Kolmas kuukausitankkaus putkeen herralla. ![]()

Jens Kyllönen luottaa kans timontin heppoihin, uusimmassa blogipostauksessa oli tekstiä, että Carasent ja Kambi päätyneet salkkuun.

Carasent ASA: Growth investor Vitruvian Partners invests to NOK 420 million private in a private placement

NOT FOR DISTRIBUTION OR RELEASE DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, TO U.S. NEWS WIRE SERVICES,CANADA, AUSTRALIA, THE HONG KONG SPECIAL ADMINISTRATIVE REGION OF THE PEOPLE’S REPUBLIC OF CHINA, SOUTH AFRICA, OR JAPAN OR ANY OTHER JURISDICTION IN WHICH DISTRIBUTION OR RELEASE, WOULD BE UNLAWFUL.Carasent ASA: Growth investor Vitruvian Partners to become significant minority shareholder in Carasent through NOK 420 million private placement

Oslo, Norway, 22 July 2021

Carasent ASA (“Carasent” or the “Company”, ticker code “CARA”) is pleased to announce that Cardigan Holdco S.à r.l., a company indirectly owned by Vitruvian Investment Partnership IV, a fund managed by Vitruvian Partners LLP (together “Vitruvian”) has on 22 July 2021 subscribed for 11,987,332 shares (the “Private Placement Shares”) in the Company at a price of NOK 35.05 per share in a private placement of new shares in the Company (the “Private Placement”).

Following registration of the share capital increase pertaining to the Private Placement, the Company will have a share capital of NOK 104,718,852, divided into 78,617,757 shares, each with a nominal value of NOK 1.332.

Following registration of the share capital increase related to the share issue and delivery of the shares to Vitruvian, Vitruvian will hold 11,987,332 shares in the Company, equal to 15,25% of the total number of shares and votes in the Company, thereby crossing the 15% disclosure threshold set out in the section 4-2 of the securities trading act.

“I am pleased to see Vitruvian becoming the largest shareholder in Carasent. With its proven experience from the e-health sector, I am confident that Vitruvian will make an important and value adding contribution to Carasent going forward. Furthermore, the investment from Vitruvian enables Carasent to pursue additional acquisitions as we experience increasing opportunities for consolidation within the sector,” comments Johan Lindqvist, chairman of the board of directors of Carasent.

The new shares to be issued through the Private Placement corresponds to 17,99% of the existing shares outstanding in Carasent. The Company intends to use the net proceeds from the Private Placement to finance potential acquisitions and strengthen the ability to capitalize on organic growth opportunities, as well as for general corporate purposes.

A spokesperson for Vitruvian comments: “Carasent has built a very strong reputation in the Nordic healthcare market where its eHealth solutions have proven to drive improved patient outcomes and greater efficiency for healthcare providers. As a rapidly growing Nordic eHealth leader, Carasent is well positioned to continue benefitting from the ongoing cloud adoption, as well as customers’ desire to manage their various digital applications through a single platform. Johan and Dennis have with their team built an outstanding company with a central focus on customers’ needs. We are excited to have the opportunity to partner with the Carasent team and support the Company’s next phase of development, by leveraging our experience and network to seek to create value for all shareholders over the coming years.”

The share capital increase pertaining to the Private Placement was resolved by the Board of Directors of the Company (the “Board”) on 22 July 2021 pursuant to an authorization granted by the Company’s general meeting held 30 June 2021. The Board of Directors has considered the Private Placement in light of the equal treatment obligations under relevant acts and regulations, and is of the opinion that the Private Placement is in compliance with these requirements. Following careful considerations, the Board is of the view that it is in the common interest of the Company and its shareholders to raise equity through the Private Placement, in view of the current market conditions and the growth opportunities currently available to the Company. In connection with the fully underwritten private placement of new shares by the Company at a price of NOK 33.40 per share announced on 26 May 2021 and completed on 2 June 2021 (the “May Private Placement”), the Company made a customary lock-up undertaking towards DNB Markets, a part of DNB Bank ASA, as manager of the May Private Placement, not to issue new shares for a period of 90 days from completion of the May Private Placement, except with the consent of DNB Markets. DNB Markets has consented to the Private Placement.

