AROC: Mahdollinen weekly trend change (up) olisi kyllä vahva signaali pysyvämmästä suunnan muutoksesta.

The following article, from the Chinese SSTK Biotech research team including Ellen He and Sven Skog, seems to have been peer-reviewed and is now published in the journal Science Direct (the article have been available as a pre-print up until recently).

“Concentration of human thymidine kinase 1 discover invisible malignant human tumours” Concentration of human thymidine kinase 1 discover invisible malignant human tumours - ScienceDirect

As I understand, the article may have a direct relation to the very recent post from SSTK Biotech, in which there is a comparison between sTK1p and Grail - from a Chinese perspective.

The article also discuss some possible differences between TK1 antibodies derived from chicken (SSTK Biotech) vs mouse (AroCell TK 210 ELISA).

According to the authors, these differences may be of relevance when it comes to the special case of screening and early detection of pre-malignancy in the overall healthy population.

On the other hand… in the recent Swedish 30-year followup study (Per Olof Lundgren, Bernhard Tribukait et al) there are presented the following very interesting longterm results which, quite on the contrary (?), seems to indicate a similar “screening capacity” within the AroCell TK 210 Technology? Quote from the Swedish 30 year study, using the AroCell TK 210 ELISA:

“In addition to death from prostate cancer, our study predicted that a high TK1 value, predicts the death of any cause. We have not been able to find any specific causes of death other than prostate cancer, though. The growth of malignant cells, as well as inflammatory conditions, implies an increased cell division, which in turn can be reflected as an increased concentration of TK1 in the blood. Large screening studies with 8000 and 11,000 healthy participants, respectively, have been conducted in China, where TK1 concentration/TK1 protein levels in the blood were measured. At the time of screening, certain undiagnosed tumor diseases are captured and there are also indications that TK1 predicts not yet clinically detectable malignant diseases.” Serum thymidine kinase 1 concentration as a predictive biomarker in prostate cancer - PMC

As an amateur I find these results really inspiring, as they seem to indicate that data generated using AroCell TK 210 ELISA may be pointing in a similar direction as large screening studies performed by SSTK Biotech in China. If so, the origin of the TK1 antibodies, chicken vs mouse, may not be that a critical factor.

Monoclonal (AroCell), not polyclonal (SSTK Biotech), antibodies may be essential from a Western regulatory and industrial perspective… and a Western based business (AroCell) may be preferable when selecting a longterm partner - factors that may favour AroCell TK 210 Technology?

Osavuosikatsausta taas luettuani halusin nostaa sieltä esille seuraavan otteen, joka antaa erittäin paljon uskoa tulevista tuotoista

“Nykyään AroCellillä on erittäin edullinen asema. Meillä on vahva kassa-asema, vahva myynnin kasvu ja organisaatio, joka kattaa kaiken tutkimuksesta ja kehityksestä myyntiin, tuotantoon ja jakeluun. Erittäin omistautuneiden ja osaavien työntekijöidemme ansiosta näemme nyt merkittävää edistystä.”

Anders Hultman, toimitusjohtaja

Tähän kun lisää jo tapahtuneen liikevaihdon kasvun ja rahavirran nopean suunnan kääntymisen.

Moni pelkäsi rahavirran kasvavan huonompaan suuntaan ja, että kassa alkaisi tyhjentyä kiihtyvään tahtiin yhteisyrityksen perustamisen takia. Mutta, nyt kaikki näyttäisi lupaavalta, liikevaihto kasvaa kymmeniä prosentteja, kulut pienenee, jos trendi säilyy niin rahavirta kääntyy nopeasti positiiviseksi ja kassassa on paljon rahaa, yhtiö on netto velaton.

Varsinkin nyt kun inflaatio on korkealla ja korot nousee, tällä on erittäin paljon merkitystä.

Tämän lisäksi kyse on kasvuyhtiöstä, niin tähdet on nyt oikeassa asennossa.

Suurimpana riskinä näen sen, miten iso kassa suojataan inflaatiolta ja vääriltä investointi päätöksiltä.

Edelliseen viitaten:

Arocellilla on kassassa käteistä n.

0,3 SEK/osake

Ja

Päivän kurssi on n. 0,6 SEK/osake

Strategy Update 2022 (November 22)

“We are welcoming you to AroCell’s Strategy Update. CEO Anders Hultman and the management team will inform you about current developments as well as the major strategic initiatives and possibilities for 2023.”

