Varmaan tyhmä kysymys mutta mistä tuosta ilmenee että käyttää Voxturin palveluita?

The SingleSource ACT is being offered through a collaboration with Voxtur, a technology company creating a more transparent and accessible real estate lending ecosystem.

Doh, olen sokea. Noniin, hyvä että tämä latu aukesi, ensimmäinen diili on aina se vaikein.

" About SingleSource

SingleSource is a leading provider of property services supporting the U.S. housing industry. Founded in 2000, the company offers nationwide solutions in valuations, title & settlement, property preservation, REO asset management, and document management. SingleSource supports a broad cross-section of clients in the financial services industry including servicers, originators, banks, credit unions, investment banks, and hedge funds. The company has completed more than 5 million home valuations, facilitated over $4 billion in REO sales, and currently supports 40,000 closings a year and 250,000 field services units a year. The company stands apart for its superior experienced staff, sophisticated technology, and vibrant corporate culture that fosters diverse ideas in good times and bad. SingleSource is based Canonsburg, Pennsylvania, near Pittsburgh."

Jos kaikki 40 000 menee tästä eteenpäin AOL:n kautta, tulee siitä net profittia ainakin $4M vuodessa ($100 per AOL, jotain tällaista joskus muistelen kuulleeni jostain Voxturin haastattelusta).

Jos se olisi noin suoraviivaista niin nythän ne tekisi Title insurancen kautta huomattavasti isompaa liikevaihtoa. Näiden vaihto olis viime vuonna muistaakseni 2,8M. Tuo on niin epämääräisesti kirjoitettu, että ehkä tarkoittaa että he ovat vain jollain tavalla enemmän tai vähemmän mukana 40000 kaupassa vuodessa. Ehkä saavat niihin myytyä sitten jotain palveluitaan, ehkä ei ![]()

Zoominfon mukaan näillä ois n. 300 työntekijää ja vaihtaisivat vähän alta 100 miljoonaa usd.

https://www.zoominfo.com/c/singlesource-property-solutions-llc/113689810

Toisessa paikassa taas sanotaan 20 miljoonaa… Tiedä näistä.

Sitten olen tuijottanut väärää firmaa, laitatko linkin?

Nojuu, on sen pakko enemmän olla kuin 2,8M. LinkedIN:ssä 133 työntekijää.

Eli ei tämä taidakkaan olla mikään ihan nakkikiska @Perttu_Hamalainen ![]()

Kanukeilta napattu…vähän turha ehkä kun ei pääse lukemaan mutta otsikko lienee tärkein ![]()

Attorney title opinions could give title insurers a run for their money

Thanks for all the effort you’ve done so far. We really do appreciate it.

I would still recommend to refrain from using caps when writing on this forum. I think we are able to read and understand text without the need to dramatically emphasize certain parts. Also, it’s just considered bad form in general. If I’m not mistaken, that is the reason your messages have been flagged in the past.

@sukkana and @Colin_Fisher I am not complaining and I have never flagged those past replies. Personally I don’t really care. But some people do care, and I was just giving advice on how to not get your messages flagged and explaining the reasons why some messages get flagged. But if it’s too much effort to write according to forum guidelines, then it’s really a shame.

I deleted it - don’t want to offend

I know caps can be offensive when highlighting and emphasizing a point - it is too much for so many sensitive people. I hope I didn’t hurt your feelings @ToomasRahula

Oh come on ![]()

![]()

We have one of the top holders of Voxtur sharing thoughts on this board and we complain about CAPITAL LETTERS.

Please send a copy to my private mailbox in this forum if you will. I am not offended.

@Incompentent_Investo The author has ABSOLUTELY NO IDEA WHAT THEY ARE TALKING ABOUT.

"This is not a new product it has been in market for fifteen years. Freddie adopted the use three years ago with no increase in switch from ALTA title policy to AOL.

Also there are many law firms who offer today AOL"

Anyone who understands that Voxtur DOES NOT CREATE THE AOL. As I have said many, many times Voxtur has created a PLATFORM that ENABLES the adoption of AOL at scale.

