Yhtiöllä oli suunnattu anti reilu kuukausi sitten, joka vastasi 30% osakemäärästä eli varsin iso anti olikin. Yhtiö perusteli annin käyttötarkoitusta “jo tunnistettujen tulevien kasvumahdollisuuksien hyödyntämisellä”. Itse odottaisin siis uusia kassavaroja käytettävän laajentumiseen Norjaan ja mahdollisesti johonkin tiedossa oleviin yrityskauppaan.

Luottoa yrityksen johdolla oli sillä he merkitsivät vahvasti osakkeita annissa:

"The following primary insiders in the Company were allocated shares in the Private Placement:

Johan Lindqvist, Chairman of the Board, has been allocated 170,213 Offer Shares in the Private Placement, and will following delivery of such Offer Shares hold an aggregate of 2,994,337 shares, corresponding to 5.7% of the total number of shares and votes in the Company after the Private Placement

Jesper Jannerberg, CEO, has been allocated 170,213 Offer Shares in the Private Placement, and will following delivery of such Offer Shares hold an aggregate of 4,972,831 shares, corresponding to 9.4% of the total number of shares and votes in the Company after the Private Placement (passing below the 10% disclosure threshold)…

Dennis Höjer, CEO Evimeria AB, has been allocated 170,213 Offer Shares in the Private Placement, and will following delivery of such Offer Shares hold an aggregate of 4,403,266 shares, corresponding to 8.3% of the total number of shares and votes in the Company after the Private Placement (passing below the 10% disclosure threshold)

Niclas Hugosson, Business Developer and founder of Evimeria, has been allocated 340,425 Offer Shares in the Private Placement, and will following delivery of such Offer Shares hold an aggregate of 4,502,417 shares, corresponding to 8.5% of the total number of shares and votes in the Company after the Private Placement (passing below the 10% disclosure threshold)…

Lars Forsberg, CFO, has been allocated 85,106 Offer Shares in the Private Placement, and will following delivery of such Offer Shares hold an aggregate of 1,310,106 shares, corresponding to 2.5% of the total number of shares and votes in the Company after the Private Placement.

Ebba Fåhraeus, Board Member, has been allocated 42,553 Offer Shares in the Private Placement, and will following delivery of such Offer Shares hold an aggregate of 127,556 shares, corresponding to 0.2% of the total number of shares and votes in the Company after the Private Placement.

Jon Schultz, Legal Counsel, has been allocated 12,766 Offer Shares in the Private Placement, and will following delivery of such Offer Shares hold an aggregate of 80,973 shares, corresponding to 0.2% of the total number of shares and votes in the Company after the Private Placement."

Linkki tiedotteeseen:

https://newsweb.oslobors.no/message/513179

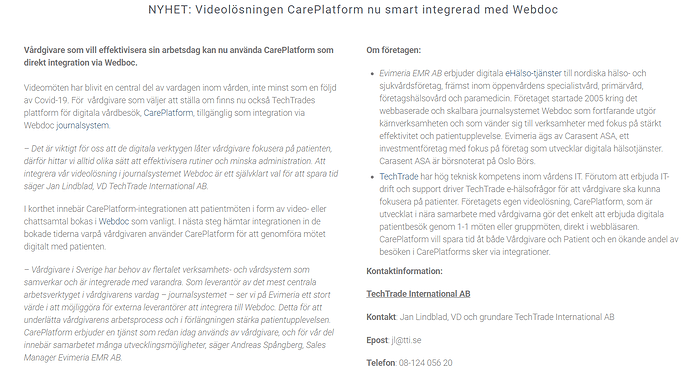

Hieman olen miettinyt voisiko antirahojen kohde liittyä Evimerian palveluun integroituun videopalveluun, jolla klinikat voivat olla etäyhteydessä asiakkaisiinsa.

, lähde:

https://evimeria.se/