BioStock Life Science Fall Summit 2022 (November 29 - November 30)

“Anders Hultman, CEO, will be presenting at this year’s BioStock Life Science Summit.”

For quite some years now AroCell appears to have shown a very low profile on the subject of early detection of cancer - that is screening of seemingly healthy individuals with no previous history of cancer.

This seems to be very much in clear contrast to the Chinese TK1-company SSTK Biotech (including AroCell founders Sven Skog and Ellen He) which almost exclusively promotes sTK1p as a tool for early detection and as a screening tool on population level.

Recently SSTK Biotech seems to have even stepped up in promotion activities, an example is the recent article “Who is the Chinese version of Grail?” which appears to compare TK1 and cancer diagnostic giant GRAIL - allthough from a strictly Chinese perspective.

Nevertheless, such a comparison with GRAIL can not be dismissed as un-significant - especially in view of the almost total silence from AroCell on the same subject of early detection. It is very clear that AroCell do not actively promote sTK1p as a method of early detection of cancer in the healthy population. In clear contrast SSTK Biotech compares sTK1p with the giant GRAIL.

This discrepancy between AroCell and SSTK Biotech, in the way of promoting sTK1p, is far to big to not pay attention to. If sTK1p in China can deliver early detection of cancer - then surely AroCells sTK1p must possess, if not exactly the same, a quite similar capacity in the Western world?

So, why do not AroCell talk anything at all about these possibilities within early detection? What can be the reason for not doing this? Imagine AroCell TK 210 Technology being selected by Exact Sciences, or GRAIL, to be included as a co-parameter in studies on early detection of colorectal cancer, lung cancer, or whatever, that would surely be a big thing? If Chinese sTK1p is told to have such power, why not AroCells sTK1p?

To me this is a very strange situation. There must be some reason for AroCell not talking more and deeper about early detection. Maybe the field of early detection is to big for AroCell to handle - there is simply way to much data that first must be generated before being able to adress early detection?

And, in view of not having the clinical data at hand… maybe AroCell do not want to be regarded as a new version of “Elisabeth Holmes” - that is just fancy talk without backing from data?

Still - sTK1p as an early warning flag is one of the most interesting and inspiring aspects of this biomarker. I do not understand why there can not be a way in which AroCell can talk about this quality of sTK1p. It could be in a very simple and unproblematic way - maybe just to announce that AroCell recognize this capacity in sTK1p and are looking actively for partnerships to explore these possibilities.

Or - can there be some other reason for AroCell having this low profile on early detection? Maybe there are allready related projects going on in this area - which could be the reason for AroCell not to interfere by suggesting the establishment of competing alliances?

Consider the area of hematological cancer. Hematological cancers was early on, around 2011-2013 (if I remember correct) considered to be the first area of implementation for AroCell TK210 ELISA. So - how come AroCell has not yet been able to establish any clinical presence at all in this area of implementation? And in the official discussions regarding FDA - there is no talk what so ever about hematological malignancies?!!

My personal “hypothesis” is that this lack of progress within hematological cancers is somehow related to the Roche deal. That is, Roche is the one who will implement TK1 within hematology - not AroCell.

And, if such an arrangement goes for the area of hematology - maybe something similar is going on within the area of early detection? That is - maybe AroCell is keeping a low profile because the area of early detection is allready being taken care of by Roche?

So, are there any signs of Roche investigating this area in oncology - screening of healthy?

Yes, and the following company looks quite interesting - Medial EarlySign.

https://www.linkedin.com/company/medial-earlysign

Apparently Roche have since 2021 started three development projects on early detection in collaboration with Medial EarlySign - a company delivering AI-solutions.

#1. Gastric cancer (2021-09-13)

#2. Lung cancer (2022-07-07)

#3. Colon cancer (2022-10-10)

Here is a quote from the announcement by EarlySign:

“Our next steps are to help bring new diagnostics methodologies to the global market through better management and utilization of vast amounts of data in ways that were previously unimaginable. By coupling our proven machine learning infrastructure and data science expertise with the global leadership of Roche, we are looking forward to bringing forth a new class of predictive tools to make a significant contribution to improve human health.”

So, maybe it is not impossible that sTK1p could be a valuable co-parameter in these Roche-projects on early detection, and if so, maybe increasing the probability of Roche moving forward in the since 2018 established license deal with AroCell?

