Jatketaan taas yksinpuhelua, Q2 earnings call transcript

Luvuissa ei niinkään uutta tulosten jälkeen, mutta kysymyksissä mielenkiintoisia kommentteja:

Panostusta julkisen puolen hyväksyntäprosessiin, mennyt läpi ja lisää kauppaa tulossa

So public sector is our biggest vertical solution space. We have a dedicated public sector team based in Arlington, Virginia. The FedRAMP is very important aspect to it. So, we do see that there are opportunities that involve FedRAMP that we’re able to close now that we’re FedRAMP authorized. FedRAMP certification itself is a long process. This is also why we talk about, this first in market first mover advantage it took it usually takes several years to obtain the authorized status go from the initiated status.

And we continue to see robust pipeline from that. So it’s important thing. And it’s also been cited by other software companies of their various stages of process. So as to the overall TAM, it is harder to gauge right now. We know it’s important. And we have a robust pipeline associated with FedRAMP authorized status.

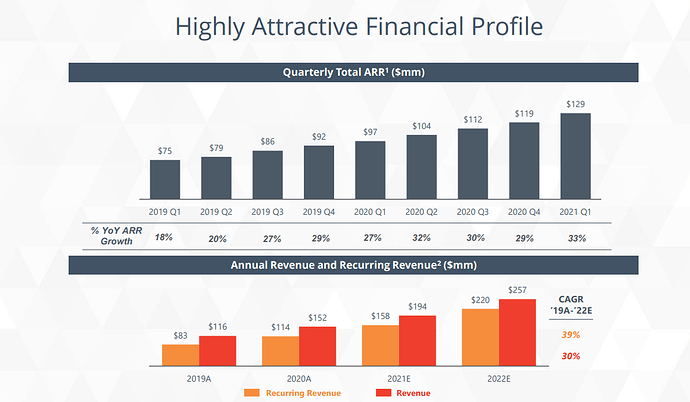

Teams -käyttäjiä aiemmin 7M, nyt yli 8M. Ei yleinen mittari, mutta antaa kuvaa edistymisestä

It’s a metric. Yes, it’s over 8 million. And it’s a metric we don’t intend to update on a quarterly basis. Because the nature of our licensing and coverage and hybrid licenses, we think the best reflection of our growth continued to be ARR growth annual reoccurring revenue growth. So but yes, so it is now a well over 8 million.

Operating Income ennustetta laskettu 8M$ → 6,2M$, nämä menee kasvupanostuksiin

Sophia Wu

Yes. Hi, Jason. So this is mainly because we increase our investment into our business split between three buckets. We increase our investment in sales and marketing, including new positions in channel business, which TJ will share a little bit more color later. We also increased our standing in G&A, which is a mix of a few things, its incremental public accompany cost, increase the professional fees more than we originally budgeted, and also additional headcount such as hiring of Jim, which will add additional strength to the existing management team. We also see good opportunities to increase our investment in R&D to bring new products in 2020 and beyond. So therefore, we increase the headcount in H2.

TJ Jiang

So Jason, on the channel side, Sophia mentioning we announced our global channel program in July, so we’re investing very aggressively into the Channel and Channel initial stages are relatively expensive. There’s a whole priming the pump action going on, as well as essentially enabling accelerating channel partners to then conduct business with us and be familiar with our products. But of course, channel is the fastest way to secure our business given the massive TAM in front of us, we have expanded channel coverage to not only our a monthly recurring side of SMB business, but also our telesales, mid market business, selling to businesses all the way up to $2 billion annual revenue. So it’s a very aggressive investment from our side. Of course, at the same time, we are meaningfully controlling to make sure that we are managing our OpEx costs meaningfully, but still maintain aggressive growth posture.

Kanava- ja MSP-myynti kasvaa nopeasti, eli pienyritykset pääasiassa.

Yes, so far, it’s, it’s about 5% of our ARR right now. And we’re growing three digits. It is meeting our expectations. We’re investing more aggressively into it. It’s a fantastic market, as we mentioned before, right, because we’ve been enterprise focused, but being SaaS provider allow us to be accessible, far more accessible to the SMB market. So that allow us to effectively double our TAM because again, the user base that SMB market represents, in the Microsoft 335 ecosystem. We define also SMB as businesses with $250 million annual revenue, or 500 employees or fewer companies. That’s actually a very, very big space.

And now especially with Windows 365, so Cloud PC, where every instance has Microsoft Team baked in. In fact, our team’s app, which called My Hub, it’s the number one team’s app in Japan, and one of the top ones globally, it’s baked in into these instances. So, what it does is create that evergreen motion here. And as Microsoft continually update their builds and have the releases updated in real time, via these Cloud PC instances, our latest apps gets rolled out as well. So, I think that will only help increase lower the barrier to entry and increase our ability to go to market. So it’s only good from AvePoint’s business opportunity perspective.

Näkymät ennustettu konservatiivisesti ja varman päälle

→ positiivinen yllätysmomentti todennäköinen Q3/Q4

So against this some macroeconomic volatility and uncertainty right now, we are being constructive in our guidance. So, we remain consistent with our previous guidance of maintaining this 30% revenue growth.

Kasvun ja kannattavuuden kanssa tasapainollaan, TAM on todella iso ja sitä halutaan vallata, mutta silti kannattavasti

from the business perspective, we clearly have a massive TAM in front of us. We want to accelerate our ability to capture that. So yes, we will play a nice balanced play between growth, revenue growth and profitability. Ultimately, we want to stay north of that Rule 40 as the benchmark guidance and measurements against SaaS companies. So, whether that’s 30% growth versus 10% profitability or 40% growth versus neutral profitability, that’s something we’ll continue to work on. But ultimately, we want to go after the TAM in front of us quicker.

All-in-all, ainakin oma näkymä on tästä huomattavasti markkinan 4-7% pudotusta positiivisempi. Analyytikoiden kommenttien välistä lukemalla näkisin mietoja tavoitehintojen nostoja.

Potentiaalisena optiona on jo aiemmin mainittu myös yritysostot. Tässä ei tullut esille, mutta uskoisin olevan työn alla. Rahaa on kassassa ja osakkeilla saa nyt osamaksun ainakin hoidettua. Valuaatiota pitäisi vaan saada ylöspäin, niin olisi paremmin pelivaraa.

deSPACeja lyödään edelleen, mutta fundan pohjalta AvePoint on omaan salkkuun valittu pitkään pitoon. Juna jatkaa kulkua ja kyydissä pysytään, vaikka markkinan vastaanotto tulokselle oli mitä oli. En sitten tiedä mitä markkina odotti, mutta luvut oli ennusteen mukaisia.