Eilen tuli Hayden Capitalin uusin sijoittakirje. Mielenkiintoisia näkemyksiä markkinasta, laitetaan kirje tähän luettavaksi:

January 6, 2022

Dear Partners and Friends,

Please see the following table and link for our quarterly performance update.

As you’ll notice below, the last two months of 2021 were particularly tough for our strategy. During November and December, our portfolio declined by -14.6% and -20.6%, respectively.

This resulted in a -27.5% loss for the quarter, and a -15.8% decline in the portfolio value for full-year 2021. Since inception, we have generated +24.6% annualized returns for our partners, versus +14.8% for the S&P 500 and +10.8% for the MSCI World indices.

When our partners first join Hayden, we ask them to be mentally and emotionally prepared for at least a -50% drawdown. In fact, we can almost guarantee that this will happen over the decade-plus relationship that we strive for with all of our partners. Periods like these will test the foundations of our investor base, and I’m happy to report that we have passed with flying colors thus far. Trust is very rare in our industry and I’m proud that our partners have placed their trust in Hayden.

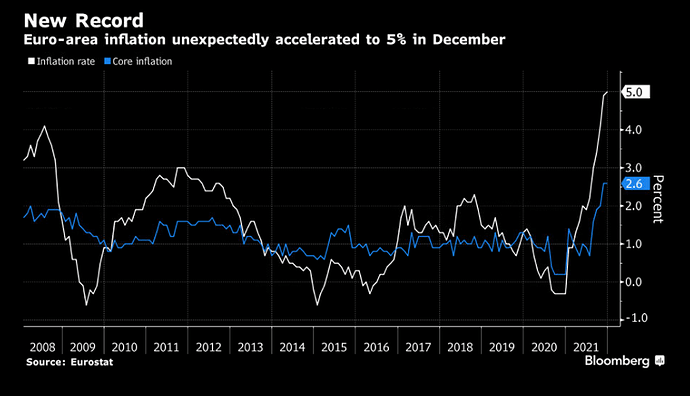

Partners will notice that the most recent draw-down started in mid-November, as fears of rising interest rates on the back of heightened inflation increased. This was exacerbated over the following weeks, as the Fed signaled that they would indeed be tightening and raising rates in 2022. These higher interest rates mean that profits years into the future are less valuable today.

Our strategy aims to largely invest with companies that are earlier in their lifecycles, who require capital to invest in high-margin opportunities (marketing spend to acquire sticky repeat customers, building logistics infrastructure to ship orders quickly and garner customer loyalty, etc.). As these companies prove out their business models, and achieve scale / dominance in their markets, the underlying profits eventually overwhelm the internal investment opportunities, and the sustainability of the business model becomes “obvious” to other investors. This is our specialty – to shepherd our companies as they traverse this journey and provide them with the capital needed to achieve their goals.

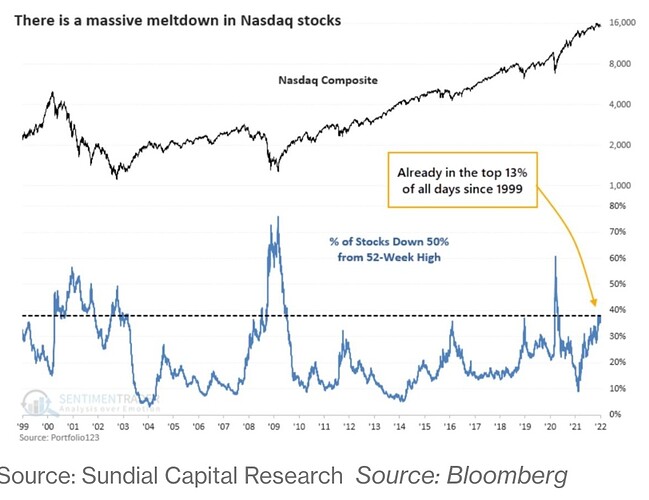

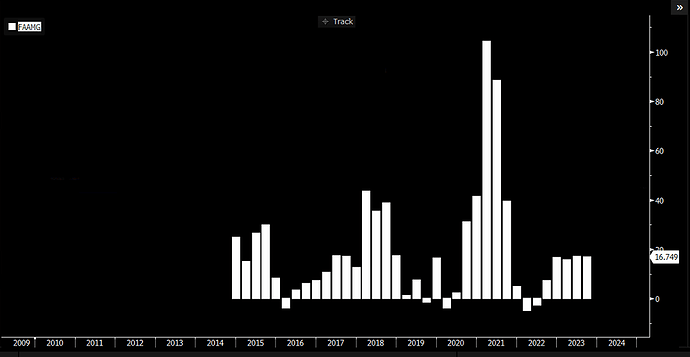

Unfortunately, in today’s environment, the companies in our portfolio can fall out of favor with other investors, and thus their short-term price is impacted. Additionally, while we routinely suffer 30%+ draw-downs seemingly every year, this time may seem especially painful because the indices are still near their highs.

