se, että kuka on aggregator on spekulaatio, muille on löytynyt white label:

Mainitkaa yksi voxturin onnistunut ja kohtuuhintainen yritysosto? Suutareiksi paljastuu yksi toisensa jälkeen.

Eikös ne kaikki ole ihan hyviä jos/kun jokainen BU tekee tällä hetkellä voittoa vaikka RE markkina on paskin noin 100 vuoteen? Kohtuuhintainen on sitten subjektiivinen käsite. Toki ne numerot/ohjeistus pitäisi nyt saada vahvistukseksi ettei olla vain puheiden varassa.

En tiedä kuinka tarkkaan seuraat RE markkinoita ja firmoja mutta siellähän menee firmoja nurin tällä hetkellä ja esim kilpurit Doma ja Blend teki karmivat tappiot 2022. Voxtur sen sijaan teki käytännössä voittoa (ilman kirjanpidollista 4M varausta) vuonna 2022 (edit. Q3/2022 - ei koko vuonna, vielä)? Tuossa yllä Gary (juu se suuri lupailija) kertoi, että 2023 tehdään voittoa?!

Kerrotko miten nämä yritysostot on paljastunut suutareiksi?

Koittakaa nyt käsittää, että kaikki suuretkin bisnekset on olleet joskus pieniä…monet vielä rajusti yliarvostettuja koko matkan kasvussa suureksi.

Se, että ette viitsi perehtyä sen tarkemmin lukuihin, jotka vielä selitetään auki, on teidän asianne ja Me joilla tässä omistuksia, tiedetään riskit ja kestetään osakkeen hinnan arvonvaihtelut - suuren ajattelijan tavoin: pörssissä kärsimätön raha siirtyy kärsivällisille.

Se että ette kestä pomppuja matkalla on teidän riskin sietokyvylle liikaa. Me jotka kestetään se, niin matkan pomppuisuus ei todellakaan haittaa: emme kaipaa myöskään kauhisteluja, veetuilua tai holhoamista asioihin.

Emme myöskään mene katki näihin sijoituksiin ja ymmärrämme riskit.

Joo se jaksaa kyllä hämmästyttää, että kaikki ei hyväksy ja ymmärrä, että kaikki ei sijoita kuten he ja asia pitää tulla ilmoittamaan tänne yhtiökohtaiseen ketjuun. Ei kaikkia kiinnosta seurata pelkästään liutaa jotain 50 vuotta pörssissä maanneita mörnijöitä ja laskea sitten kerran vuodessa tunnuslukuja, että onko se p/e nyt tänä vuonna 15 vai 15.03. Varmasti aika monella Voxturin omistajalla on kuitenkin hajautettu salkku ja Voxtur vain mukana siellä tuomassa oman mausteensa.

Siitä olen samaa mieltä, että Voxturin ketju on huikea ketju ![]() Se määrä seurantaa, selvitystä ja analysointia minkä porukka on tehnyt tässä ketjussa kahden vuoden ajan on ainakin oman kokemukseni mukaan ihan omassa luokassaan tällä foorumilla. Se lienee myös yksi tämän forumin tarkoituksista, vaikka vähän väliä joku ehdottelee koko ketjun sulkemista koska se on aina ketjulistojen keulilla. Ymmärtämättä yrityksestä mitään. Toki viestien paljous tekee tutustumisen/perehtymisen helposti liian vaikeaksi.

Se määrä seurantaa, selvitystä ja analysointia minkä porukka on tehnyt tässä ketjussa kahden vuoden ajan on ainakin oman kokemukseni mukaan ihan omassa luokassaan tällä foorumilla. Se lienee myös yksi tämän forumin tarkoituksista, vaikka vähän väliä joku ehdottelee koko ketjun sulkemista koska se on aina ketjulistojen keulilla. Ymmärtämättä yrityksestä mitään. Toki viestien paljous tekee tutustumisen/perehtymisen helposti liian vaikeaksi.

Samalla hyvä muistutus, että kyseessä on vain 2 vuotta vanha yritys (nykyisessä muodossaan/tarkoituksessaan). Tätäkään ei moni kommentoija ymmärrä, kun ei vaivaudu katsomaan iLAn/Voxturin historiaa. Sitä varoittelua Voxturin riskeistä on ketjussa toitotettu ensimmäisistä viesteistä asti jos vaivautuu lukemaan esim Pertun ja Keisarin viestejä. Toki jos perehtyy niinkin syvällisesti, että lukee vain sen ihan ensimmäisen viestin ja kommentoi sen perusteella niin ehkä tämä(kin) jää huomaamatta ![]()