Remember that clinical trial, sponsored by FIND, and which included TUBEX TF and several other tests? Source: Commercial Typhoid Tests Validation - Full Text View - ClinicalTrials.gov

It seems as if the above original clinical trial was substituted by the following study, which have now been completed. Source: Commercial Typhoid Tests Validation Trial - Full Text View - ClinicalTrials.gov

Here is a preprint of the completed study (preprint = not the final publication).

Source: https://www.medrxiv.org/content/10.1101/2022.07.17.22277655v1.full

TUBEX TF seems to have performed really well, among the top 2-3 performing tests when summarizing all different regions world wide into one score (also, as I understand, taken into account an earlier small TUBEX study, with low number of participants, showing some variation in Pakistan).

Besides technical performance there are probably also other important factors contributing to a good test, such as price, reliability and ease of use when using the test in real life settings.

Strategiapäivitys 2022 (22. marraskuuta)

”Toivotamme sinut tervetulleeksi AroCellin strategiapäivitykseen. Toimitusjohtaja Anders Hultman ja johtoryhmä kertovat sinulle ajankohtaisesta kehityksestä sekä tärkeimmistä strategisista aloitteista ja mahdollisuuksista vuodelle 2023.

Tiistaina kullaan mitä Arocellilta voidaan odottaa lähiaikoina. Olisiko siellä myös jotain mikä palauttaisi Arocellin arvostuksen sijoittajien keskuudessa ja uskoa tulevaan

Twitterissä joku kirjoitti hyvin, että vaikeinta sijoittamisessa on olla oikeassa, jos markkina ei ole kanssasi samaa mieltä.

Mielestäni Arocell on yhtiö jonka markkina-arvo on poljettu vain ja ainoastaan FDA hakemus prosessin takia. Toki markkina-arvoa pumpattiinkin ennen kuin tuli tieto että, lupahakemusta pitää täydentää tai hakea eri hakemuksella.

Tällä hetkellä yhtiöllä on rahaa kassassa n. 0,3SEK/osake ja kurssi on n. 0,6SEK/osake, eli markkina arvostaa Arocellin omaisuuden ja liiketoiminnan arvoksi n. 0,3SEK/osake. Ei kuulosta kovin tehokkaalta, varsinkaan yhtiölle joka keikkuu kasvu ja arvo-osakkeen määritelmän rajoilla (totta, tulos ei ole vielä plussalla, eikä maksa osinkoa).

Yhtiö (yhdistynyt Arocell ja IDL) on parempi ja vahvempi, kuin ennen tietoa että FDA lupaa pitää hakea eri reittiä.

FDA lupa prosessi on kesken, hakemusta ei ole lopullisesti hylätty ja haudattu.

IDL:n hankinta on osoittautunut erittäin hyväksi ja kannattavaksi.

Taloudellisesti yhtiöllä on aikaa; rahavirta kääntyy tätä menoa nopeasti positiiviseksi, yhtiö on netto velaton, kulut on saatu sopeutettua yllättävän nopeasti ja kassassa on rahaa pyörittää yritystä nykyisilläkin menoilla useita vuosia, ilman että rahaa tarvitsee omistajilta pyytää.

Mutta, odottavan aika on pitkä ja sen takia onkin hienoa että osavuosikatsausten välillä on mm. Strategiapäivitys ymv. Tiedottamista, jossa kerrotaan sijoittajille missä mennään ja mikä seuraava yhteinen päämäärä /tavoite on.

Valuutta korjaus

“Even if the number of observations is relatively low it further emphasizes the potential of TK-1 as an interesting biomarker in COVID-19.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

I just found some VERY interesting results on TK1 in AKI (Acute Kidney Injury) published by Per Venge and co-writers in “Journal of Clinical and Laboratory Medicine” (published July 6, 2022).

Quote from the article:

"However, the finding of the association of Thymidine Kinase 1 to stages of AKI but not survival is novel. Previous studies showed that plasma concentrations of TK-1 are elevated in many viral infections and

the finding of raised concentrations in SARS-CoV-2 infections in this report may be in line with this notion. TK-1 is usually used as a marker of tumour growth and the question arises whether the progressive increments related to AKI stages reflect tissue injury or expansion. In a logistic regression analysis with the inclusion of all biomarkers described in this report, TK-1 together with HNL 763/8F were the only two independent biomarkers of severe AKI (data not shown). Even if the number of observations is relatively low it further emphasizes the potential of TK-1 as an interesting biomarker in COVID-19."