I also said - that ANY LAWYER can write an AOL - but if they merely write one it does not enable it to be ‘appended digitally’ to the loan.

Voxtur’s AOL PLATFORM allows it be ‘digitally appended’ to the loan and to follow it throughout its lifespan.

Futher the AOL is EXPLICITLY ENABLED by Fannie and Freddie to ensure that transaction costs and total cost ownership for lower income home buyers are REDUCED.

Who actually believes that Fannie and Freddie are creating these for higher value loans - given that they are explicitly NOT for the larger loans.

The author is incompetent at best - and purposely misleading at worst.

I reposted as it seems some people CAN handled CAPS for EMPHASIS.

Here is a list of the more relevant links - PR, Article, Company and ACT Product Page:

SingleSource Property Solutions and Voxtur launch an alternative to title insurance that’s designed with Fannie Mae and Freddie Mac’s new guidelines in mind

PR:

Article:

Attorney title opinions could give title insurers a run for their money

Company:

New AOL Product ACT

Jos joku muuten ihmettelee Singlesourcen sivujen toimimattomuutta, niin heillä taitaa olla verkkoliikenne estettynä Yhdysvaltojen ulkopuolelta. Ainakaan itselläni tuo ei Suomesta aukea, mutta yhdysvaltalaisesta IP-osoitteesta käsin taas toimii.

Tässä pari kuvakaappausta uuden ACT-tuotesivun keskeisestä sisällöstä.

EDIT @sukkana olikin tämän jo huomannut ![]()

Itse en ihan hahmota, että jos uusia asuntolainoja otetaan pyöreästi noin 1,5 miljoonaa kuukaudessa, niin miten tällä secondary marketilla (secondary mortage market / mortage servicing rights market) voi olla 4 miljoonaa transaktiota kuukaudessa? Myydäänkö samoja lainoja eteenpäin useampaan kertaan?

Siltä näyttää:

Example of Selling an MSR

Sarah takes out a $500,000 mortgage from Lender A. She sends the lender a monthly payment of principal and interest. Three years later Lender A decides to transfer its MSR on Sarah’s mortgage to Company B. Under the terms of the contract, Company B is paid a fee by Lender A for processing all of Sarah’s remaining mortgage payments. The mortgage lender can then spend more time and money providing new mortgages while the company assuming the MSR forwards the mortgage payments to the lender.

Eli jos 1,5 miljoonaa lainaa vasten on 4 miljoonaa MSR-transaktiota, niin lainoja keskimäärin myydään eteenpäin 2,66 kertaa (ilmeisesti lainan keston aikana). Onhan Suomessakin noita lainojen kilpailutuksia aina silloin tällöin. Lainan siirtojen välissä on Voxtur ottamassa käsittelymaksut.

Huomenta, tämä on varmaan sama artikkeli kuin eilinen jota ei päässyt lukemaan, mutta tämän pääsee kun avaa esim Googlella incognito ikkunaan.

Artikkelin loppuosa on mielenkiintoinen ja antaa vähän lisää lihaa luiden ympärille tähän Garynkin väitteeseen, että Fannie ja Freddie painaa päälle myös AOL laajemmalle käyttöönotolle.