Carnegie AS and DNB Markets act as managers (the “Managers”) in connection with the Private Placement.

BAHR acts as legal advisor to the Company in connection with the Private Placement. Schjødt acts as legal advisor to Vitruvian in connection with the Private Placement.About Carasent ASA

Founded in 1997, Carasent ASA (former Apptix ASA) is a Scandinavian E-health company that develops and expands digitalization that helps customers in providing efficient and quality health care services. The company operates through its subsidiaries Evimeria EMR AB, Avans Soma AS, and Metodika AB, acquired in 2018, 2020 and 2021, respectively.

About Vitruvian

Vitruvian is a leading international growth investor headquartered in London with offices in London, Stockholm, Munich, Luxembourg, San Francisco and Shanghai. Vitruvian focuses on dynamic situations characterized by rapid growth and change across industries. Vitruvian has backed over 50 companies, including 12 healthcare investments and dozens of SaaS businesses, and has assets under management of approximately €10 billion. Notable investments include global market leaders and disruptors in their field such as CRF Health, Maxcyte, Doctari, Farfetch, Wise (prev. Transferwise), and Global-e. Vitruvian has a strong presence in the Nordics with an established office in Stockholm and twelve investments across the region: Accountor, Benify, BHG Group, Carasent, CRF Health, EasyPark, Just Eat, Scrive, Snow Software, Storytel, Trustpilot and Unifaun. More information can be found at: http://www.vitruvianpartners.com.DISCLAIMER

The information included in this announcement is defined as inside information pursuant to MAR article 7 and is publicly disclosed in accordance with MAR article 17. The announcement is made by the contact persons.

For further information, please contact:

Dennis Höjer (CEO)

dennis.hojer@evimeria.se

+46 733 28 49 22Johan Lindqvist (Chairman)

johan.lindqvist@windchange.se

+46 733 55 09 35Vitruvian media contact

Thomas Ahlerup

+46-768-966 300

Pitäis olla todella hyvä pääomasijoittaja. 1mrd nok kassa mahdollistanee 200m nok liikevaihdon ostot karkeasti. Vitruvian aum 10mrd€ ![]()

Kävin äkkiseltään viime viestit läpi, eikä silmään osunut että oltaisiin tätä vielä täällä postattu

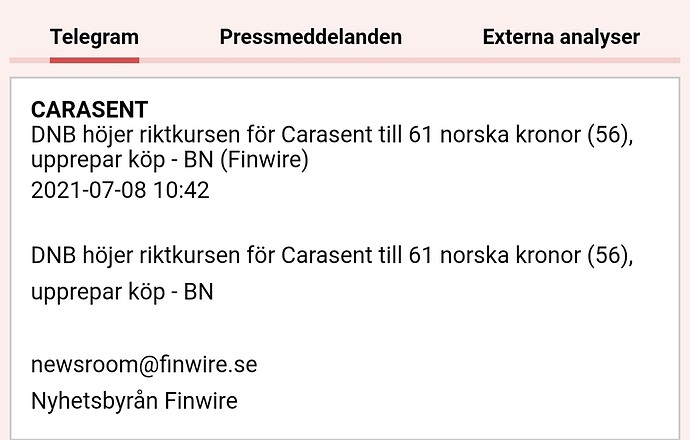

DNB nostanut tavoitehintaa 8.7. 56NOK - > 61NOK (Osta)

Early Access

Carasent: Comments on Vitruvian Partners and the private placement

“It goes without saying that we expect more M&A in the coming 6-12 months. In our latest note, we wrote that we expected two more acquisitions this year, something we still do. We also believe Carasent has several hot leads or some kind of ‘short-list’. With NOK ~900m in cash, it is crucial to have faith in management’s capital allocation capabilities, something we have, after discussions with key people such as chairman Johan Lindqvist and CEO Dennis Höjer. They think like owners and investors (both are large shareholders).”

