Eteenpäin mennään. Tuloslive klo 09.00;

OSE-FILING

October 25, 2023 – Oslo, Norway

Nel ASA: Third quarter 2023 financial results

(October 25, 2023 - Oslo, Norway) Nel ASA (Nel, OSE:NEL) reported quarterly revenues of NOK 405 million in the third quarter of 2023, up 121% from NOK 183 million in the same quarter of 2022. EBITDA came in at NOK -109 million, showing a steady improvement from previous quarters. EBITDA margin from the electrolyser division was -10% this quarter, up from -12% in Q2’23 and -64% in the same quarter last year. Order intake was NOK 352 million, and at the end of the third quarter the order backlog was NOK 2 854 million, up 36% from Q3 2022 and in-line with the previous two quarters. The cash balance was NOK 3 799 million at quarter end.

Quarterly highlights

- Nel ASA (Nel) reported revenue and income in the third quarter 2023 of NOK 405 million, up 121% from the third quarter 2022 (Q3 2022: 183). All segments, Fueling, PEM electrolysers and alkaline electrolysers experienced strong growth compared to the same quarter last year.

- EBITDA in the quarter was NOK -109 million (Q3 2022: -214). The EBITDA is improving with increasing revenues on large-scale electrolyser contracts and improving cost control in Nel Fueling.

- Net loss of NOK -226 million (Q3 2022: -260), mainly related to loss from operations and a net negative unrealised fair value adjustment from shareholdings of NOK -90 million. The same quarter last year had a net negative unrealised fair value adjustment from shareholdings of NOK -99 million.

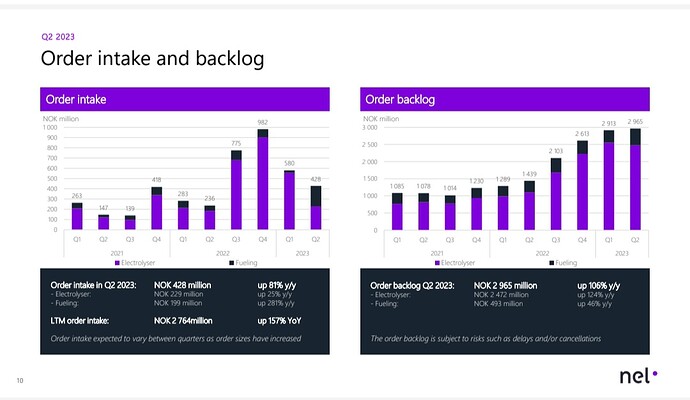

- Order intake in the quarter amounted to NOK 352 million (96% from electrolyser), down 55% from the same quarter last year (Q3 2022: 775).

- At quarter end, Nel had an order backlog of NOK 2 854 million (86% related to electrolyser), up 36% from the third quarter of 2022, and in line with the previous quarter.

- Cash balance of NOK 3 799 million at quarter end (Q3 2022: 3 520).

- Reached a milestone of generating more than NOK 1 billion (NOK 1 239 million YTD 2023) in revenue and income (Full year 2022 revenue and income of NOK 994 million).

“For the first time we have exceeded one billion NOK in YTD revenues, with still one quarter to go. At the same time, margins are improving as the company is scaling production and becoming more streamlined” says Håkon Volldal, CEO of Nel. “This shows that our newly implemented strategy is starting show real impact”.

Nel Hydrogen Electrolyser reported a 116% increase in revenue and income compared to the same quarter last year. Growth in alkaline electrolysers was strong as Nel continued the deliveries of electrolyser equipment from the manufacturing facility at Herøya in Norway. Revenues from sales of alkaline electrolysers increased 194% compared to the same quarter last year, and quarterly sales of PEM electrolysers increased 51% from Q3 2022.

Nel signed two significant electrolyser contracts this quarter. The pipeline continues to improve, where the top 20 leads suggest an average project size of about 360 MW, and a median of about 250 MW. Overall demand is growing, and customers are increasingly looking towards suppliers with available capacity and a proven track record. However, project developers are facing increasing cost of capital with rising interest rates, higher renewable power prices, lack of visibility on funding schemes, and reduced concern about available capacity.

“With increased project size, complexity and risk, the need for competence and experience increases accordingly. Nel is therefore well positioned for large-scale leadership” says Håkon Volldal. “We are in a financially sound position and will only sign contracts with acceptable risk profiles that have a positive financial contribution”.

Plymouth Charter Township, a suburb of Detroit, Michigan, US, was in the third quarter selected as the home for Nel’s new electrolyser Gigafactory where the company is looking to build up to 4 GW of production capacity (in phases), split between PEM and Alkaline. Nel has also secured USD >50 million in state funding related to setting up the factory (both direct investment support and tax credits/exemption) and could potentially receive additional funding of USD 75m in federal/state support, predominantly in cash. No final investment decision has been made yet for the factory.

For the Fueling division, revenues remained at the same level as in Q2’23, while EBITDA margin improved from previous quarter and same quarter last year, implying the measures made in the division are starting to have an impact. Order intake in the third quarter was marginal as Nel is shifting focus towards high-capacity systems for heavy-duty transportation.