Source: https://www.sciforschenonline.org/journals/clinical-laboratory-medicine/article-data/JCLM141/JCLM141.pdf

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

I´m quite proud of this finding, as it seems to actually be very much in line with a post by myself on the former Avanza Forum (date/time: 2021-10-05, 12:09) which seriously speculated in a function for TK1 related specifically to kidney injury! And the forum post even speculated in a relevance to Covid-19!

The speculations were based on reading many research articles on different topics related to TK1, and so I found an research article from 2010 which very interestingly told that specifically in a type of kidney tissue, the TK1 enzyme is up-regulated in NORMAL tissue (not cancer tissue) and this seemed very interesting and triggered more reading on injury of the kidney - which logically would lead to the release of TK1 into the blood (in a similar way to TK1 is being released into blood from disintegrating cancer cells). Further reading indicated a relevance of AKI to death in acute emergency situations, including Covid-19, and all this put together became this speculation that seems to actually be quite in line with these now published results from Per Venge and co-writers. Wow, for me such things are even better than the share value going up…

Ok, so the bottom line, according to Per Venge is:

“Even if the number of observations is relatively low it further emphasizes the potential of TK-1 as an interesting biomarker in COVID-19.”

My take would be to maybe even expand the potential to all emergency situations in which AKI (Acute Kidney Injury) is relevant, including COVID-19.

AroCell tiedottaa, että tänään he esittelevät yhtiön strategista kehitystä sekä vuoden 2023 aloitteita ja mahdollisuuksia Strategiapäivässä klo 09.30 alkaen.

-

Yhtiön keskittyminen liiketoiminnan kassavirran positiivisuuteen kehittyy hyvin.

-

Orgaaninen myynnin kasvu nykyinen tilauskanta mukaan lukien kehittyy hyvin. Lisääntyneiden myyntiresurssien ja strategisten kumppanuuksien kautta.

-

Yhtiön vahva taloudellinen asema ja sisäinen infrastruktuuri mahdollistavat tuotevalikoiman laajentamisen tulevaisuudessa.

-

Uudet kliiniset tutkimukset alkavat toteutettavuustutkimuksina suurempiin rekisteröintitutkimuksiin.

Katsoiko joku strategia päivityksen, ja jos, niin tuliko siellä tiedotteen lisäksi jotain kiinnostavaa?

Arocell liiketoiminta näyttää kehittyvän hyvään suuntaa ja vauhtikin on hyvää.

You can watch the Strategy update here.

https://www.redeye.se/events/857195/strategy-update-arocell-2

It’s in Swedish, but most, if not all, of the PowerPoint slides are in English.

The Video have a CC, automated translation, but it’s so bad that it’s not worth even trying.

The Strategy Updated was better than expected. I expected more of the same from CEO Anders H, not saying that’s bad, but the update was far above exceptions. We get to hear from the whole Team, and i feel so much more confident in the company now than I did before. I feel they have the perfect team with the right goals, professionalism and dedication is key, and that’s the words i would describe Arocell with after watching this update.

I recommend anyone that is interested in Arocell to watch the whole update.

It’s 1h 10min long, well worth the time.

I totally agree with Narvis, and also nice that the area of early detection of cancer is adressed and on the AroCell agenda. There is so much interesting to learn from this Strategy update about the progress of the company. Nearly every sentence delivers information that matters, covering all areas - financial, scientific, logistic, sales and so on.

Arocell markkina-arvo 134 MSEK 13,4 M€

Arocell käteistä rahaa n. 68 MSEK 6,8M€

Arocell varaston arvo 32MSEK 3,2M€

Eli kun vähennetään Arocellin markkina-arvosta likvidit varat 134 - 68 - 32 = 34MSEK 3,4M€

Sijoittajat arvostavat Arocellin liiketoiminnan ja muun omaisuuden, saman arvoiseksi kuin omakotitalo merenrannalla tai Helsingin keskihinnalla alle 600m2 lattia-alaa n. 34MSEK → 3,4M€

Ja tämä kun muutetaan osake kohtaiseksi hinnaksi, liiketoiminta ja muu omaisuus arvostetaan n. 0,15 SEK / osake, kun viimeinen kurssi on n. 0,58 SEK/ osake (sisältää likvidit varat)

Korjatkaa jos menin omissa päätelmissäni (valuutta pyörittelyssä) solmuun. Tai jos päätelmä on oleellisesti virheellinen.