Tämä pt:n kirjoittama viesti on varmaan oppikirjaesimerkki siitä miten huono DD tehdään. Vilkaistaan uusin osari ja lukaistaan joku viesti ja myönnetään että ei tunneta yritystä, ei jatkoon ![]() Sitten se tullaan vielä vapaaehtoisesti kertomaan seurakunnalle kyseiseen yhtiöketjuun

Sitten se tullaan vielä vapaaehtoisesti kertomaan seurakunnalle kyseiseen yhtiöketjuun ![]()

![]()

Tälläiset viestit kiitos kahvihuoneelle. Tämä viesti ei tuottanut lisäarvoa edes sinun behavioral economics- tutkimukseen. Ymmärrän että kurssi reaktiot tuovat eri ihmisistä erilaisia piirteitä esiin. Sinulle numerosarja personal trainerille se näyttää antavan iloa tulla kertomaan ketjun historiasta ja yrityksen huonoudesta. Vaikkei halua sijoittaa yritykseen niin tässä ketjussa on myös ollut paljon hyviä ja ansiokkaita viestejä. Näistä tälläisistä menee mielenkiinto seurata yrityksen tilannetta vaikkei omistaisikaan osaketta.

Hyvää lauantaita ketjuun! ![]()

Ketjuun tuli hetki sitten tasan 4000 viestiä, se on todella paljon. Ketjussa on paljon hyvää tietoa tietoa sekä jonkin verran ei ehkä niin hyvää asiaa ja varmaan iso osa tietää, missä ovat mukana, eli hyvin riskisessä yhtiössä, jossa nähdään olevan isoja mahdollisuuksia. Uusille ja aloitteleville varmasti haastava yhtiö eikä ehkä ihan kaikki ymmärrä, missä ovat mukana, mutta ei liiaksi voi holhota, vaikka riskeistä kannattaa aina välillä muistutella hyvin uskottavasti perustellen.

Olen omistanut tätä, mutta myin osuuteni pois ja pääsyynä oli se, että en itse ymmärtänyt tästä ihan tarpeeksi… osin johtuen heikohkosta englannin kielen taidostani. Toki oli siinä muitakin syitä.

Muutamia muistutteluja:

- Kunnioitetaan kaikkia kirjoittelijoita omilla viesteillään sekä kuunnellaan niin karhuilijoita kuin härkäilijöitä.

- Turha provoaminen on turhaa provoamista. Sisällötön viesti, jossa ei ole mitään uutta, niin on sisällötön viesti, jossa ei ole mitään uutta. Yksinkertaista?

Eli ei tällaisia viestejä ketjuun.

Eli ei tällaisia viestejä ketjuun. - Se on nähty eri yhtiöketjuissa, että hyvin argumentoidut ja perustellut karhuiluviestit, joissa on edes jonkin verran jotain uutta ovat varsin arvostettuja. Eli jos laitat viestiä ketjuun, niin tutustuhan yhtiöön lukemalla ketjua ja katsomalla materiaalit, mitä tänne on laitettu.

- Jos joku provoaa tai kirjoittaa karhuiluheiton, missä ei ole mitään uutta pointtia, niin ei siitä ehkä tarvinne suuttua kovasti, vaikka tunteiden nouseminen on ymmärrettävää. Sellaiset voi jättää omaan arvoonsa eikä ainakaan kannata jatkaa turhista puhumista kirjoittamalla turhia.

- Luulen, että suurin osa ei tykkää erityisen härkäisistä tai karhuilevista viesteistä, vaan huomattavasti uskottavampi on sellainen viesti, jossa pyritään sanomaan asiat, kuten ne oikeasti ovat tai miten niiden kuvitellaan olevan. Megahärkäily herättää epäluuloa heti fiksummissa sijoittajissa ja vastaavasti huonot karhuviestit tuovat sen olon, että “ehkä tämä firma on sittenkin hyvä, kun eivät löydä tästä kunnon kritisoitavaa”.

- Ei viedä Voxtur-kinoja Kahvihuoneelle eikä niitä täälläkään pidä jatkaa, vaan asioista voi keskustella järkevästi argumentoiden sekä perustellen ilman turhempia tunteiluja.

Riskejä on hyvä korostaa ja sitä täällä on tehtykin. Siitä ei ole varmaan juuri ketään eri mieltä, että tämä on riskinen yhtiö ja ehkä juuri aloittelevalle tämä on haastava yhtiö jossain määrin ymmärtää.

Kiitetään niitä, jotka ovat parhaansa mukaan jakaneet täällä tietoa olivatpa ne sitten negatiivisia tai positiivisia. Pyydetään anteeksi ja myönnetään olevamme väärässä, jos siihen on aihetta.

Kannattaa aina tutustua kunnolla yhtiöön ennen siihen sijoittamista. Jos tekee vääriä ratkaisuja, niin katse peiliin eikä sitten syytellä toisia.