Closing prices seen as regressive

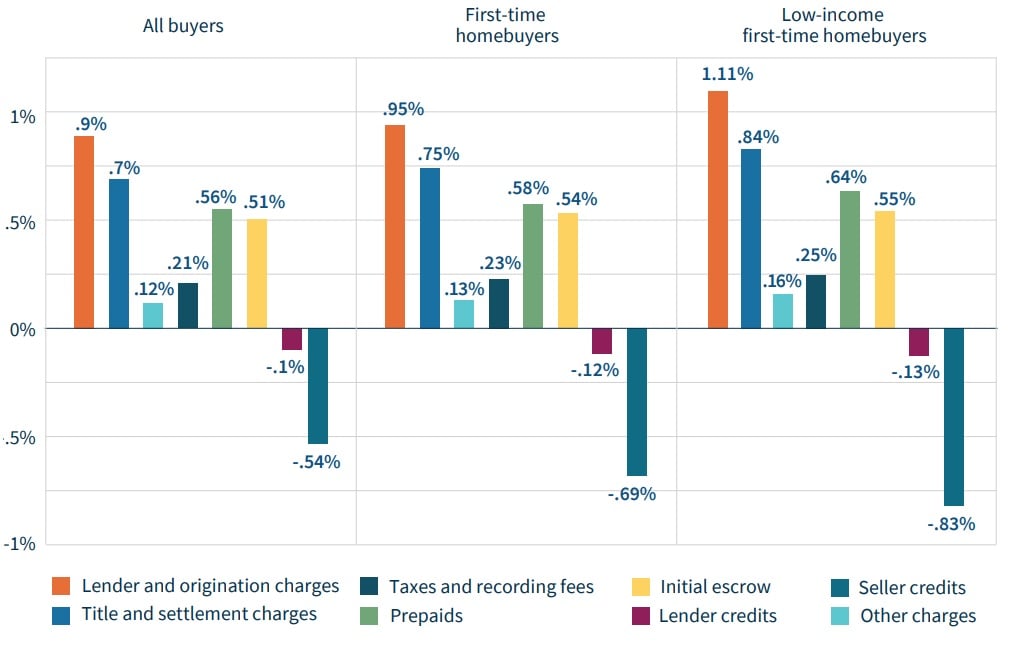

In a current evaluation, Fannie Mae researchers Mark Palim and Nuno Mota discovered that title and settlement expenses for first-time homebuyers averaged $1,946, or 0.75 p.c of a house’s gross sales worth.

The December evaluation of 1.1 million house buy loans Fannie Mae acquired in 2020, discovered low-income first-time homebuyers paid a good greater proportion of a house’s sale worth — 0.84 p.c, on common.

That was certainly one of a number of findings bolstering the authors’ arguments that title insurance coverage and different closing prices are regressive, as a result of debtors taking out smaller-balance loans pay comparatively greater charges, for a service that primarily advantages lenders.

Closing prices as a proportion of gross sales worth

Supply: “Limitations to Entry: Closing Prices for First-Time and Low-Earnings Homebuyers,” Fannie Mae.

“Providers within the mortgage course of corresponding to lender title insurance coverage, value determinations, and credit score stories assist lenders and buyers measure, handle, and worth the dangers inherent in mortgage lending,” Palim and Mota wrote. “This advantages mortgage buyers, lenders, [Fannie and Freddie], and different mortgage market members immediately, permitting for the sound and liquid operations of the mortgage market. However in the primary, debtors bear the price of this profit, and, as proven above, that value is regressive: First-time and low-income homebuyers pay extra on a relative foundation than present or higher-income owners.”

A few of these providers “might now not be as obligatory as we now have come to imagine,” the researchers wrote. “Know-how-driven threat administration and valuation strategies may even make a lot of them out of date, or not less than far less expensive. The trade should confront the truth that some providers related to closing prices might not contribute meaningfully to both the standard of the mortgage or the probability a borrower will succeed at homeownership.”

SingleSource says every ACT is backed by a mortgage service suppliers errors and omissions insurance coverage coverage issued by carriers which are A-rated by AM Finest. The insurance policies cowl the “full worth of the mortgage for the lifetime of the mortgage and are totally transferrable within the secondary market,” the corporate stated.