Instead of investors selling and raising cash (thus driving the index prices down), they are instead “rotating” into the financials, commodities, cyclicals and other sectors of the market (simply shifting money from one index “pocket” to the other). This is because unlike previous draw-downs where investors could “hide-out” in the safety of bonds, the prospect of rising rates means that bond prices will inevitably decrease (higher rates = lower bond prices), so they are “rotating” within equities instead.

This keeps the index prices stable and masks the turbulence underneath. For example, since February 2021, the Chinese Internet indices are down approximately -50% and -65%, as measured by the Hang Seng Internet Index and KWEB ETFs, respectively. Since November 2021, newly IPO’d companies (reflecting earlier stage business models), as represented by the Renaissance IPO ETF, are also down approximately -25%.

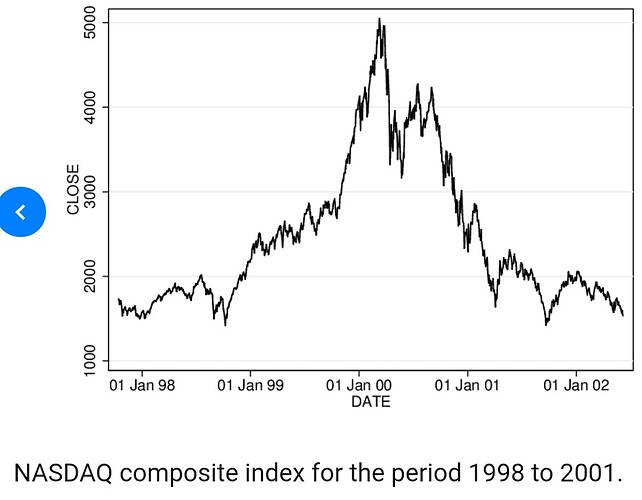

However, the good news is that we may be approaching the bottom of this sell-off. For example, when compared to technology stocks even 15 - 20 years ago (in a similar rising rate environment, but where Fed Funds rates were going from 1% to eventually 5%, versus today’s 0% going to 0.75%), today’s valuations seem cheap.

As just one simplistic example, Tencent was routinely valued at ~7 – 14x revenues, with ~49% growth y/y and with ~40% margins in its first few years of being public (2004 – 07). In comparison, our largest position of Sea Ltd is trading today at the trough-end of ~7x revenues, with significantly higher 80%+ growth y/y, and ~40 - 60% structural margins.

While it’s true that Sea isn’t yet showing the underlying profitability due to its heavy investments, the ecommerce business model is much more “proven”, with the KPI’s / levers necessary to get to sustainability better understood. In addition, the internet in China was at a far more nascent stage in 2005 than Southeast Asia today (only 8.5% of China’s population had internet access, versus ~75% in Southeast Asia today). The outlook for business models of internet companies was far less certain back then, arguably justifying a lower valuation for Tencent historically than Sea today. Granted this is just one example, but we’re seeing similar cases across the board.

The fundamentals we’re seeing for our businesses remain extremely strong, and our expected earnings trajectory is unchanged. It’s simply with rising rates, the amount that other investors are willing to pay for these future earnings streams are lower (thus resulting in lower multiples, but likely closer to the bottom than not).

As such, we are very optimistic about the long-term future of our portfolio and are encouraging any partners or potential partners who are interested in investing additional capital, to please reach out.

This is only the second time we’ve officially put out a call for capital in our 7-year history (with the first time being on April 3, 2020). In fact, we are “pounding the table” even harder than two years ago, given the valuations we’re seeing in our portfolio. Additionally, thank you to our partners who have already pre-emptively reached out, and contributed capital.

While I can’t predict the bottom of this draw-down, I do suspect we’ll start to see some stabilization in the markets soon. There’s going to be volatility over the next few months, but I’m highly confident that we’ll be very envious of the prices we’re seeing today looking back in five years’ time.