Korjatkaa jos olen väärässä mutta eikös tämän Web Shield kaupan ehdoissa mainita, että Zignsec joutuu maksamaan 2022 aikana lisäksi yhteensä 8 miljoonaa euroa, mistä puolet osakkeina ja puolet käteisenä?

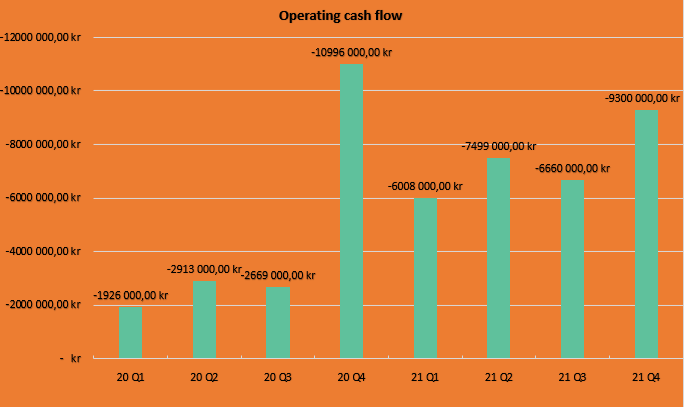

Eli anti tarvitaan, jotta kyetään maksamaan 40MSEKiä, koska kassassa vuoden 2021 lopussa vain 26MSEKiä.

Lisäksi tulee reilu 15% liudentuminen uusista osakkeista (> 4M kappaletta) annin lisäksi. eli liudentumista tarjolla aika tavalla hyvin lähitulevaisuudessa, mikäli tulkitsen oikein?

" Upfront Consideration, Deferred Consideration, Lock-Up Period

The Upfront Consideration of EUR 20 million, equivalent to approximately SEK 201.5 million, is paid with EUR 10 million cash (equivalent to approximately SEK 100.75 million), and EUR 10 million (equivalent to approximately SEK 100.75 million) is paid with newly issued ZignSec shares. The Consideration Shares are issued at SEK 24.52 per share, equal to the VWAP on Nasdaq First North Growth Market for the ten consecutive trading days preceding this announcement (excluding today’s trading).

25 percent of the Consideration Shares will be subject to a 3-month lock-up and 75 percent will be subject to an 18-month lock-up, all from the date of signing the transaction.

Furthermore, the sellers are entitled to a Deferred Consideration of up to EUR 8 million, corresponding to SEK 80.6 million. The Deferred Consideration shall be paid within one month of Web Shield having completed the audited financial statements for the year 2021, but no later than 1 September 2022, and will be paid at 50 percent with cash and at 50 percent with shares. The subscription price for the Deferred Consideration Shares shall correspond to the VWAP for ZignSec’s shares on the Nasdaq First North Growth Market during the 10 consecutive trading days prior to the issue of the Deferred Consideration Shares. The Deferred Consideration Shares will be subject to a one-year lock-up from the issue date.

Issue of Consideration Shares

The board of directors of ZignSec will resolve to issue the Consideration Shares at the completion of the transaction pursuant to the authorization granted by the annual general meeting on May 26, 2021.

The Consideration Shares represent 15.2 percent of the total number of shares and votes in ZignSec on a fully diluted basis. By issuing the Consideration Shares, the number of shares and votes increase by 4,109,094. The share capital increases by SEK 162,843.40.

The Consideration Shares are issued at SEK 24.52 per share which equals the ten day VWAP of ZignSec shares on Nasdaq First North Growth Market up to and including June 8, 2021, and using the exchange rate EUR/SEK as of June 8, 2021 at European Central Bank.