No condos, coops, or manufactured properties

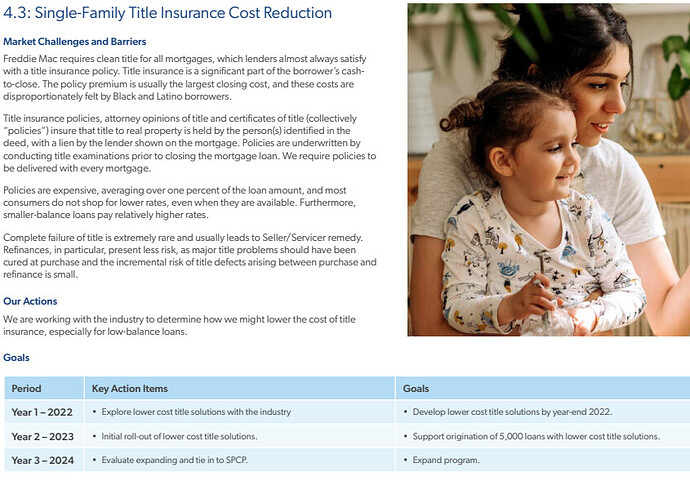

On April 6, Fannie Mae up to date its Promoting Information to encourage lenders to permit debtors the choice to make use of an legal professional opinion letter in lieu of conventional title insurance coverage extra typically.

“We imagine extra frequent use of legal professional opinions may result in financial savings for some debtors,” Fannie Mae officers stated in publishing a federally-mandated Equitable Housing Plan that particulars methods the mortgage large intends to “knock down limitations inside mortgage, rental, and possession processes that unnecessarily problem customers, particularly people who disproportionally burden Black households.”

Within the plan, Fannie Mae stated it additionally intends to launch a title insurance coverage value discount pilot program that might embrace coordination of bulk buy of title insurance coverage or a subsidy for qualifying consumers.

Freddie Mac on June 1 made a related replace to its Promoting Information, telling lenders that an legal professional’s opinion of title is appropriate to Freddie Mac in lieu of a title insurance coverage coverage.

Freddie Mac’s Equitable Housing Finance Plan additionally particulars plans to work with the trade to roll out decrease value title options subsequent 12 months, with the aim of serving to lenders originate 5,000 mortgages backed by these options subsequent 12 months.

“Title insurance coverage is a big a part of the borrower’s cash-to-close,” Freddie Mac officers famous within the plan. “The coverage premium is often the most important closing value, and these prices are disproportionately felt by Black and Latino debtors.”

Whereas Fannie and Freddie have opened the door for lenders to depend on an legal professional’s opinion of title as a substitute of title insurance coverage, there’s an extended checklist of circumstances that might restrict their use by first-time homebuyers.

The mortgage giants gained’t settle for an legal professional’s opinion of title for condos, coops, or manufactured properties, for instance, and SingleSource and Voxtur will solely present them for loans of as much as $1 million.

However for title insurers coming off of a banner 12 months through which they collected a report $26.2 billion in premium income in 2021, it’s wanting like a brand new competitor has a foot within the door.

Saa syyttää bulleroinnista, mutta minun on hyvin vaikea käsittää miksi AOL ei löisi läpi. Jos saat vakuutuksen 700 rahalla vs esim tuo keskimääräinen 1946 rahaa, niin miksi et ottaisi halvempaa? Ainoa ongelma on rajoitettu saatavuus toistaiseksi ja varmasti myös toistaiseksi vähäinen tieto kuluttajilla siitä, että tällainen vaihtoehto on tarjolla. Valtiotasolla tavoitteena on edullisemmat asunnonhankinnan kulut, isoimmat lainoittajat Fannie ja Freddie tukee tätä ja Voxturilla valmis ratkaisu ![]()

Tuossa artikkelissakin viitattu Freddien lainaohjelma käynnistyy vasta vuonna 2023. Tämän vuoden aikana “tutkitaan vaihtoehtoja edullisemmalle title insurancelle”. Vuonna 2023 myönnetään sitten 5000 tällaista lainaa. Ilmeisesti Fannie on sitten enemmän etukenossa tässä aiheessa.

E. tämä on kylläkin sitten origination puolen aloite, eli myönnetään 5000 lainaa joissa title insurance alternative. Voivat siis ostaa per heti lainoja joissa AOL title insurancen sijaan.