Mainitaan vielä, että diluutio on n. 18%, mutta analyytikot eivät ole huolissaan. Hyvänä merkkinä pidetään sitä, ettei osakkeista annettu alennusta ja analyytikot luottavat johdon kykyyn löytää rahoille käyttöä. Markkinat näyttävät suhtautuvan asiaan myös hyvin positiivisesti, jos kurssinousua katsoo.

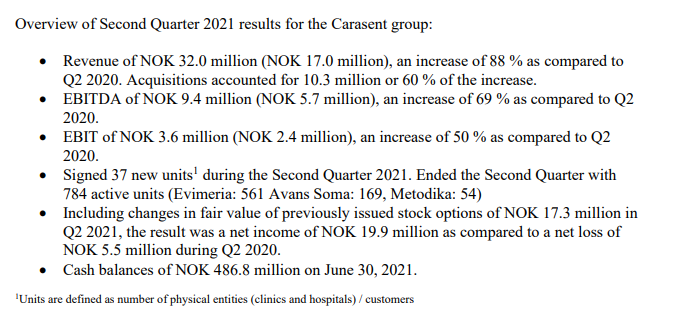

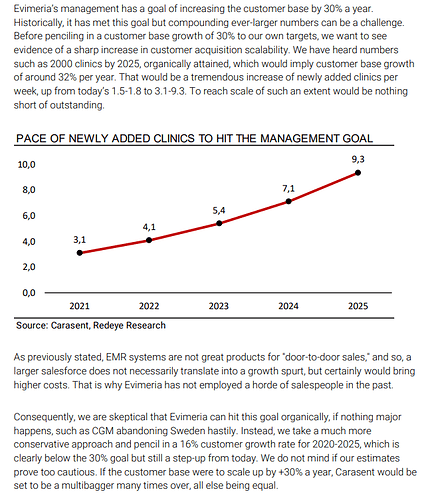

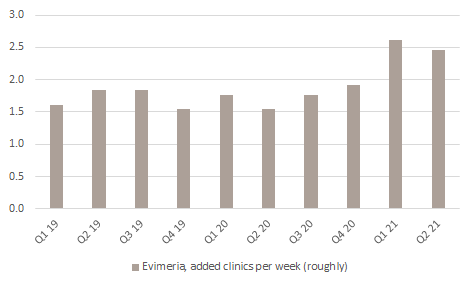

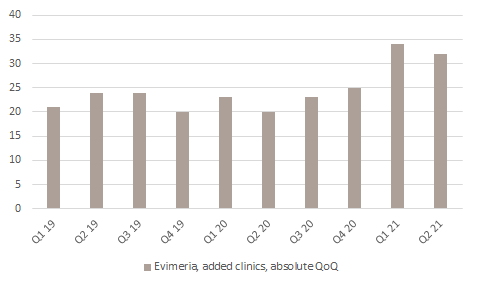

Itselleni ehkä koko raportin tärkein luku. Kuinka monta uutta klinikkaa Evimeria sai:

Johto pitää sanansa. Sanoi, että Q1 2021 luku ei ollut outlier vaan ennemminkin uusi normaali ja tästä tahti voisi vielä kiihtyä. No tahti ei kiihtynyt (ainakaan vielä), mutta pysyi lähes samalla tasolla kuin Q1.

Toki myös 36% orgaaninen kasvu Evimerialle ja Avans Somalle on kiva juttu.

Riittävän hyvältä näyttää minunkin mielestä. Toinen mielenkiintoinen KPI on tuo webdoc:integrated services. Eli saadaanko tämä lähemmäksi 1:2 ajan kanssa.

The ratio between Webdoc and integrated services was 1 to 1.1,

and Evimeria continues to expand its ecosystem of new services and features

Vertailun vuoksi mitä tarvittaisiin, jotta johdon “bullish” tavoite toteutuisi 2025 mennessä (osake olisi oletettavasti selvä multibagger)

The organic growth remains robust, with combined growth for Evimeria and Avans Soma of

36% compared to Q2 2020 (constant currency), tracking well in line with our plan.

Vitruvian uutena toisena pääomistajana herättää kyllä luottamusta. Siellä on kaksi deep pocketed -tahoa tukemassa yhtiön kapitalisointia tarpeen vaatiessa ja kontaktiverkostot on hyvät.