Kirjoitellaan fiksusti hyvin perustellen ketjuun ja kunnioitetaan toisia. Mukavaa lauantai-iltaa! ![]()

@o11 I re-read your comment. I haven’t looked into the covenants - there may well be language around conforming with applicable regulatory, legal and registration requirements.

So there may be an issue with a breach in that instance. The issue is what is the cure - given that this problem is not of Voxtur’s making I would suspect that they would work to help cure this issue quite quickly.

In the end - the bank wants the loan to be a performing loan. And given that the former Vice-Chairman of BMO is on the Board. I would suspect that they will be amenable. This is not the condition that they want to breach the debt on.

Vähän tympääntyneenä tähän jatkuvaan kinasteluun foorumilla tuli mieleen, että olisiko ideaa perustaa Voxturille oma Discord palvelin? Sinne voisi sitten luoda kanavia (uutiset, spekulaatiot, mutuilut jne) tarpeen mukaan ja myös keskustella enemmän chat-omaisesti? Discordista löytyy käsittääkseni myös (toimiva?) voicechat jota kautta sitten voitaisiin ehkä sitten tulevaisuudessa pyörittää esim Jimin haastatteluita? Onko jollakulla riittävästi osaamista Discordista ja olisiko väellä kiinnostusta tällaiseen?

Voisi olla keskustelukielenä englanti niin josko sinne löytäisi ulkomaaneläviäkin? Saisi lahkolaiset keskustella ja vaihtaa ajatuksia rauhassa ja epäileväiset olisi tyytyväisiä kun Voxtur ei keiku aina foorumin kärjessä.

- Joo Discord

- Ei Discord, jatketaan täällä.

Joo tuo moderointi on se haaste. Inderes on kuitenkin moderoinnin ansiosta se laadukkain foorumi mitä nyt olen itse keksinyt. Moderaattoreita pitäisi olla riittävästi, mutta josko täältä saataisiin riittävästi osallistujia niin äkkiä olisi kuitenkin kymmeniä järki päässä olevia joille moderointioikeudet sopisi.

E. Kai tätä testata kuitenkin voi. Allekirjoittaneella ei ole osaamista mutta palvelimen onnistuin luomaan ja tässä kutsulinkki: Discord

Totta tämäkin, mutta Discord tarjoaisi alustana kyllä aika paljon lisää hyviä ominaisuuksia.

Itsekkin olen miettinyt tuota discord vaihtoehtoa. Tosin mitä olen noita ulkomaisia keskustelukanavia lukenut, siellä on näitä tiettyjä tyyppejä jotka eivät tuo mitään lisäsisältöä keskusteluihin ja ainoa mitä he ajavat takaa on joko trollata tai he koittavat ajaa osakkeen hintaa alas viesteillänsä joiden sisältö on tyyliin: “management going to do RS this or next month” tälläistä tyyppejä sinne ei kaivata. Karhuilu on tietenkin enemmän kuin tervetullutta jos siinä on jotain sisältöä. Kanavan moderaattoreilla pitäisi olla sitten aika herkässä banni sormi tälläisen tyyppien kanssa

Se että jotakuta harmittaa joku asia satunnaisesta syystä ei kyllä ole mikään syy siirtää keskusteluja minnekään muualle.

Jatketaan vaan täällä.

Juu, ei sitä nyt yhden käyttäjän mielipiteen/idean tiimoilta olla mihinkään siirtämässä ja äänestyksen tuloskin on selvä. Discord palvelin nyt pyörii siellä kuitenkin ja sinne saattaa muodostua jotain aktiivisempaa keskustelua tai sitten ei. Mutta kuten tuonne kahvihuoneellekin kirjoitin, niin ehkä näille molemmille kanaville on oma käyttäjäkuntansa ja tarkoituksensa ja ne voivat elää rinnan.

Noin 40 käyttäjää siellä on tällä hetkellä joten kyllä sille ehkä kuitenkin on tilausta.

Teknisesti tämä Inden foorumi ei siis aktiiviselle keskustelulle sovi, eikä se ole tämän (alkuperäinen) tarkoituskaan.

Mielestäni ei siirrytä discordiin vaan keskitetään kaikki keskustelu tänne. Niin kuin moni jo todennutkin, niin tänne toivoisi vain kylmää analytiikkaa yhtiön tilanteesta. Oli se sitten positiivista tai negatiivista. Olen todennut, että tunnepitoinen vuodatus puolisolle erittäin savuisen single maltin jälkeen aamuyöstä on yleensä paras tapa purkaa henkinen kuormitus.

Jos se discord nyt kuitenkin jo on olemassa, niin täytyypä itsekin liittyä. ![]()