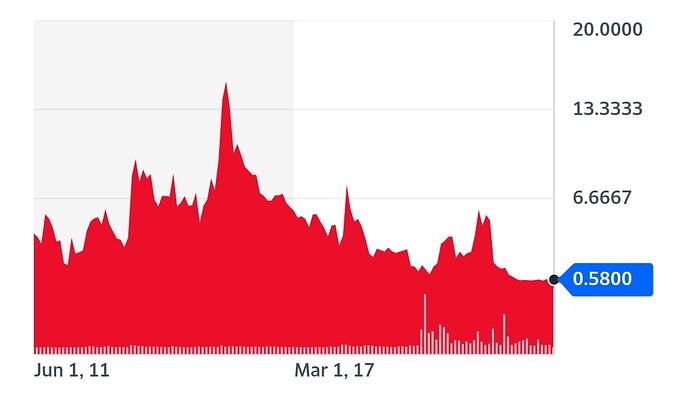

Firman pitkästä pörssihistoriasta löytyy pientä vinkkiä. Löytyy monta piikkiä, josta tultu rytisten alas. Nykyhinnassa on sitten arvosteltu mukaan firman useaan kertaan käyneet “lupausten” pettämiset, jonka vuoksi ei enää riitä isompaan arvostukseen sijoittajien luotto. Oma veikkaus.

Ymmärrän tuon, mutta en ymmärrä sijoittajan kannalta asiaa.

Yhtiö (sen hetken liiketoiminta) on ollut kallis yli 4 SEK/ osake.

Mutta, nyt sijoittaja saa yhtiötä 27 kertaa halvemmalla joka, on liikevaihdolla mitattuna huomattavasti suurempi, kasvaa ja viimeisten tietojen mukaan edelleen kasvu jatkuu, ei velkaa, kulut saatu sopeutettua, rahavirta kääntymässä positiiviseksi, ei pelkoa että omistajien pitäisi rahoittaa yhtiötä vuosiin.

Minulle itselleni ei ole väliä rikastunko yhtiöllä joka on joskus suoriutunut huonommin ja olen siihen aikaisemmin pettynyt. Ainoastaan sillä on minulle väliä olenko arvioinut yhtiön nykyisen arvon oikein ja miltä sen tulevaisuus tänään näyttää.

Incap on mielestäni hyvä esimerkki tällaisesta yhtiöstä. Ikävä kyllä olen aina ollut siinä liian pienellä panoksella ja kotiuttanut voittoja turhaan matkan varrella.

Buffetin pari kuuluisaa sitaatia, joka mielestäni sopii tähän:

-

“Paras aika ostaa yritys on silloin, kun muut ihmiset myyvät sitä, ei silloin, kun he ostavat sitä.”

-

- “Et voi ostaa sitä, mikä on suosittua, ja olla oikeassa.”

@ Torniojaws and Joukkis

Maybe both of you are right?

I very much agree with Joukkis in that the valuation of the company seems extrelemy low - and this is also in line with the latest RedEye analyzes, which give a fair value of SEK 2,30:- per share (base case).

On the other hand there is this troublesome past in the stock history, which is pointed out by Torniojaws, and this may hesitate some investors to enter the stock (allthough for example a sudden “go-ahead” from Roche probably would change everything overnight).

But - what if you change the point of view just a little bit and look at the case from another angle?

After all, “AroCell” is just the name of the company… and the reality is that the business case is since last year in fact a merger between two companies - AroCell and IDL Biotech. And, looking back on the actual business development, since the merger last year, it is quite obvious that the vast majority of the reported activities in the company this last year, have been related to the former IDL Biotech business!

So… what if we instead “play around” a little bit - and change the company name to IDL Biotech? This would probably reflect the effects of merger in a better - or at least equal - way? Than we will have this completely new stock history to contemplate when looking at the current share price!

IDL Biotech AB Stock Price Today | TE IDLb Live Ticker - Investing.com

IDL Biotech AB Stock Price Today | TE IDLb Live Ticker - Investing.com

This alternative stock history looks quite different and appears to be relatively free from the spikes that could be seen in the AroCell stock history?