Bonuksena on sitten jäätävä kassa ja johdon kommenttien perusteella “targets are identified”

Hence, we are now positioned to capitalize on the identified organic and acquisitive opportunities going forward.

We have identified a broad range of strategic opportunities in new geographies, segments and

offerings, with a strong rationale

Norjan webdocissa ehkä kvartaalin verran viivettä aikaisempaan?

During the quarter, we continued our work to develop Evimeria’s service offering for the

Norwegian market. The goal remains to launch at least parts of Evimeria’s offering for selected

segments and customers in Norway at the end of 2021 or beginning of 2022.

Uusia maita kiikarissa

Metodika has a complementary market presence that will expand Carasent’s geographical

footprint significantly by giving access to new European markets such as Denmark, Finland, UK,

Germany and Italy.

Näkymät positiivisia koronasta huolimatta

We expect the pandemic to remain with us for a period going forward, but in summary

the limited short-term negative effects for Carasent are outweighed by a positive effect with

regard to long-term future prospects.

Ei vaikuta ollenkaan huonolta, strong hodl for me ![]()

![]()

Mutta mites tämä Avans Soma. Q2 EBITDA noin NOK 5m (yksi kvatteri) ja bisneksestä maksettiin NOK 122.5m. Kuulostaa hyvältä ![]()

Redin kommentit

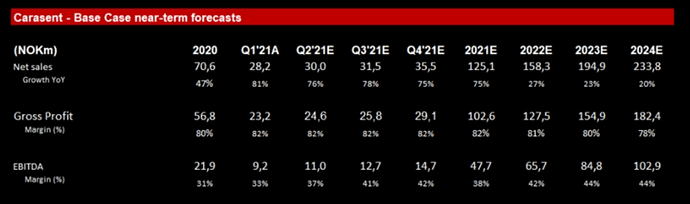

Carasent’s net sales were in line with Redeye’s estimates, but profitability and customer intake were stronger than expected. Redeye’s first impression of Carasent’s Q2’21 is positive, and the business shows good progress in almost every corner.

Redeye is positive to today’s Q2’21 report. Our base case is, at the moment, NOK 56. We will be back with a longer take tomorrow morning.

ketju

Synkkään laskupäivään ja vuoden -87 karhuilumaanantain pelottelun (KL) keskelle vaikka hieman fundaa redin kommenttien muodossa ![]()

Redeye sees the Q2’21 report as another proof of a quality business with an organization (and management) that is executing its strategy well. We raise our base case slightly to NOK 58 (56).

Denniksen haastis. 3h aikarajan jälkeen avoin kaikille

Jos oikein ymmärsin pääkohtia… saa korjata:

- tyytyväinen kvartaaliin

(- keskeinen kpi added clinics meni vähän ohi) - NRR ei kannata olettaa olevan samalla 126% tasolla jatkossa

- yksi valmis evimeria-platform käytössä noin 2v aikajänteellä (avans soma ja metodika sulautuvat pilveen)

- tullaan näkemään kovaa M&A toimintaa. Uusi pääomistaja mahdollistaa verkoston laajentamisen. Katseet pohjoismaissa.

Ketju on niin hiljainen, että sallittakoon tällainen 50-merkkipaalu hehkutus. Seuraava sitten 75…

ähäkutit. menitte lankaan.

50 NOK oli, ei sentään 50€

Carasent mainittu heinäkuun ostoissa

Onkohan tullut mitään uutisia liittyen Carasenttiin tänään kun puskee +10% laskupäivänä? Sinänsä kurssimuutoksen hehkutus tämä ei ole, lähinnä haluaisin ymmärtää onko mitään uutisia tullut tähän liittyen kun noin vahvasti menee vastavirtaan.

Evimeria - Doctrin - Syventää yhteistyötä

Dental mainittu. Muistetaan että Carasentin laajentumisesta hammashoitoon on puhuttu Redin raporteissa.

Myös kv laajentuminen. No, Carasentilla on myös tavoitteena laajentua Ruotsin ja Norjan ulkopuolelle kuten tiedetään. Toki firmalla on Metodikan kautta liiketoimintaa myös muualla mutta ei paljoa.